“Don’t make your mistakes into a habit, rather make it a habit of learning from your mistakes.”

DAVID MELTZER

The Reserve Bank has spoken…

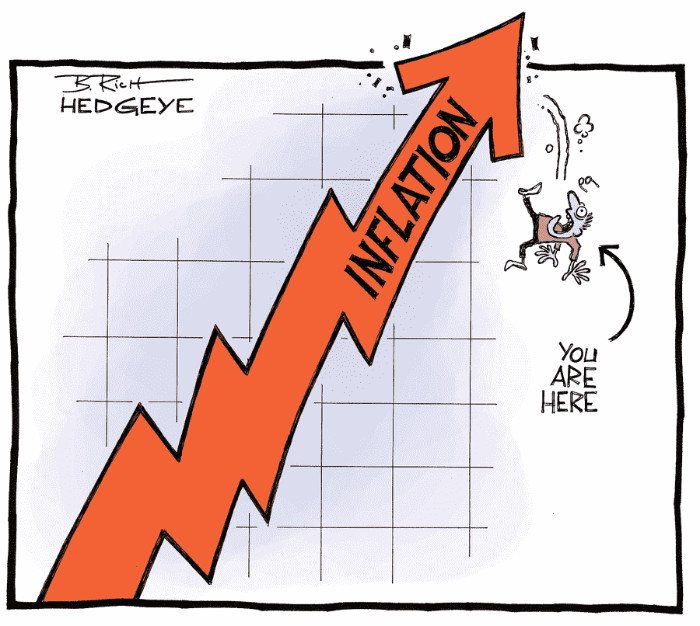

…and, as I predicted, interest rates are on hold for at least one more month. The big question now is where they will go from here. The simple answer is that they will keep going up until inflation is under control, and at this early point in the new financial year, I see no signs of that.

In the last two weeks our electricity bills have gone up by 15%, our car insurance bill is up 45%, all tolls have increased, and my favourite block of Lindt chocolate has leapt from $3.50 to $5.50. At the same time, the whole country is in a building frenzy, with massive projects going full steam in every state. My architect friends tell me it’s impossible to get anybody to work for you in the building trade, due to the growing shortage of workers.

The sad reality is that Australia, like most of the rest of the world, is still suffering a vicious hangover from all the reckless interest-rate dropping and money printing of the last decade. And in Australia, the gap between the haves and the have-nots is growing rapidly.

Image by Bob Rich for Hedgeye

Image by Bob Rich for Hedgeye

Families with mortgages are suffering from a deadly combination of increasing home repayments and inflation on nearly every item they buy. Renters face the double whammy of accommodation shortages and rent rises, thanks to a thoughtless immigration program.

But the worst hit are people in small business. Small businesses should be the engine of the economy, but many of them are in serious trouble.

Imagine if you owned a small business. At the start of the financial year your staff had big pay increases, interest rates on your home and business mortgages went up, and compulsory superannuation rose from 10.5% to 11%. To make it worse, many of your customers may be cutting back on spending because their own situation is tight. The deadly combination of falling turnover and increasing on-costs could be the end of you.

But there’s more. I am told by a reliable authority that the tax office is now embarking on an uncompromising debt collection campaign. Apparently, during the Covid years, the ATO realised that many businesses had to pay reduced tax instalments just to stay in business and took a lenient stance on late tax payments. But the ATO have now changed tack: they are aggressively chasing late tax payments and have no hesitation in adding penalties. This could be the final straw for many people in small business.

Last week Michelle Bullock was confirmed as the new RBA governor. As I wrote in my last newsletter: “Last week Reserve Bank Deputy Governor, Michelle Bullock, argued that the unemployment rate would have to climb to 4.5% to tame inflation. For this scenario to happen 140,000 people may well lose their jobs. She was adamant that inflation will not return to the bank’s 2% to 3% target band without a sustained period of low employment growth. She said, “our assessment is that, for the first time in decades, firms’ demand for labour exceeds the amount of labour that people are willing and able to supply. That is, employment is above what we would consider to be consistent with our inflation target.”

