“Asking for help is not giving up…

It’s refusing to give up”

DAVID MELTZER

Welcome to our December newsletter

It’s been another busy year – but then, aren’t they all? The highlight for me was releasing my Will’s Death and Taxes book, which has been selling exceptionally well – clearly filling a much-needed gap. As the population continues to age, estate-related issues are becoming increasingly common. I’m often surprised at how many people remain unaware of the death tax on superannuation – or the need to act quickly if the account holder of an account-based pension, usually your partner, passes away. Delay could mean the suspension of the pension for over a year.

And don’t forget the podcast that comes with this newsletter – it covers some of the information here in more detail. Don’t miss it.

The financial advice reforms have been in the too-hard basket for three years. Just last week, they announced some sort of compromise, creating a different level of advisors that could be used by superannuation funds. This is a difficult area because advice can be complex – and many people are still not prepared to pay for it. Time and time again, I get emails from people saying, “I rang my superannuation fund – waited for hours – and then the advice they gave me was wrong.”

The aged care reforms are now law and Rachel Lane and I will be launching a new book about aged care in April. There will some major changes and getting it wrong can be very costly.

The local and international share markets have done well. If you look at the Stock Exchange Calculator on my website, you’ll see that $500,000 invested a year ago – in December – would have been worth $575,000 on November 30. That’s a gain of 15%. Sure beats leaving your money in the bank!

I’m still getting questions about whether you should exit the market in case something happens when Donald Trump becomes president. I urge you all to take a long-term view. Once you try to time the market, you are on a slippery slope because you will be trying to judge when the best time is to exit the market and then decide the best time to get back into the market. History tells us that the best performance comes from hanging in there. Just make sure you have adequate cash on hand for the next three year’s expenses.

Books for Christmas

We are less than three weeks from Christmas Day so if you’re looking to buy books as gifts, you’ll need to act quickly. We have heaps of stock available and will be shipping all orders express post – don’t delay.

Surround yourself with financial wisdom with Ebooks.

Your phone or tablet brings you a finger tap away from the entirety of human knowledge and the summer break is a great time to put into place all the plans you have for an abundant retirement – from your sun lounge. My Ebooks can come with you to the campsite, hotel, pool or beach.

While you relax, learn how to create and protect a lasting legacy with Wills Death and Taxes Made Simple eBook.

Discover all the ways make the Australian superannuation system work tirelessly in your favour with Super Made Simple eBook.

Or bring that happy, healthy, abundant retirement much closer with Retirement Made Simple eBook.

Bitcoin

Bitcoin looks like the star of 2024, with a mind-blowing increase in price of 147% for the year.

Cartoon by Bob Rich for Hedgeye

Cartoon by Bob Rich for Hedgeye

The big question is: what happens next? The buzz is that – with Donald Trump returning to power and pledging support for cryptocurrency – Bitcoin could be poised for a big run. We’ve hit the stage where Uber drivers and home handymen are telling me to get on board. That’s a classic red flag! I don’t hold any crypto, and I’m reminded of financier Joseph P Kennedy’s famous warning: “You know it’s time to sell when shoeshine boys start giving stock tips.”

You can even find Bitcoin ATMs in many newsagencies now. The best part for small investors? You don’t need to buy an entire coin: you can start with small fractions. We were driving in the country recently, and I was chatting to the owner of a small newsagency agency … I asked him if anyone used his bitcoin ATM; he said it was extremely busy, especially with the young folks.

Then he shared something remarkable. He had bought five bitcoins a few years ago at $10,000 each. Today, his holding is worth nearly three-quarters of a million dollars. When I asked if he planned to sell, he shrugged and said, “I’ll just let it sit there.”

I’m hearing more and more stories like this: people who bought a couple of bitcoins on a whim a few years back now find themselves sitting on life-changing profits. Yet people’s prevailing attitude seems to be the same: let it ride and see what happens.

The price has certainly been volatile. On 22 December 2017, Bitcoin hit a peak of AUD $26,000 before plunging to just AUD $4,700 in February 2019. It then surged to AUD $82,800 by 5 November 2021, only to retreat to AUD $25,000 in December 2022.

Now, Bitcoin has reached an all-time high of AUD $152,000, representing an incredible 146% increase over the past year.

Cartoon by Bob Rich for Hedgeye

Cartoon by Bob Rich for Hedgeye

This is not a new phenomenon. Back in the 1600s, the Dutch found themselves swept up in a frenzy over a simple flower – the tulip. These exotic blooms, brought all the way from the Ottoman Empire, became the must-have item of the day, a real symbol of wealth and sophistication. Everyone wanted them. Demand shot through the roof, and so did prices. Some of the rarest tulip bulbs sold for more than the cost of a house!

