“If you don’t like how things are, change it!

You’re not a tree.”

JIM ROHN

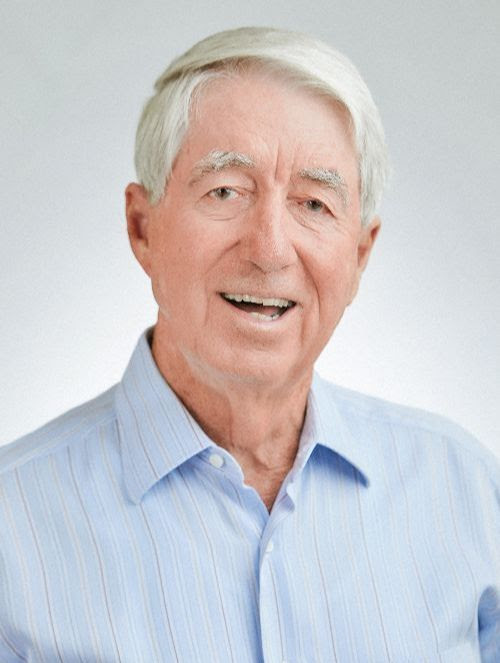

The Making Money Made Simple Podcast

Renowned broadcaster John Deeks and I discuss all the big topics covered in this newsletter in detail each month.

Welcome to our September Newsletter

And welcome to spring. It’s been a fascinating year to date and one can only ponder on what might be ahead of us in the years to come.

I spent much of August staying with my son James and his family in Los Angeles. As always, the biggest challenge was negotiating the Los Angeles International Airport. The queues at Passport Control were the worst I’d seen, but fortunately I’d been tipped off about the Master Passport Control app. Before leaving home you enter your passport details and photo; then, on touchdown, you take a quick selfie. That generates a digital receipt allowing you to head straight to the designated MPC lane.

It cut my wait dramatically and turned what could have been an ordeal into a smooth entry.

And here’s another pleasant surprise – you can now complete your arrival in Australia declaration online before you even leave the country you’re in. Haven’t we all wondered how pointless that paper document is, the one they hand you as the plane is about to land? Do it online instead, show them the receipt, and you sail straight through. Too easy! Why didn’t they think of this years ago?

The Productivity Round Table

As I predicted, there was nothing of great note that came out of the talks except the Treasurer Jim Chalmers’ focus on older people. He now claims, “one of the intergenerational levers of the tax system” is best seen through an intergenerational lens.

(ABC News: Mark Moore)

(ABC News: Mark Moore)

So instead of cutting the huge amount of government waste we are currently experiencing, he wants to find out ways to make the oldies pay a bigger share of tax. He mentions that older people hold the bulk of the nation’s wealth, but that is the nature of compound interest.

The biggest factor that determines how much you will have when you pass on is the rate of return on your investment and the length of time it’s been there. In Making Money Made Simple I talk about the riddle of the lily in the pond. It goes like this: if a lily in a pond starts as a tiny speck and doubles every day and fills the pond in 10 days, how long will it take to go from quarter full to full? The answer is two days. It goes from a quarter to half on the ninth day and half to full on the tenth. And that’s how it is with the world’s wealth. Most people die with more money in superannuation than they retired with because of compounding – and that simple truth is why compounding remains the greatest wealth creator of all. And that’s something worth remembering as the tax debate heats up.

The housing conundrum

Hot on the heels of the housing round table, Prime Minister Anthony Albanese announced a major boost for first-home buyers. The government’s 5% deposit scheme has been fast-tracked to kick off on 1 October 2025, allowing buyers to get into the market with a tiny deposit and skip the hefty lenders’ mortgage insurance bill. That alone can save tens of thousands.

The key changes include:

- The 5% deposit scheme will start on 1 October 2025, a year earlier than planned.

- Income caps and participation limits removed, opening the scheme to everyone.

- Property price caps lifted to reflect current market values.

- The government estimates first-home buyers will avoid $1.5 billion in mortgage insurance costs in the first year.

- $10 billion earmarked to build 100,000 homes reserved for first-home buyers.