The Reserve Bank is between a rock and a hard place. They cannot tolerate a continuing situation of negative real interest rates (i.e. interest rates below the rate of inflation), yet there is no sign that inflation is abating. The rest of the world is continually raising rates with no sign of stopping – if we don’t follow suit our dollar will drop further and make imports more expensive. Of course, this will add to inflation.

Furthermore, the more they delay increasing rates the bigger the shock will be when they have to start increasing again if inflation does not reduce. My tip is that the cash rate will hit 5%.

There’s no simple answer – all you can do is make your own situation as safe as possible.

Your feedback please

My new book Estate Planning Made Simple is coming on very well and we are on track for release in November this year. But I’m keen to get some real-life experiences. I would love people to send me an email telling me what they went through when a special person in their life died and/or they had to wind up an estate. Have you been an executor, if so, what was that like? What advice would you give to anyone now given your experiences?

Image by Kerri Shaver on Unsplash

Image by Kerri Shaver on Unsplash

A typical one I received recently was from a widow who told me that they had been living on her husband’s account-based pension; when he died, the executor told the fund of his demise straightaway. They stopped her pension immediately and took six months to restore it. The lesson there is that the executor should not have been so fast, advising the fund about the death of the fund member.

Last Friday’s Event

As I foreshadowed in my last newsletter, my son James and I were the speakers at a business lunch in Brisbane last Friday. First of all, thanks to all of you who attended – your support is most appreciated.

The subject of my talk was the fundamentals of building wealth. It just happened that four days earlier I had addressed an investor group at which a chap asked me to sign a well-used copy of Making Money Made Simple, which his dad had given him 35 years ago. He said, “That book enabled me to retire at 52.”

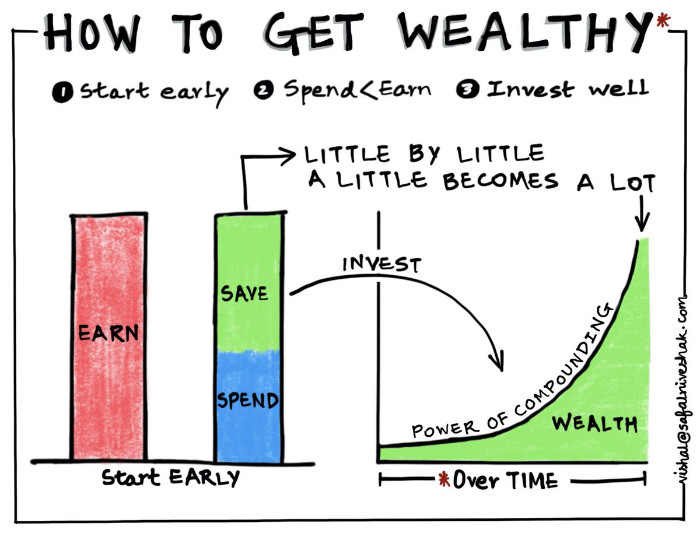

The lesson here is that financial fundamentals do not change. Whenever I talk about becoming wealthy, I quote the famous 1926 book The Richest Man in Babylon by George Clason. The main message there is: “A part of all you earn is yours to keep.” To do this, you must be spending less than you earn – this habit alone would put you in the top 15% of Australians.

The next fundamental to understand is the power of compounding. How much you have when you retire depends mainly on the rate of return you achieve during your working life. I told the audience about Jess and Paul, each aged 20, on a salary of $25,000 a year, with $3000 in superannuation. Paul takes an active interest in his super and selects funds/assets that obtain an average net return of 9% over the next 45 years. At age 65, Paul has $2.1 million in super. Jess is disengaged with her super, so she takes no notice of the fees she is charged or how the fund is performing. She just leaves her money in the default investment option, which returns 4.5%. At age 65, Jess has only $640,000 in her super. That’s a difference of $1.5 million.