Then traders started buying and selling tulip futures – betting on flowers that hadn’t even bloomed yet! It was all going gangbusters until February 1637, when the bottom fell out of the bubble. Buyers vanished, prices crashed, and people who’d gambled everything were left empty-handed.

The Poseidon bubble was a wild ride that became the stuff of Aussie legend. Back in 1969, Poseidon NL was just another little mining company until word got out they’d struck it rich with a nickel discovery in WA. With nickel prices soaring, the share price went from a humble 80 cents to an eye-popping $280 faster than you could say “gold rush”. Everyone wanted a piece of the action: mums, dads, taxi drivers, the bloke down the pub … But then it all came crashing down like a cyclone blowing through a tin shed. Nickel prices nosedived, doubts crept in, and the shares sank like a stone. It was a fair dinkum reminder: what goes up doesn’t always stay up.

Just three years ago a horde of day traders, acting on information from social media site WallStreetBets, joined forces to do battle with American hedge funds who had shorted stocks like GameStop, which had shot up 8720% to $483 in just two months. That stock plunged rapidly, dropping to around $40 by mid-2021.

What do these tales all have in common? They are investment bubbles. The item at the core of an investment bubble may have real intrinsic value, but at some point, market sentiment strays well away from that value. From then on, the sky’s one limit, and the other is the bottom of the deep blue sea. A bubble is all about investor sentiment, and when one forms, it will inevitably pop at some point. If you want to gamble on a bubble, by all means do so – as long as you don’t bet more than you can afford to lose.

Scams

The email made me feel sick to the stomach. It was penned by a woman whose husband – let’s call him Jack – worked as a fly-in-fly-out worker. Unfortunately, it looks like the nest egg his wages funded may be lost to the couple, due to an unfortunate combination of circumstances.

Image by Freepik

Image by Freepik

The story began innocently enough. One evening, the husband was having a beer with his mates on site and the conversation turned to self-managed superannuation funds (SMSFs). A co-worker spoke glowingly about SMSFs, assuring those gathered round that they were a surefire way to make more money than traditional superannuation funds. This piqued Jack’s interest, and he started trawling through the internet, wanting to learn more.

During his search, he came across a website called “Compare Your Super.” Intrigued, he made contact and quickly got a call back from someone purporting to be from Australian Fiduciaries Limited (AFL). Jack mentioned his preference was to buy an investment property, but the caller told him there were much better options available.

They suggested he start an SMSF, which would offer freedom and control over his superannuation. Once he had his own fund, they assured him, he could withdraw money whenever he wanted, free from the usual preservation rules. It seemed ideal! They then convinced him that their own funds were a far better option than real estate or traditional investments. The upshot was that they talked him into investing in their grandly named Ethical Alpha Fund (now known as Global Diversity Fund).

Jack explained it to his wife, and they went ahead and set up an SMSF with AFL, rolling all their superannuation into the new fund.

Their dreams were crushed when just two weeks ago they read an article revealing that AFL had been hit with an interim stop order by ASIC “to protect retail investors,” and that Compare Your Super had been liquidated. Information is still hard to find, but it appears that some of AFL’s investments have been frozen. At this stage, Jack and his wife cannot find out when any of their super funds might be refunded to them, and if so, how much.

It’s a tragic but all-too-familiar tale. Searching the web for the “best” investments is like diving into a lake filled with alligators. It’s dangerous, and you rarely know what’s under the surface. Fake sites are prevalent, and scammers are clever at designing names which are very similar to well-known and highly regarded institutions. You can never be certain exactly who you are dealing with.

The scammers work hard, because the payoff can be huge. Just recently I got an email from a woman in Sydney who had been cold-called – by the time she contacted me, she was about to start an SMSF to build an investment property in Perth. Of course this would be constructed by the scammers, to maximise the amount of money they could extract from her. Luckily I got her out of that trap before the deed was done.

Image by Freepik

Image by Freepik

SMSFs are fine in the right context and can be extremely good for the acquisition of business premises, or to enable investors to invest in quality property syndicates which are not available through a normal fund. But they are not for most people. Any suggestion from someone – other than a financial adviser you have an ongoing relationship with – to start an SMSF with a vague goal, like “getting better control of your finances” is a red flag.

Another red flag is receiving a cold call regarding investment. If you are contacted out of the blue, the proposal is far more likely to serve the caller than you. And a promise that’s too good to be true – like an SMSF with no preservation restrictions and quick access to your money – should always raise red flags.

These investment scammers exploit people’s lack of awareness, targeting those who want control over their super but lack the expertise to manage it independently. If you’re not financially savvy, why would you take your money away from professional management to do it yourself? Sadly, this FIFO worker and his wife have learned that lesson at a heartbreaking cost.

