I’ve looked at life from both sides now

From win and lose and still somehow

It’s life’s illusions I recall

I really don’t know life at all

JONI MITCHELL

Welcome to our latest newsletter.

It’s been a work in progress and the last 24 hours made me think of the famous words “If you want to make God laugh, tell him your plans.

I thought I had completed this newsletter last Friday and had everything set for it to go out today, Monday 26th of August. Yesterday was Sunday in Los Angeles -the day of our scheduled departure – and we were looking forward to arriving home in Brisbane at 5 am on Monday. We duly arrived at Los Angeles airport at 6:15 pm for the 9.15 Qantas flight to Brisbane.

Image by freepik

Image by freepik

Everything was on time and then a message came up that our flight was delayed till 11.15 pm. Subsequent messages announced further delays with the grand finale being the flight was cancelled. There were no announcements just a text to your phone. We were flying business class and my Qantas status is Lifetime Gold. It meant nothing – if I hadn’t gone to the desk to make inquiries about our future nothing would’ve happened.

I was told that there were no seats available direct to Brisbane for the next night, but we could go home via Sydney if we caught the 11:45 pm on the Sunday, which is tonight as I write this. Of course, we grabbed it but when the new ticket arrived I was stunned to see we arrived in Sydney at 8 am tomorrow and our flight to Brisbane was booked for 5 pm. That meant a nine-hour layover in Sydney.

When we asked about accommodation we were told we would be given a hotel voucher. They said If we went to the Qantas counter at gate B 32 Qantas staff would give us all the paperwork. Of course, when we got there at 1 am. the counter was closed. Geraldine and I were the only people around and after banging on the glass a guy finally came out. He organised the paperwork but did point that our luggage was with Qantas and we would not see it again to our final destination. All we had to get us to Brisbane was our hand luggage, which was minimal, and the clothes we were wearing. We ended up in a reasonable airport hotel but the staff did make it clear that check out time next morning was 11 am.

I appreciate that aircraft do break down and flights can be cancelled but I would’ve thought that a reasonable airline would have given far more thought to their passengers’ welfare. We were lucky inasmuch as James lives in Los Angeles and we could spent the day with him. If we had been a family with young kids, it may have been very tough.

Words from James

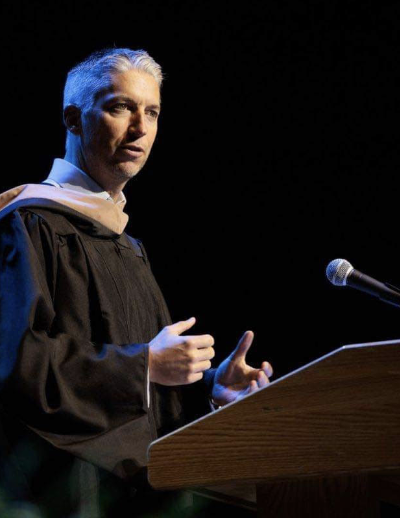

This is being written from Boston, as we complete the final leg of our annual trip to the USA to visit our son and his family. We normally just go to Los Angeles, which is their home, but this time we flew via Boston, as James was giving a major speech to the Hult University graduates of 2024. There were over 2000 people at the event which was held at the MGM Music Hall and James was the keynote speaker having graduated from Hult 11 years ago. It was a splendid ceremony made perfect by stirring bagpipes followed by Land of Hope and Glory by Elgar as the students filed in. It was a very proud moment for we parents.

This is being written from Boston, as we complete the final leg of our annual trip to the USA to visit our son and his family. We normally just go to Los Angeles, which is their home, but this time we flew via Boston, as James was giving a major speech to the Hult University graduates of 2024. There were over 2000 people at the event which was held at the MGM Music Hall and James was the keynote speaker having graduated from Hult 11 years ago. It was a splendid ceremony made perfect by stirring bagpipes followed by Land of Hope and Glory by Elgar as the students filed in. It was a very proud moment for we parents.

James spoke about the importance of embracing exponential thinking. He said:

“You need to surround yourself with people who see the world without limits and who back themselves to win.”

“You need to surround yourself with people who see the world without limits and who back themselves to win.”

True words indeed – the main thing young people need to learn is that their life can take many unexpected changes and failure is usually the best mechanism for long-term success.

The contrast between the two cities is striking: LA is brown and dry, with freeways everywhere; whereas Boston is like a piece of London dropped into America. Boston’s buildings and parks are extraordinary, and much of the architecture reminds me of Mayfair.