Image by Vishal at Safal Niveshak

Image by Vishal at Safal Niveshak

Once you understand those two lessons, the next one makes sense: putting strategies in place to make saving and investment happen automatically. The money you invest is the foundation of your financial future. But let’s face it, if you try to save what’s left out of each pay, there is never anything there. There are many strategies to automate saving and investing, such as automatic debits to investment and superannuation, and reinvesting dividends on your share investments.

Once you have these in place and have built up a base, you can increase the money working for you by borrowing for growth assets.

When I wrote Making Money Made Simple in 1987, I pioneered the concept of paying your home loan fortnightly instead of monthly. The banks all laughed; they hadn’t realised that if you change from $2000 a month to $500 a week, you actually increase your repayments by $2000 a year. You pay your loan off significantly faster! And you don’t even feel it.

The next fundamental is to understand and work with the tax system. I always ask an audience what kind of tax they would prefer to pay: income tax, GST or capital gains tax (CGT). They never say CGT, even though it’s by far the mildest tax: you don’t pay until you dispose of an asset, and you get a 50% discount after a year. I guess because you pay it as a lump sum, rather than a trickle, people notice the pain of paying it more.

From July next year, the legislated tax cuts should be in place, which means the 30% tax bracket will extend from $45,000 a year to $200,000 a year. This is great news for many people: please make sure you take advantage of it. You’ll need to understand how franked dividends work – sadly, most people have no idea. Here’s the bottom line: once the new tax brackets are in place, franked dividends will be tax-free for everybody earning less than $200,000 a year.

Suppose you had $200,000 in an index fund returning 4% growth and 4% income. After 12 months you would have earned $16,000, which is all tax-free thanks to a combination of CGT and franking credits. This is the best way to build wealth there is!

These are the fundamentals we all need to know about money. I hope one day they will make it into the school curriculum. Until then, I’ll just have to keep writing and speaking.

Making Money Made Simple – 24th Edition

After my own children, there is nothing I am more proud of bringing into the world than “Making Money Made Simple”.

Over 36 years, and 24 editions, this book has been a north star guiding countless Australians to financial security and freedom in retirement. It was voted one of the most influential 100 books of all time and while the principles are timeless, tax and superannuation laws change every year.

I’ve just finished a methodical and thorough 24th update of Making Money Made Simple with the latest information and income tax rates, pension data and superannuation laws for the 2023-2024 financial year.

As a reader of this newsletter, you may already have Making Money Made Simple or another one of my books in your eBook library, so I’m offering an exclusive discount on the updated eBook to you.

Regular retail price $16.99 special newsletter reader’s price $11.90.

The discount will automatically be applied at checkout. If you don’t see the discount applied, use the code 6718G291FZ0X

Remember, this offer applies to the eBook only – if you would like the paperback version, it’s in my main bookstore now.

ING debit card

I’ve mentioned this card a few times recently, but judging by emails from some of you, there still appears to be some confusion about their fees.

What follows has come directly from them. I was astounded to find you get a 1% cash back on utility bills just by using this card. That was news to me. I asked them for clarification and their reply is below:

Orange Everyday Benefits include:

- 1% cashback on utility bills

- Unlimited rebates on ING international transaction fees

- 5 rebated ATM withdrawal fees a month (this will exclude international ATM operator fees from 1 August).

To be eligible for these benefits you need to:

- Deposit $1,000 per month from an external source into any personal ING account in your name (excluding Orange One and Living Super)

- Make at least 5 card purchases in a month

Please note that Orange Everyday customers who hold an ING Home Loan are automatically eligible for Orange Everyday Benefits and are not required to meet this monthly criteria.

- Re the point about withdrawing at least $200 in one ATM transaction in order to have your ATM fees reimbursed. This is not correct. To be eligible for the ATM rebates you only need to meet the eligibility criteria stated above.

- The only change that will come into effect from 1 August is that we will no longer rebate the fee charged by international ATM operators. We will still rebate the fee ING charges for international ATM withdrawals so long as it’s within the 5 cap (highlighted above) per month.

