“Government projects are notorious for taking longer and costing more than originally planned. This is because they are typically very complex and involve many stakeholders with differing interests and priorities.”

SENATOR TOM COBURN, 2013

Last Tuesday’s budget was a surprise…

As the first real budget after a change of government, it didn’t follow the historical pattern. Typically, the incoming government discovers to their horror that the financial situation of the country was much worse than their predecessors had claimed, and severe medicine needs to be taken to get things back in order. Their first budget includes all the hard stuff the new government thinks needs to be done. Then in the following budget, which could well be an election budget, given the three-year election cycle, they reward voters with a much more friendly budget.

But the only obvious nasty in this budget was increasing taxes for people who have more than $3 million in super. This has already been debated ad nauseum. It’s not yet legislated and it’s two years to the proposed effective date. In any event, it won’t raise much money, as anyone with more than $3 million in superannuation will have the smarts to invest elsewhere in more tax-friendly ways.

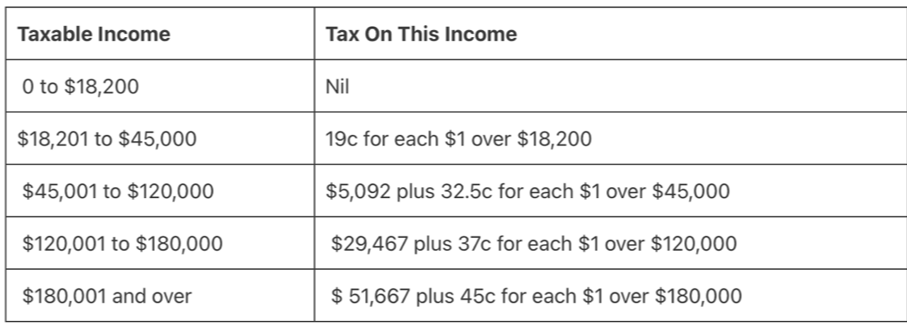

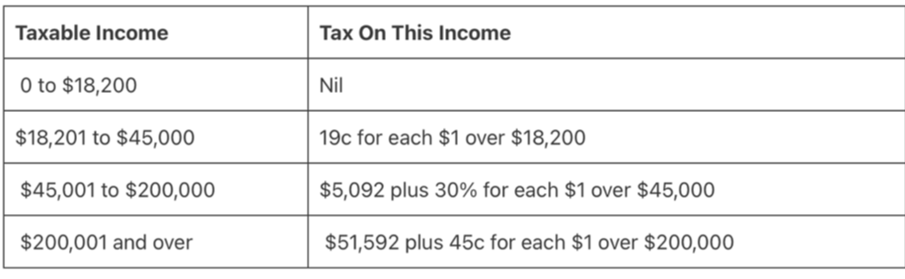

It was great that the legislated tax cuts were kept – if they had been rescinded, many ordinary workers would have been pushed by bracket creep into higher tax brackets.