The costs mount up

Just be aware that when you travel overseas the costs may be much more than you expect. For example, when dining in America the numbers are pretty much the same as Australia. If you want coffee and scrambled eggs for breakfast you will probably pay $5 for the coffee and $20 for the eggs. That’s a total of $25.

Then there is the tip which is normally at least 20% and then the conversion rate which is currently about 1.50. So the bill goes to $US30 when the tip is added and then becomes $45 Australian.

And then in many states and cities, the taxes are never-ending. This is an extract from our bill in Boston:

Image by Freepik

Image by Freepik

Travel Finance

Travel finance is always a hot topic, and the day before departure my inbox was inundated with queries about Latitude finance. After many years of their card having zero annual fee, they had just emailed all card holders advising they were bringing in an eight-dollar-a-month fee. The big question from readers was, “What should we do?”

A quick look at Latitude’s annual report indicates why they need to increase their revenue. After copping a loss of $137.9 million, which included $68.3 million of costs related to a cyber-attack, they announced no dividend would be paid for the year ended June 2023. A $100 annual fee paid by each of their many card holders would certainly help their bottom line.

The timing was perfect, as I just prepared my armoury of credit cards ready for departure. My major tools are currently my Wise card and my ING card. These are both debit cards with good conversion rates: one good thing about a debit card is you never come home to a large, unexpected credit card bill. I believed I would need a credit card for checking in at hotels, and I know that a normal Visa or Amex credit card does the job to act as a guarantee for payments, but I make it clear I’ll be paying with my debit card, as I don’t want to be slugged by the high rates of exchange charged by most Australian credit cards.

The day I left I got an email from a fellow in Budapest telling me he had been reading my stuff online and I was wrong to say that you can’t use a debit card to guarantee a hotel reservation. He is a huge fan of the Wise card, and assured me that he always used it to guarantee hotel reservations.

It was a perfect opportunity for some on-the-spot market research. We checked into the Fairmont Boston, where staff made the usual request for a credit card as a “guarantee”. I asked if I could pay upfront, and they replied that I couldn’t – they will only take a card guarantee and bill you at the end of your stay.

Without a word, I handed over my Wise card and within seconds an amount in excess of US$3000 was approved. Straight away, the Wise app on my phone showed the transaction as “pre-authorised”.

This is a game-changer! A major problem for retirees is that banks refuse to give them a credit card, yet cards have been essential to act as a guarantor for hotel and rental car bookings. A no-fee debit card that will be accepted universally for accommodation and rental car bookings makes credit cards obsolete for most retirees, who have reached the stage in life where they don’t need a line of credit. It also avoids credit card fees, and while you “miss out” on points, their alleged benefits are minuscule.

The cream on the cake is that debit cards don’t need finance approval, as you are accessing money you have already. So unless you actually need credit, you can let your Latitude card go, and travel with debit cards. Let’s raise a glass to the wise reader from Budapest.

Image by Freepik

Image by Freepik

The Wise card

I’ve mentioned the Wise card before, but let me make it clear I have no financial interest in promoting it. I had never heard of it until a reader took me to task not mentioning a card which had saved her thousands of dollars in fees. It turned out she is a senior figure in the World Health Organisation and travels the world extensively in her job. During our email exchange I found out she lives in Brisbane, and we had a few mutual friends.

Since then I’ve recommended Wise to a few of my friends who travel a lot and they were all ecstatic in their praise of it. I’ve also have had emails from people telling me there are other cards just as good but they tend to be issued by major institutions and I just have not had time to research them.

What I love about the Wise card is the ease of getting one. Geraldine and I simply did an online application from home which required a selfie with our passports, and the completion of a simple form. The card was approved on the spot and we also took up the option of the $10 once off payment for a Wise Visa card.

It is a multiple currency card but so far I’ve only used Australian dollars and American dollars. You can switch between currencies in a flash, and I kept it all in American dollars for this trip. I also took my ING debit card which has been a good friend for years but it’s interesting that the ING card with the balance of AU$10,000 does not seem as valuable as a Wise card with a balance of US$6,700.

The ING card also charges 3% fee for all overseas transactions which is rebated provided you comply with their terms of conditions. The Wise card is fee free. I had to make a cash withdrawal of $US200 to provide some spending money for grandchild number one who is about to go on a school trip to Cambodia – naturally this incurred a Bank of America ATM fee of $4.50. The moment that $200 came out of the ATM Wise sent me a text to tell me at ATM withdrawal has just taken place. It’s a great safety mechanism.

