Shop

Showing 1–9 of 31 results

-

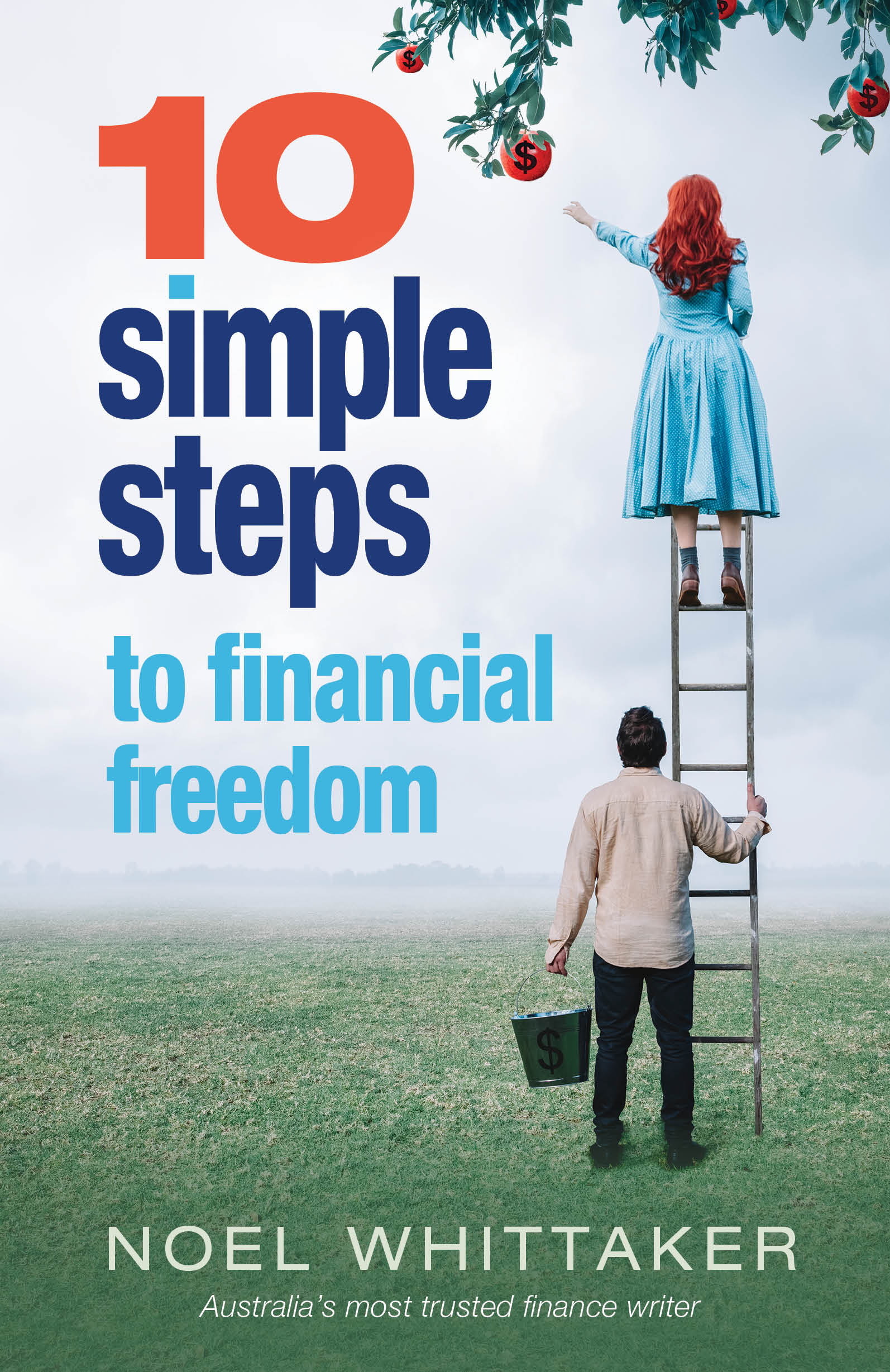

10 Simple Steps to Financial Freedom

$19.95 -

10 Simple Steps to Financial Freedom – 2 book bundle

$35.95 -

10 Simple Steps to Financial Freedom – 3 book bundle

$49.99 -

10 Simple Steps to Financial Freedom + Beginner’s Guide to Wealth Bundle

$39.95 -

10 Simple Steps to Financial Freedom + Making Money Made Simple

$39.95 -

10 Simple Steps to Financial Freedom + Making Money Made Simple + Beginner’s Guide to Wealth Bundle

$54.95 -

Sale!

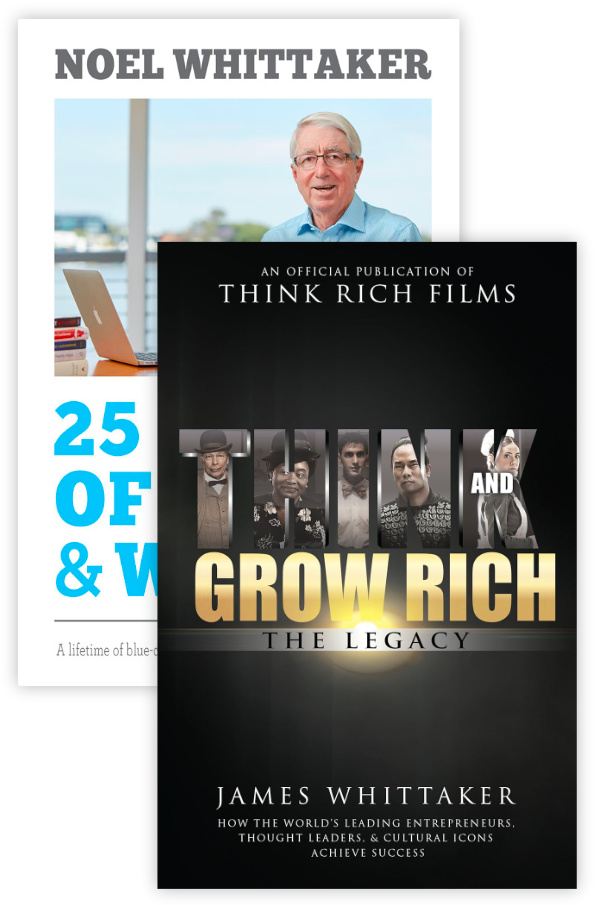

25 Years of Whitt & Wisdom

Original price was: $49.95.$29.95Current price is: $29.95. -

25 Years of Whitt & Wisdom + Super Made Simple Bundle

$44.95 -

25 Years of Whitt & Wisdom + Think and Grow Rich: The Legacy

$49.95