To put it in perspective, a Brisbane buyer could purchase a $1 million home with a $50,000 deposit and avoid about $42,000 in mortgage insurance, while a Bendigo buyer could secure a $600,000 home with $30,000 down and save around $25,000.

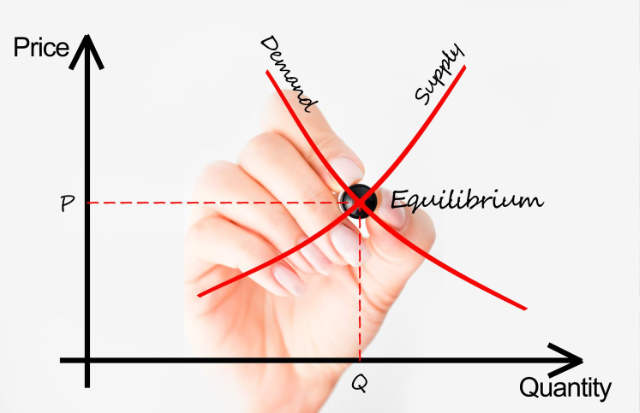

But here’s the sting in the tail – the price of housing ultimately depends on supply and demand. Supply is already extremely constrained and getting worse, while these initiatives simply add to demand, pushing prices up further. Coupled with the latest interest rate cut, housing may be drifting even further out of reach for first-home buyers.

Upcoming seminar in Sydney

Thursday 11 September

Thank you so much for your fantastic support. The event was booked out within two hours of the newsletter going out. They do have a waiting list and they’ll be confirming all registered attendees a few days before the event. Hopefully some of you on the waiting list will be able to finally secure a seat and we’ll be looking to do more next year – of course we’ll keep you informed.

I am booked to do a seminar in Townsville on Wednesday, 29 October. More details will come in the next newsletter.

I am also working with my publishers on seminars in Tasmania next February.

How to beat the banks

Image by dooder on Freepik

Image by dooder on Freepik

Recently a reader wrote:

“My older parents interstate to be closer to family. They sold their Queensland home and 11 days ago the ~$730,000 proceeds landed in their ANZ account of 30+ years. With ANZ’s rates so low, they planned to move it into a high-interest savings account while deciding how best to fund retirement.

Before settlement, Mum opened a Macquarie Bank account and tested it with a $10 transfer from ANZ. But ANZ only allows $25,000 per day via internet banking, so she tried a $28 telegraphic transfer by phone. That’s where the nightmare began.

Despite multiple calls and hours on the phone, ANZ repeatedly interrogated her, refused to believe the Macquarie account was hers, and even locked the new account. A planned transfer disappeared and then reappeared, cancelled by ANZ. She has spoken to their Falcon security team over and over, provided documents, read out bank details, and yet they keep rejecting the transfer — while charging her for the attempt.

They’ve had a complaint lodged for over a week with no reply, and also with the Bank Ombudsman, but in the meantime their money is frozen. They’re losing about $100 in interest every day — money they need to live on.

My parents are 85 and 90. They are stressed, upset, and desperate for access to their own funds. Do you have any suggestions on how to proceed?”

My response was instant. Don’t mess around, get them to go straight to the Australian Financial Complaints Authority (ACFA) and I’m sure things will happen pretty quickly.

Their website is afca.org.au:

This week, I was thrilled to get the following from the person who had inquired:

“AS soon as the AFCA complaint was submitted ANZ got back to them within days as a result, investigated and agreed that they had submitted everything that ANZ had requested. They restored access to both their ANZ and Macquarie accounts, and offered them $1700 in compensation for forgone interest, and a further $2,000 in compensation. They were satisfied with the response, with no thanks to ANZ.

I think ANZ’s behaviour was disgraceful, and it caused extreme stress and distress to my parents. Banking for 35 years with ANZ counts for nothing now.

Thank you for your suggestion and support. My parents also appreciated it, and it encouraged them to follow through with AFCA when they were almost giving up.”

Right now the banks are totally focused on profitability and not service. In fact, yesterday I got a notification from St. George Bank that in future any transactions which involve a staff member would attract a $1 fee. The good news is there’s one thing that really gets action the going – a complaint to ACFA. I’d love to hear of any more similar incidents.

