“The easiest way to get to where you want to be is to find someone who is already there and ask them for directions.”

DAVID MELTZER

Welcome to our November Newsletter

Last week our Reserve Bank raised interest rates another 25 basis points. It was a bad decision.

I am one of 32 ‘experts’ who are surveyed each month for their prediction on the next monthly rate movement, and this month I was in the minority – just 30% of us forecast no change. It was not so much a prediction from me as it was a fervent wish. The last thing we need is another rate rise.

Image by stockking on Freepik

Image by stockking on Freepik

Central banks around the world are trying to combat inflation with one blunt instrument: interest-rate control. They have been sold on the idea that inflation should be kept within a specific target band, and all their efforts are directed to keeping it there, but the problem is that it’s a concept with no statistical validity.

Many people are flabbergasted to learn that the Reserve Bank of Australia’s 2% target was created out of thin air in 1990 by the Reserve Bank of New Zealand and has no basis in any sort of academic study whatsoever. In fact, it appears to have come from an off-the-cuff remark made during a TV interview with Roger Douglas, New Zealand’s finance minister at the time, who said that he’d ‘ideally’ want an inflation rate between 0% and 1%.

The 2% you hear today as a target was originally intended as a ‘boundary’ – nothing more – for inflationary bias, which was estimated to be just 0.75% at the time.

Following New Zealand’s lead, other countries, including Australia, Canada and the UK, adopted the 2% inflation target. The US Federal Reserve officially adopted the 2% inflation target in January 2012 under the leadership of Chairman Ben Bernanke.

The RBA is in challenging territory – it wants to see inflation drop, but increasing the loan repayments of average families will not affect inflation. We have imported inflation because of the wars in Ukraine and the Middle East. There are massive challenges in the building industry due to shortages and rising costs: architects tell me their developer clients who have approvals are not prepared to start building because the build costs are potentially so high the deals no longer work.

Image by gpointstudio on Freepik

Image by gpointstudio on Freepik

And what are governments doing? They are exacerbating the problem. They are pouring money into the system with massive infrastructure building projects everywhere and keeping demand high with migrants arriving at a rapid rate. This puts huge pressure on the already overcrowded rental market. We now have the ridiculous situation where central banks are putting the brakes on, while the rest of the government does everything they can to keep their foot on the accelerator.

Despite 12 previous rate hikes in the current cycle, the anti-inflation battle is far from over. Last month the latest Australian inflation figures were released for the September quarter, with mixed news. Quarterly inflation rose from 0.8% to 1.2%, while the annual rate (rolling 12 months) fell from 6.1% to 5.4%. It’s going to be a slow road to the RBA target.

Certainly, the rate rises in the last cycle have dampened the enthusiasm of shoppers – companies like Harvey Norman and JB Hi-Fi report declining sales, but they have had little effect on the big picture. Our inflation is structural.

A big problem is unemployment. Job markets are still very tight here and around the world: wages are rising everywhere. Rising wages without an equivalent rise in output just pushes prices higher and feeds the inflationary spiral. So where to from here? It’s anybody’s guess – the Reserve Bank can’t keep crushing working families and small businesses in a futile attempt to stop inflation, but they show no sign of stopping. Sadly, I feel things will get much worse before they get better.

To make matters worse, we are approaching dangerous times for our spending. The Black Friday Sales are now a major shopping event, then we have Christmas and then the school fees arrive. This is a time to be particularly cautious about your spending and I suggest you use debit cards, not credit cards. At least that way there are no unexpected shocks when the credit card statement arrives.

Another attempted break-in

Wednesday 8 November 2023 was a memorable day. That was the day when Optus captured the media all day because of outages – it was also the day when we had our third attempted break-in. We weren’t affected by Optus because we have stuck with Telstra for our mobiles.

After two attempted burglaries in the last 10 years, we make a point of arming the entire house when we go to bed at night. It’s just a matter of pressing one switch and every room except our master bedroom is monitored – this includes the garage, which is a separate building from the house. Apart from the two big doors, this building has a small side door, which we keep unlocked when we arm the house at night.

Image by jcomp on freepik

Image by jcomp on freepik

The reasoning is that the perpetrators will look in the garage first to see if there are cars worth stealing, and this will trigger the alarm, causing the burglars to lose interest and flee. On police advice, we have a bevy of security lights around the house which come on if there’s any interference during the night.

Something unusual happened on the night in question when we were preparing for bed. I tried to trigger the alarm, but a fault sign came up. My first thought was it would be a hassle to ring the alarm company to fix this and a burglary was a one-in-a-million chance. However, a voice inside me said to go the extra mile, so I rang our alarm company and after 30 seconds on the phone the alarm system was back to normal. The security company told us they were receiving an unusual number of similar calls because the Optus outage had put a lot of monitoring systems out of action.