I will probably finish my American trip with US$ 2,000 on the card. I have a speech in Christchurch New Zealand on 7 September so once I leave America, I’ll just switch the USD to New Zealand currency. It is truly universal.

Markets

It’s been a volatile few weeks in the share market, with some large falls followed by big bounce-backs. It’s not a problem for seasoned investors, because we’ve been through it many times before, but it scares the life out of people who don’t understand how share investing works.

Shares’ volatility leads to massive media coverage and invariably results in a spate of emails seeking guidance. A 46-year-old emailed me to ask if he should switch his superannuation from growth to capital stable, and someone who is retiring in two years asked if they should move all their superannuation to cash. Either of these strategies could have serious long-term consequences, so today I will re-state the value of shares.

Image by Bob Rich for Hedgeye

Image by Bob Rich for Hedgeye

Historically, shares have been the best performing asset class. One of their major advantages is liquidity. If I’ve got a $1 million share portfolio and you have a $1 million investment property, I can sell my shares in parcels if necessary (minimising capital gains tax), but if you need money, you can’t sell the back bedroom. Of course, this unique benefit comes with a cost, which is that share prices fluctuate daily, and the price is often not an accurate indicator of the state of the company.

Because of liquidity, the value of shares continually moves up and down, but in the long-term the trend has always been upwards. You need to understand that fluctuations are normal: don’t get spooked. History tells us that every decade has about six good years and four bad years.

The large swings happening at the moment naturally raise questions like, “How far are the markets going to fall?” and, “Is this a good time to invest?” I have long believed that it is never a bad time to make a good investment. Let’s face it, no one knows when a market is going to peak or hit the bottom. In any event, experienced investors know that it’s time in the market that counts, not timing the market.

Unfortunately, the average Aussie has a strange approach to investment. When a stock market boom has become well established they love to jump in and buy up big, because they believe the boom is never going to end. When the market has one of its inevitable downturns (as it is doing now) they stay away in droves, or worse still, sell out at the worst possible time. All this does is turn a paper loss into a real one.

A classic example of the folly of trying to time the markets is the story of clients of Peter Lynch, the legendary manager of the Fidelity Magellan Fund. In the late 1980s and early 1990s, Lynch’s fund was one of the best-performing mutual funds in the world. Despite this, studies later showed that the average investor in the fund earned significantly less than the fund’s overall returns. Why? Because investors repeatedly tried to time the market by buying when the fund was doing well and selling when it was performing poorly, instead of riding out market volatility. By letting fear and greed dictate their decisions, they bought high and sold low.

This behaviour illustrates how difficult it is for even experienced investors to time the market effectively. Over the long term, trying to predict short-term market movements typically leads to poorer outcomes than simply staying invested and benefiting from the overall growth of the market.

Image by Bob Rich for Hedgeye

Image by Bob Rich for Hedgeye

I have always suggested that retirees keep at least three years’ planned expenditure in cash-type assets to give themselves an alternative source of funds to ride out market downturns. However, they should keep in mind that rising life expectancies mean that they probably have 20 or 30 years investing ahead of them. No one should stay mostly invested in cash for that long.

Despite the current volatility, investors have done well over the last few years. An investment of $100,000 in January 2022, in a fund which matched the All Ordinaries Accumulation Index, is now worth $115,000 – a gain of 15% per annum. The same investment made in January 2000 is now worth $723,000 or 8.6% per annum, which matches the long-term return on Australian shares for the last 120 years. Don’t be scared of shares’ volatility.

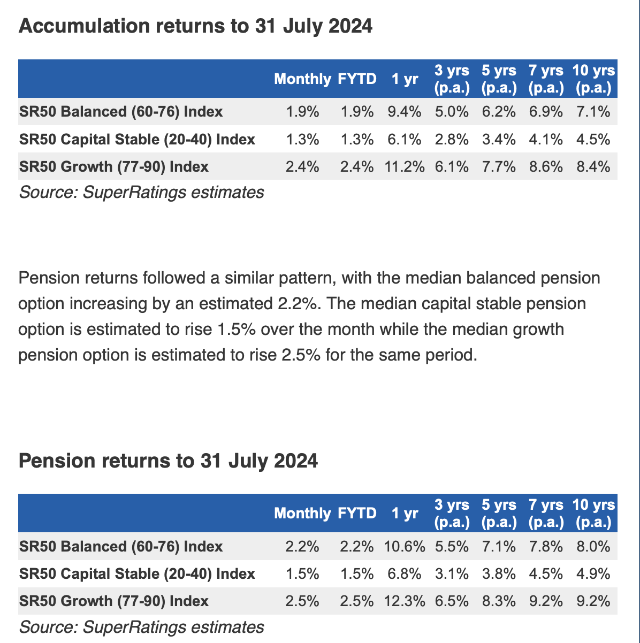

The latest Superannuation numbers are below. Notice that share based investments continue to be the best performers.