The future is here

Two years ago I wrote of the thrill of riding in my son’s Tesla, then newly equipped with an early version of self-driving. It felt revolutionary at the time, yet the improvements since have been dramatic. It really does think now. On a high-speed freeway, James set it to “hurry” mode, and the car used its long-range cameras to weave effortlessly between four lanes. It was like riding with a racing driver.

Later, at a coffee shop in Ventura, I saw another demonstration. The car found a narrow street space beside the café and reversed itself neatly in. I doubt many drivers could have managed it. But the technology doesn’t stop there. The new Tesla is now equipped with GROK, a powerful generative AI tool built directly into the vehicle. To show it off, James asked: “There’s a podcast called Win the Day by James Whittaker. One episode features an interview with James Whittaker and his father, Noel Whittaker. What were the main takeaways from that podcast?” The response was breathtaking. Within a second it replied that the episode was number 87, then listed the three main points I discussed. How on earth could any device scan 250 podcasts and summarise the content of one in a split second? It felt like science fiction made real, and a reminder that the pace of technological change is far faster than most of us can imagine.

Having fallen for the charms of the fully self-driving car, albeit with a driver on board, we decided to go one step further and catch a Waymo.

This is a fully autonomous RoboTaxi. You call it with the Waymo app and it arrives under its own steam. At first, it’s a strange feeling to see an empty car pull up, but the process is simple – open the door with your app, hop in, and let it take you where you need to go. It relies on a huge array of sensors – Lidar, radar and cameras – which makes it more costly than Tesla’s leaner system.

And that’s the big picture. Driverless cars are no longer a futuristic dream; they’re here now, quietly rewriting the rules of transport. The only real question is not if we’ll adopt them, but how fast.

Retirement made simple

As life keeps changing, so must our knowledge. Don’t forget there is now a brand new a brand-new edition of Retirement Made Simple — updated with all the latest superannuation thresholds and rules that took effect on 30 June 2025. It’s available now from my website, and as always, the best value is in the bundle deals—because we pay the postage when you buy more than one.

Grab a Bundle & Save!

FREE SHIPPING ON ORDERS OVER $35 IN AUSTRALIA

Super hits a milestone.

Last July marked an important milestone in Australia’s financial story. The superannuation guarantee system, introduced 33 years ago, finally reached its long-planned target of 12% of wages. From here, no further increases are scheduled.

When I was in Sydney recently, I caught up with my long-time friend Paul Keating to celebrate. Given the topic, our conversation naturally turned to Treasurer Chalmers’ proposal to tax unrealised capital gains. But since we’ve both opposed it from the outset, there wasn’t much to debate. Instead, Paul reflected on what he set out to achieve all those years ago.

“I wanted an Australia where every worker would have money put away for their retirement, professionally managed so they could benefit from compound interest, and protected until they reached preservation age.”

It’s a simple idea, but its impact has been profound. In the early 1990s, compulsory employer contributions started at just 3%. Over time they were gradually increased, with the final step to 12% only reached last year. The journey wasn’t smooth; there were several attempts to stall it. At one point, pressure mounted to freeze the guarantee at 9%.

We both know how many millions of Australians have had their lives changed by that persistence. I told Paul about an email I’d received only the day before from a 65-year-old woman:

“I have no home, and my only asset is $250,000 in super. How will I cope in retirement?”

I explained that at 67 she would be eligible for an indexed age pension of about $30,000 a year for life and could also draw around $18,000 annually from her super, enough to last until at least 90. Her reply was short but heartfelt:

“Thank you, you’ve put my mind at rest.”

Paul produced a large box of cards and letters of thanks he’s received over the years. Many came from people who, without superannuation, would have faced retirement with little more than the pension and perhaps the family home. For them, super has meant choices, dignity and independence.

Critics have always argued that workers would be better off taking the money now rather than locking it away. Paul and I have never agreed with that proposition. People adapt their spending to what they take home. They don’t miss the 12% any more than they miss the tax withheld from their wages, but they certainly notice the difference when they retire.