Cost of living

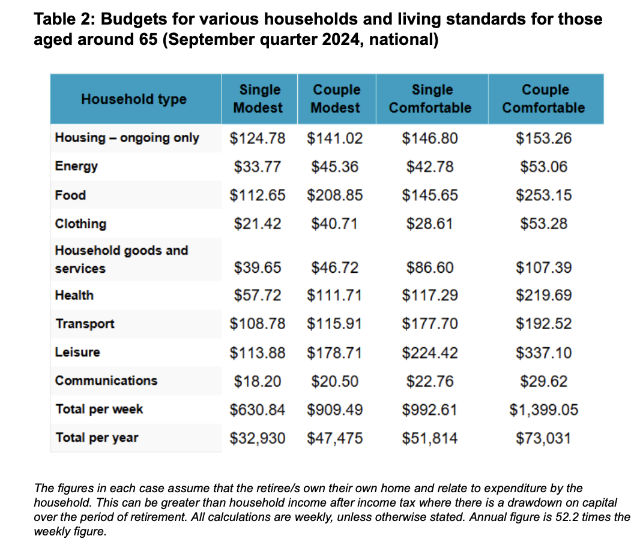

ASFA, the voice of super has just released some welcome news for retirees as the season of giving approaches – the cost of funding a comfortable retirement fell by 0.5 percent in the September quarter, leaving more money in the pocket for Santa’s little helpers.

The latest data shows that in order to reach the ASFA Comfortable Standard, couples aged around 65 now need $73,031 annually to achieve a comfortable retirement, while singles need $51,814.

Image by Freepik

Image by Freepik

This equates to $595,000 in superannuation and savings for a single person retiring at age 67, and $690,000 for a couple retiring at age 67. The September quarter retiree budget fall was driven by factors such as lower automotive fuel prices and Commonwealth and State Government rebates aimed at lowering the cost of energy.

You’d have to wonder where they got the figures from. Everything has gone up except petrol prices. They’re only down because of the price of oil droppings, a situation which certainly won’t stay forever.

I’m including the details because I think it’s good at this stage of our lives to keep track of our expenditure to see if there’s ways we can chop it down. But don’t forget if you’re older and you foresee yourself dying with a paycheck of money, it’s a good idea to spend that on experiences while you are young enough to enjoy them. Here are the figures.

Food: Prices rose 3.3% over the 12 months to the September quarter, with sharp rises for essentials like fruit and vegetables.

Health: Dental services rose 0.9% this quarter. Over the past 12 months medical and hospital services prices rose by 5.6%.

Transport: Costs were down in the quarter, with automotive fuel dropping by 6.7% and urban transit down 2.1%.

Insurance: Costs increased by 2.8%, with rises in premiums across house, home contents and motor vehicle insurance reflecting higher reinsurance, natural disaster and claims costs.

Travel: International holiday travel and accommodation was up 1.9% in the quarter, while domestic holiday travel and accommodation rose by 1.1%.

Here are the detailed calculations. Have a think about whether you’re spending could fit into these boxes.

Life expectancies

Image by wayhomestudio on Freepik

Image by wayhomestudio on Freepik

Life expectancy is back in the news, with recent revelations that Australians’ life expectancy has fallen for the second year in a row, due to COVID-19. Well, of course, bad news makes good headlines, but do you need to be worried? Not at all. Life expectancy tables are just a snapshot of the population as a whole and have nothing to do with individuals. And, like the property market, it varies from region to region. For example, life expectancy in North Britain is six years less than life expectancy in the South – all because of lifestyle.

Of course, getting an idea of how long you might live is important when you’re deciding how much money you will need when you retire. But the biggest factor in how long a person lives is really how they live – that’s the good news! Keep in mind that you should treat any projected life expectancy figures with healthy scepticism. How can anybody accurately forecast what medical breakthroughs will occur over the next 100 years?

Not long ago, National Geographic featured a striking headline: “This Baby Might Live To 120”, highlighting medical breakthroughs extending human life spans. One notable aspect was a genetic disorder that stunts growth but also shields against cancer and diabetes. Isolating this gene could mean breakthroughs in preventing these diseases altogether.

David Williams, founder of My Longevity Pty Ltd, introduced the SHAPE acronym to help people estimate their life expectancy: Surroundings, Health, Attitude, Parents, and Eating habits. It’s a sensible approach: those with supportive environments, good health, a positive outlook, favourable genetics and balanced nutrition often outlive those who lack these advantages. Over time, our differences amplify, underscoring that personalised strategies work.

On his website, www.mylongevity.com.au, Williams offers a free SHAPE Analyser quiz for anyone over 44.