Our book shop

It’s been a frustrating month for my team. Because of the huge demand for the book Wills, death & taxes Made Simple and the new Super Made Simple we ran out of stock. This required a reprint of the Wills book which of course takes time, and an urgent message for stock to Harper Collins in Sydney where most of the books are kept for distribution to retailers.

Despite urgent messages and frantic phone calls it took Harper Collins two weeks to get the books to us by which time I had left for Los Angeles. To make it worse we suffered two glitches to our system which resulted in some order notifications vanishing.

We now have stock and as far as I know the system glitches have been fixed.

But, if you have any ordering issues just email me straight away at noel@www.noelwhittaker.com.au and I’ll be right onto it. I supervise all orders personally and promise you all emails are attended to as a priority.

And finally

How important does a person have to be before they are considered assassinated instead of just murdered?

How important does a person have to be before they are considered assassinated instead of just murdered?

Why do you have to ‘put your two cents in’ but it’s only a ‘penny for your thoughts’? Where’s that extra penny going to?

Once you’re in heaven, do you get stuck wearing the clothes you were buried in for eternity?

Why does a round pizza come in a square box?

What disease did cured ham actually have?

How is it that we put man on the moon before we figured out it would be a good idea to put wheels on luggage?

Why is it that people say they ‘slept like a baby’ when babies wake up every two hours?

If a deaf person has to go to court, is it still called a hearing?

Why are you IN a movie, but you’re ON TV?

Why do people pay to go up tall buildings and then put money in binoculars to look at things on the ground?

Why do doctors leave the room while you change? They’re going to see you naked anyway.

Why is ‘bra’ singular and ‘panties’ plural?

Can a hearse carrying a corpse drive in the carpool lane?

If the professor on Gilligan’s Island can make a radio out of a coconut, why can’t he fix a hole in a boat?

Why does Goofy stand erect while Pluto remains on all fours? They’re

both dogs!

If Wile E. Coyote had enough money to buy all that ACME crap, why didn’t he just buy dinner?

If corn oil is made from corn, and vegetable oil is made from vegetables, what is baby oil made from?

If electricity comes from electrons, does morality come from morons?

Do the Alphabet song and Twinkle, Twinkle Little Star have the same tune?

Why did you just try singing the two songs above?

Why do they call it an asteroid when it’s outside the hemisphere, but call it a haemorrhoid when it’s in your butt?

Did you ever notice that when you blow in a dog’s face, he gets mad at you, but when you take him for a car ride, he sticks his head out the window?

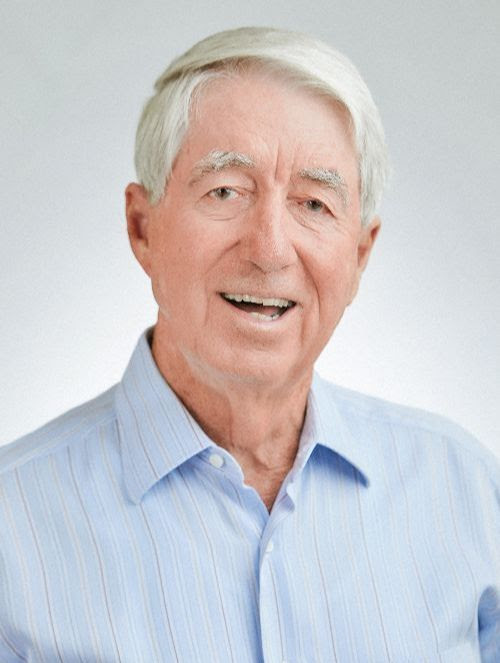

I hope you have enjoyed the latest edition of Noel News.

I hope you have enjoyed the latest edition of Noel News.

Thanks for all your kind comments. Please continue to send feedback through; it’s always appreciated and helps us to improve the newsletter.

And don’t forget you’ll get more regular communications from me if you follow me on X – @NoelWhittaker.

Noel Whittaker