Image by kues1 on Freepik

Image by kues1 on Freepik

Here’s why. Take a 25-year-old in a low-paid job earning $50,000 a year. Their employer’s super contribution is $6,000 annually. If paid as wages, they’d lose 30% in tax and be left with $4,200. Without super, they’d likely reach retirement with little more than the family home – if they could afford one – and be dependent on the pension. But with the super guarantee, assuming wages grow 3% a year and returns average 8%, they could retire in 40 years with around $2.5 million in super, tax-free.

Of course, $2.5 million in 40 years won’t have the same buying power as today, but even in today’s dollars, it’s equivalent to well over $800,000. That’s the difference between scraping by and having genuine financial security.

When you think about it, very few people can go to their dying day knowing the initiatives they personally promoted and fought for have changed the lives of millions. Paul Keating is one of them. His superannuation guarantee has not only reshaped Australia’s retirement landscape but has also given countless people the peace of mind that they will not face their later years in poverty.

Changes to deeming rates and the age pension.

Deeming is back in the news, with the surprise announcement last week by Minister Tanya Plibersek that deeming rates will rise on 20 September in parallel with the automatic indexation of the pension. Deeming is a major issue for retirees – it doesn’t just affect income-tested pensioners, it also determines eligibility for the Commonwealth Seniors Health Card and plays a major role in calculating aged care fees.

Image by Freepik

Image by Freepik

Deeming began in 1990 to discourage pensioners from using low-interest accounts to dodge the income test. It was later extended to most investments, though never property. In theory, rates track the cash rate, but governments often lag. In 2010, with the cash rate at 4%, deeming hovered around 3.5%. By 2019 it was 3%, and when the cash rate fell to 0.25% in 2020, deeming dropped to 0.25% and 2.25% depending on the size of the account. This is where it still sits.

The government was aware that the deeming rates were well below what they should be, but it was a potential minefield to move them more in line with the market. They affect poorer pensioners (they’re the income-tested ones), and don’t affect the wealthier asset-tested pensioners. An increase in the deeming rate would mean an automatic drop in pension for the poorer pensioners. Imagine the headlines!

They have finally bitten the bullet and increased the deeming rates, but they’ve done it in a very cunning fashion. By announcing the change at the same time as the pension’s automatic indexation, the numbers were arranged so that any reduction in pension from more onerous deeming rates was offset by the pension rise.

From 20 September 2025, the lower deeming rate lifts from 0.25% to 0.75% and the upper from 2.25% to 2.75%. For singles, the lower rate applies to the first $64,200 of financial assets, with the higher rate on the balance. For couples, it applies to the first $106,200 combined, with the higher rate on the remainder.

At the same time, singles gain an extra $29 a fortnight, bringing the full fortnightly pension to $1,179, or $30,646 a year. Couples gain $22 each, lifting their full combined pension to $46,202 a year. As assets increase and accordingly deemed income increases, the pension will slowly reduce at the rate of 50 cents for each additional dollar deemed to be earned.

Case Study

Harry is single with $308,000 in financial investments and $10,000 in household contents. Currently, he gets the maximum fortnightly pension of $1,149. On 20 September 2025, the maximum pension will rise to $1,179. However, due to the increase in deeming rates, Harry will not receive the maximum. His deemed income will jump from $5,646 to $7,186 a year, reducing his fortnightly pension by $29. The increase in deeming rates almost exactly cancels out the pension rise.

To see how the changes affect your own personal situation just go to my website, www.noelwhittaker.com.au, to download the new pension charts and play with the age pension calculator and the deeming calculator, all of which have been updated with the new numbers. Just bear in mind, they won’t come into effect till 20 September.

Go to Free Downloads page for Get the latest Pension Charts

When the rate of pension goes up, the upper limit threshold cut-off point automatically increases as well; the cut-off point for a homeowner couple has just risen to $1,074,000. For a single, it’s $714,500.