Yes, on gas, water and electricity bills so long as you meet the eligibility criteria and your utility provider is listed here (most are).

https://www.ing.com.au/everyday-banking/utility-bill-cashback.html

Threads

From time to time I’ve passed on great information that comes from Keith Fitzgerald’s newsletters. He is based in America and always has an interesting and very rational view of what is going on in the financial world.

I was astounded to read this from him this morning. It speaks for itself and needs no further comment from me:

“I will not invest in Meta because I believe that CEO Mark Zuckerberg is as ruthless as they come, especially when it comes to collecting customer data in the name of manipulating… err, publishing… social commentary.

- There was the Cambridge Analytica Scandal in 2018, which raised concerns about how Facebook handled (and facilitated) access to millions of users without their consent.

- Facebook/Meta has been accused of creating echo chambers via content algorithms and highly targeted advertising, which expose people only to information Meta wants and arguably reinforce specific beliefs.

- The company is under fire for emotional manipulation, thanks to studies like the 2012 “Facebook emotional contagion experiment,” in which it altered the content shown to users to measure emotional responses.

- The platform’s design has raised serious concerns about addictive behaviour and negative mental impact—including features like infinite scrolling and notifications, which social scientists believe promote excessive usage and potential negative psychological effects like anxiety, depression, and decreased well-being.

- Surveillance… people are worried about the Chinese, which makes no sense considering every user has just voluntarily contributed to the greatest human data repository in history.

Well, Zuck just did it again.

Meta now owns your tax return info.

According to a report by Senate Democrats, Meta has purchased the tax information of tens of millions of Americans from three large tax-preppers in order to improve its targeted Facebook and Instagram ads.

Put another way, what this means is you just got Zucked again if you’re doing your taxes with H&R Block, TaxAct, or TaxSlayer. Chances are that El Zucko and his bunch of merry marauders now own your super-private, sensitive tax return data (Read)… on top of insurance companies, credit reporting agencies, and more that have aggregated your medical records, financial records, etc.

Oh… and in case you think I’m joking around or this isn’t that bad, consider this.

You can deactivate your Threads profile at any time, but you can only delete it if you wipe your Instagram account too. 🤦♂️

My guess is that Zuck made a calculated decision that any fines levied when this comes to light will be an acceptable cost of doing business because he’s “got the data.”

Motor vehicle Security

On Channel Ten last week they featured some disturbing news. Most people, including Geraldine and myself, put the manual in the glovebox when taking delivery of a new car.

According to Channel Ten, that manual contains a QR code that can be used to start the car. Car thieves now are simply breaking the car window getting into the glovebox and starting the car using the information from the manual. Our car manuals are no longer kept in the car.

And finally

We take English for granted. But if we explore its paradoxes, we find that quicksand can work slowly, boxing rings are square, and a guinea pig is neither from Guinea nor is it a pig.

And why is it that writers write, but fingers don’t fing, grocers don’t groce, and hammers don’t ham?

If the plural of tooth is teeth, why isn’t the plural of booth beeth? One goose, two geese. So, one moose, two meese? One index, two indices? Is cheese the plural of choose?

If teachers taught, why didn’t preachers praught? If a vegetarian eats vegetables, what does a humanitarian eat?

In what language do people recite at a play, and play at a recital?

Ship by truck, and send cargo by ship?

Have noses that run and feet that smell?

Park on driveways and drive on parkways?

How can a slim chance and a fat chance be the same while a wise man and a wise guy are opposites?

How can the weather be hot as hell one day and cold as hell another?

When a house burns up, it burns down. You fill in a form by filling it out, and an alarm clock goes off by going on.

When the stars are out, they are visible, but when the lights are out, they are invisible.

And why, when I wind up my watch, I start it, but when I wind up this essay, I end it.

I hope you have enjoyed the latest edition of Noel News.

I hope you have enjoyed the latest edition of Noel News.

Thanks for all your kind comments. Please continue to send feedback through; it’s always appreciated and helps us to improve the newsletter.

And don’t forget you’ll get more regular communications from me if you follow me on twitter – @NoelWhittaker.

Noel Whittaker