Tax scale 2022-23

Tax scale 2024-25

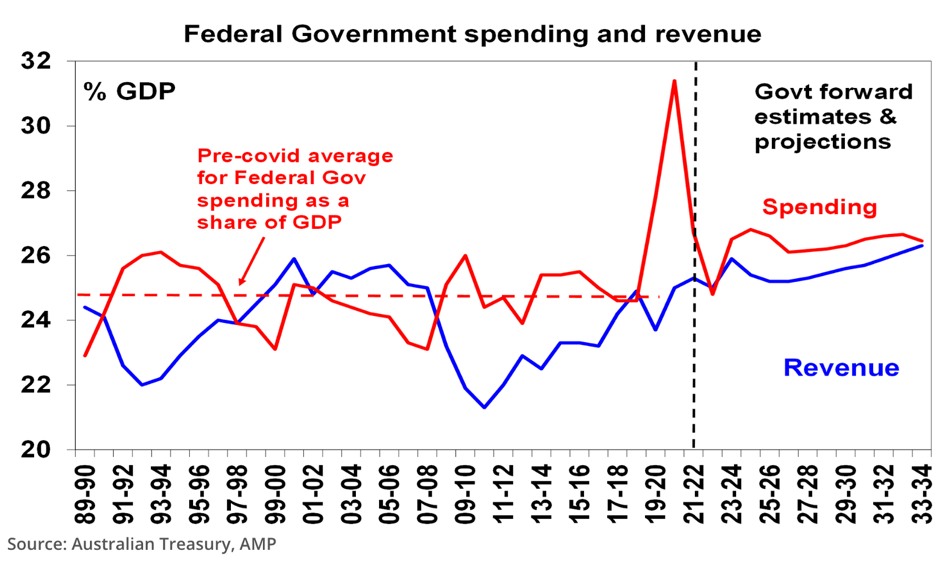

Unfortunately, there is a nasty sting in the tail: the billions of dollars to be spent on extra welfare. It’s hard to argue with assistance to people in our lowest socioeconomic group, but the biggest enemy they have is inflation. What could be more inflationary than throwing billions of dollars to a group of people who will spend it as soon as they get it?

And the increases are a permanent expenditure – the government can’t take it back when things get tough.

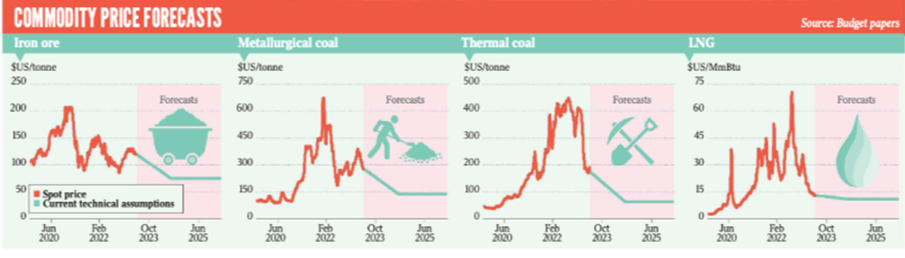

But the money to fund the expenditure is based on extraordinary revenue from iron and coal. Commodity prices are volatile. When receipts from exports tumble, the government will be stuck having to pay all this extra assistance to low-income people but won’t have the revenue with which to pay it.

When you combine the massive, proposed expenditure on low-cost housing and all the money to be pumped into the system, there is no doubt that this is a stimulus budget and therefore inflationary. And inflation means rising interest rates.

Research released this week by Finder claims that 50% of Australians live paycheck to paycheck. The combination of inflation and rising interest rates will make their life even harder.

One expected item did not make it into the budget: restoring the mandatory account-based pension drawdown numbers to what they were pre-Covid. They are not too onerous: a person aged between 75 and 79 would be required to draw 6% of the balance each year if they reverted. The table below has full details. They’re from my book Superannuation Made Easy. It would not surprise me if they are restored to pre-Covid levels from 30 June.

Watch this space.

Age care in the Budget

By Rachel Lane

The big ticket item for aged care in the Federal Budget is $11.3bn over 4 years to meet a 15% pay rise for 250,000 aged care workers. The commitment comes as a result of the Fair Work Commission’s findings in March and will see eligible workers benefit from 30 June this year. The budget provided an additional $338.7m in funding to improve home care.

Over 2023-24 an additional 9,500 home care packages will be provided at a cost of $166.8m. There are now more Australians receiving a Home Care Package than living in an aged care home. The latest home care package data shows that on 31 December 2022 there were 255,628 people with access to a package which represents an increase of 17% (37,904) from the year before.

The Support at Home Program that was due to commence in July has been delayed by a further 12 months as the industry warned that they are not ready. The program is set to replace the Home Care Package, Commonwealth Home Support and Short-Term Restorative Care programs. The new consolidated program is set to remove anomalies around assessment, eligibility criteria as well as the funding and fee arrangements which vary across the current programs and make it difficult for people to navigate. Around half the additional funding will be aimed at building the systems, trialling products and services and developing pricing for the new program.

The government will spend $827.2m over 5 years to improve the delivery of aged care, more than half of the funding ($487m) will be used to extend the Disability Support for Older Australians Program, and there is $112m to incentivise GP visits in residential aged care and $41.3m for a new “place assignment system” to enable Australians to choose their residential aged care provider.