I’m often asked if the account-based pension you draw from your superannuation fund is assessed as income for the income test. It is not. Your superannuation is given a deemed income for the income test and the account value of your superannuation fund is the amount assessed under the assets test. And remember, if your superannuation fund drops in value at any time, you are at liberty to advise Centrelink immediately.

Beware the credit card tricks.

Credit cards have been part of Australian life since the 1970s, offering convenience, but often at a cost. Over the decades, banks have profited handsomely from fees and interest charges that hit the most vulnerable hardest. One infamous case involved a low-income customer who checked her balance at an ATM, saw $30, and withdrew it, only to be slugged a $2 inquiry fee that pushed her into the red. The result? A $30 penalty for overdrawing. It’s a stark example of how small transactions can trigger outsized punishments in a system rigged against the poor.

Image by Freepik

Image by Freepik

The mistreatment continues, with penalty interest rates often wildly out of step with the Reserve Bank’s steadily falling cash rate. On overdue accounts American Express charges 23.99%; Latitude, 27.99% and Virgin Money, 20.74%. These figures are not just high, they’re psychologically engineered to appear more palatable. Pricing just under round numbers, a tactic long used in retail to mute the real cost, is now embedded in credit policy too. But whether it’s $27.99 or 28%, the pain to struggling cardholders is the same.

Given the huge cost of being late with repayments, I’ve always made a habit of paying the balance the day the statement arrives, so there can be no arguments about when it was paid. This has worked well for many years. The credit card companies always send an email when the statement is available, and I’ve relied on those emails – never keeping a diary note – until now.

In June, I began receiving texts allegedly from Virgin, asking me to contact them about my credit card. I thought they were scams and ignored them; understandable, given how many bogus messages we get these days. Then the June statement arrived with a big “Your account is overdue.” That came as a major shock since it’s never happened before. There was also a “interest charged retail, $79.71”.

I considered calling Virgin to explain that I’ve always paid my card in full on time, and that I never received an email alerting me to the statement. But knowing how long the wait times can be, I decided it wasn’t worth it. I paid the full balance that day.

Then the next statement came, and that’s when things really turned sour. Even though I’d paid the previous one immediately, I was hit with another debit: $19.05 for more interest. Assuming a mistake, I rang them to point out that I’d paid before the due date, so further interest made no sense.

That’s when the real kicker came. The woman on the phone said, “Oh no, if you miss one payment, you then lose two interest-free periods.” In other words, even though I’d paid early, I was still going to be charged again.

I told her I thought that was totally unethical, and her response was, “Well, it’s in the terms and conditions.” We all know about the terms and conditions; they are many pages long and typed in tiny print that is far too small for my ageing eyesight to comprehend. My complaints about ethics were not taken notice of, but she did offer to refund both the debits in view of my good payment record.

You could say all’s well that ends well, but that misses the point. These rules are hidden landmines, buried in the fine print, designed to trip people up. It’s legalised entrapment, and it needs to be exposed and stamped out. The regulators must act, because the banks won’t.

And finally

In democracy your vote counts. In feudalism your count votes.

She was engaged to a boyfriend with a wooden leg but broke it off.

A chicken crossing the road is poultry in motion.

If you don’t pay your exorcist, you get repossessed.

With her marriage, she got a new name and a dress.

The man who fell into an upholstery machine is fully recovered.

You feel stuck with your debt if you can’t budge it.

Local Area Network in Australia – the LAN down under.

Every calendar’s days are numbered.

A lot of money is tainted – Taint yours and taint mine.

A boiled egg in the morning is hard to beat.

He had a photographic memory that was never developed.

A midget fortune-teller who escapes from prison is a small medium at large.

Once you’ve seen one shopping centre, you’ve seen a mall.

Bakers trade bread recipes on a knead-to-know basis.

Santa’s helpers are subordinate clauses.

Acupuncture is a jab well done.

I hope you have enjoyed the latest edition of Noel News.

I hope you have enjoyed the latest edition of Noel News.

Thanks for all your kind comments. Please continue to send feedback through; it’s always appreciated and helps us to improve the newsletter.

And don’t forget you’ll get more regular communications from me if you follow me on X – @NoelWhittaker.

Noel Whittaker

Featured image by Freepik