It’s a simple, five-minute tool that projects life expectancy and initiates a personalised longevity plan, guiding users to map out and maximise their future. I highly recommend trying it. But remember that life isn’t static: your outlook and habits can shift over time. Research suggests that the longer you live, the greater your chances of living even longer are, with the dependent phase shortening. Thus, strategic planning becomes essential, especially in a situation where one partner is fully functioning and the other partner needs care.

For those aged 50 today, reaching 100 isn’t far-fetched. There’s a financial challenge in this: if you retire at 65, you’ll need to prepare for another 35 years without income. There are two things to focus on: optimising your returns on financial assets and optimising your lifestyle to maximise your retirement happiness.

Irrespective of how long we live, there are two major factors that have been proven to make for a happier, healthier and more fulfilling retirement. These are a sense of purpose and a good social network.

Whether you’re single or in a couple, having activities that give you purpose is vital – it’s the reason to get out of bed in the morning. These activities can range from pursuing hobbies or playing sports to joining your body corporate’s committee. The crucial thing is staying active and involved. In my opinion, the ideal environment for older retirees is a well-chosen retirement village. The best ones offer a wide array of activities that foster engagement and help sustain a sense of purpose.

One of the most significant advantages of a retirement village is the support the community can offer when one partner passes away. Few things are as difficult as living alone at home after a partner’s death, and many widows and widowers quickly become isolated and lonely without social support. In contrast, retirement villages offer companionship, understanding and a shared community, ensuring that life continues with connection and comfort.

My Book Retirement Made Simple has a big section covering retirement living and how senior citizens can extend their life expectancies and have a happy life.

From the mailbox

In my 20s I was working as a steward on various P&O ships around the world. I was on board the Oriana in 1987 having a wonderful time, earning quite well and enjoying my life to the full. My shift one day had me working in one of the lounges, a very quiet shift, no chance of a tip, just serving tea and coffee to a few passengers that were interested in listening to an onboard lecturer.

The lecturer was a Mr Noel Whittaker. I had served all the coffees and teas and was heading out to the pantry for a quick smoke when Mr Whittaker introduced himself to the passengers. He said, “I want to thank you for attending my lecture today. Only 8% of people actually achieve wealth, and you are the 8%.”

Image by topntp26 on Freepik

Image by topntp26 on Freepik

I had my hand on the pantry door handle and had to make a big decision. Smoke … or just listen for a few minutes. It sounded interesting.

It was the best decision of my life. I let go of the handle and stood at the back of the lounge and listened to the lecture. Afterwards I stayed back and purchased your book, and read it and read it over and over again.

I purchased my first property a year later, a two-bedroom overlooking the ocean in Clovelly, Sydney.

And finally

Signs from around the world

Cocktail lounge, Norway:

Ladies are requested not to have children in the bar.

At a Budapest zoo:

Please do not feed the animals. If you have any suitable food, give it to the guard on duty.

Hotel, Acapulco:

The manager has personally passed all the water served here.

Information booklet about using a hotel air conditioner, Japan:

Cooles and heates: if you want just condition of warm air in your room, please control yourself.

Car rental brochure, Tokyo:

When passenger of foot heave in sight, tootle the horn. Trumpet him melodiously at first, but if he still obstacles your passage then tootle him with vigor.

Dry cleaner’s, Bangkok:

Drop your trousers here for the best results.

Sign in men’s rest room in Japan:

To stop leak turn cock to the right.

In a Nairobi restaurant:

Customers who find our waitresses rude ought to see the manager.

On the grounds of a private school:

No trespassing without permission.

On an Athi river highway:

Take notice: when this sign is under water, this road is impassable.

On a poster Cancun:

Are you an adult that cannot read? if so, we can help.

In a city restaurant:

Open seven days a week and weekends.

A sign seen on an automatic restroom hand dryer:

Do not activate with wet hands.

In a Pumwani maternity ward:

No children allowed.

In a cemetery:

Persons are prohibited from picking flowers from any but their own graves.

Sign in Japanese public bath:

Foreign guests are requested not to pull cock in tub.

Tokyo hotel’s rules and regulations:

Guests are requested not to smoke or do other disgusting behaviours in bed.

On the menu of a Swiss restaurant:

Our wines leave you nothing to hope for.

In a Tokyo bar:

Special cocktails for the ladies with nuts.

I hope you have enjoyed the latest edition of Noel News.

I hope you have enjoyed the latest edition of Noel News.

Thanks for all your kind comments. Please continue to send feedback through; it’s always appreciated and helps us to improve the newsletter.

And don’t forget you’ll get more regular communications from me if you follow me on X – @NoelWhittaker.

Let me finish by wishing you a all very Merry Christmas and a healthy happy and prosperous 2025.

Noel Whittaker