An additional $309.9m will be spent to strengthen regulation of the industry and improve health and safety for residents, which includes $139.9m for enhancements to the Aged Care Star Ratings, $59.5 for a national worker screening and registration scheme from 1 July 2024, $25.3m to bolster the audit and compliance program of the Aged Care Quality and Safety Commission and $12.9m to improve food and nutrition and enforce standards.

Other spending measures in the budget include $591.3m over the next two years to continue the government’s response to Covid19 and $7.3m to reduce the number of people under 65 living in residential aged care.

On the other side of all this spending is a $2.2bn cut over three years in funding for residential aged care. The funding reduction will come from a reduction in the allocation of aged care places. Currently the government provides funding for 78 residential aged care places per 1,000 people over the age of 70. That ratio will be reduced to 60 for 3 years from 2024-25.

While there was no mention of changes to the means testing arrangements, the government is said to have paid consultants $396,000 to look into consumer contributions to the cost of aged care. Those findings may have been too soon for the Budget, but we could see them in the Mid-Year Economic and Fiscal Outlook.

Ballina event

It was great to see so many of you at the seminar in Ballina hosted by the Australian Association of Independent Retirees. It was meant to be a post-budget seminar, but as the national president of the association Wayne Standquist, who was a special guest, pointed out, the budget really had nothing to do at all with self-funded retirees. We seem to be the forgotten people once again. In any event, it was great to revisit Ballina as I had not been there for at least 30 years. It’s a stunning place and I can see why so many people call it home.

Photo by Kathleen Banks on Unsplash

Photo by Kathleen Banks on Unsplash

A highlight of the morning was a woman who approached me to say she was 80 and had been a penniless immigrant from Great Britain. When she arrived in Australia, she picked up a copy of Making Money Made Simple and got herself onto a very active saving program. Now, 35 years later, she is a self-funded retiree with adequate money and no need to rely on the government. It just goes to show the power of one book.

We drove home via Lismore. It was much bigger than I had remembered – we came in over the mountains and drove down to the river level where the whole town had been inundated. We got some petrol at a BP service station and the owner pointed out buildings where the floods had been in excess of two stories above ground level. The garage owner said that when they were rescued by boat, they had to be careful not to touch the power lines above them with their umbrellas.

Many homes are still uninhabitable, and many will not be rebuilt as they were uninsured. It’s a sad sight and truly a national disaster.

We then travelled to Murwillumbah via Uki. It was a slow trip because the road was almost destroyed in many places, and there are stop and go areas with traffic lights all along the route. It’s now 16 months since the floods and many roads have still not been repaired properly.

Young at heart

Last weekend The Australian published some fascinating research. Data from a SEC Newgate research study commissioned by the Council on the Ageing (COTA) found that most older people felt younger than their biological age and 70% rated their quality of life as high. I have reproduced a summary of the study here.

I’m also reproducing a graphic from page 396 of my book Retirement Made Simple, which has the same kind of message.

It is interesting data – those over 70 are far likelier to report their health as being very good compared to those in their 50s. And men are much more likely than women to be doing at least two hours of exercise a week. Those aged 70 plus feel an average of nine years younger than their age, while those in their 50s feel only five years younger.

COTA Chief Executive Pat Sparrow says the report “provides policymakers with a great understanding of the issues and concerns older Australians are currently facing. We need a whole of government strategy that not only addresses today’s challenges but also focuses on prevention for future generations. Band-aid solutions cannot fix the challenges we are confronted with today. The inevitability of old age means getting the policy settings right for all Australians.”

Later this year the Albanese government will release its White Paper on full employment along with an update on the intergenerational report prepared by Treasury. As the population ages this topic will get more and more publicity.

And finally

(I couldn’t resist sharing this)

I hope you have enjoyed the latest edition of Noel News.

I hope you have enjoyed the latest edition of Noel News.

Thanks for all your kind comments. Please continue to send feedback through; it’s always appreciated and helps us to improve the newsletter.

And don’t forget you’ll get more regular communications from me if you follow me on twitter – @NoelWhittaker.

Noel Whittaker