That night at 3:20 am, our alarm went off. We jumped out of bed and discovered all the security lights had come on automatically, and it seemed there was nobody on our premises. Our home has heaps of CCTV and when we played back the footage it showed three young males coming into our yard and entering the garage – which triggered the alarm. They were not fazed by all the lights automatically coming on around them. Once the alarm went off, they fled.

The police were there in 20 minutes but there wasn’t much they could do. They told us that manual cars and Teslas never get stolen. These young thieves have never learnt to drive a manual car, and Teslas have a remote facility whereby you can turn the car off from anywhere in the world. It also shows the position of the car in real time.

In most parts of Australia, youth crime is on the increase – it just pays to be aware and do everything you can to keep your home and your family safe.

You are Invited

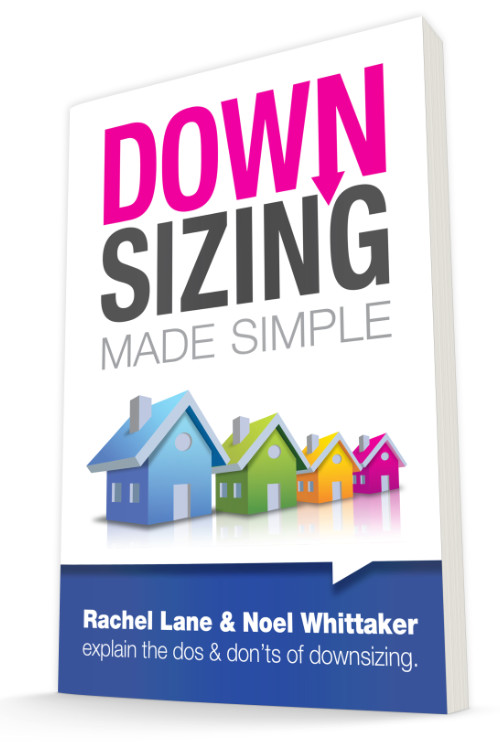

In late November and early December, Rachel and I will be travelling the eastern coast to launch our new book, Downsizing Made Simple. There are five separate events which are detailed below. Each event will consist of a 20-minute speech from both of us, and then question time from the audience.

If you’re thinking of downsizing, this is a great way to understand the advantages and disadvantages. Books are due to come off the presses this week and will be available at each venue on the day.

Just be aware that registration is important, even though the events are free, but in three events, you must email the venue and the three events you register online. If you have any trouble, just email me at [email protected]

If you select the menu where you need to send an email, the proforma form has no information on it, you will need to give them your details and confirm that you wish to attend a specific event. In Canberra, there will be two identical events.

Nov 28 – Gold Coast

Odyssey Lifestyle Care Communities

1 The Crestway, Robina

2–3pm

RSVP by 24 November

ph 5551 6720 or via email

Places are limited, bookings are essential.

Nov 29 – Brisbane – morning

Moreton Shores

87–113 King Street, Thornlands

(entry via Shores Drive)

10.30–11.30am

RSVP by 24 November

to Leigha Watt on 286 8675 or via email

Places are limited, bookings are essential.

Nov 29 – Brisbane – afternoon

Aveo Parkside Carindale Retirement Living

19 Banchory Court, Carindale

2–3pm

RSVP by 24 November here

Places are limited, bookings are essential.

On-site and street parking is limited. Additional parking can be located within Westfield Carindale and Harvey Norman.

Dec 1 – Sydney

McRae-McMahon Place by Uniting

17 Marion Street, Leichardt

10.30–11.30am

RSVP by 24 November here

Places are limited, bookings are essential.

Dec 5 – Melbourne

Europa on Alma

31 Alma Road, St Kilda

2–3pm

RSVP by 28 November

to Guy on 0499 714 196 or via email

Places are limited, bookings are essential.

Dec 6 & 7 – Canberra

Canberra Rex Hotel

(Grand Ballroom)

150 Northbourne Avenue, Braddon

10am–12noon

RSVP by 26 November here

Places are limited, bookings are essential.

How to buy Downsizing Made Simple

How to buy Downsizing Made Simple

HARD COPY

To buy Downsizing Made Simple on its own.

Just go to downsizingmadesimple.com.au

To buy the bundle of Downsizing Made Simple and Retirement Made Simple

go to my website here

E-BOOK

The ebook is available now and you can

read the first 30 pages here

Protecting our Kids

I don’t usually put this kind of material in the newsletter, but I thought this was so important it was a must.

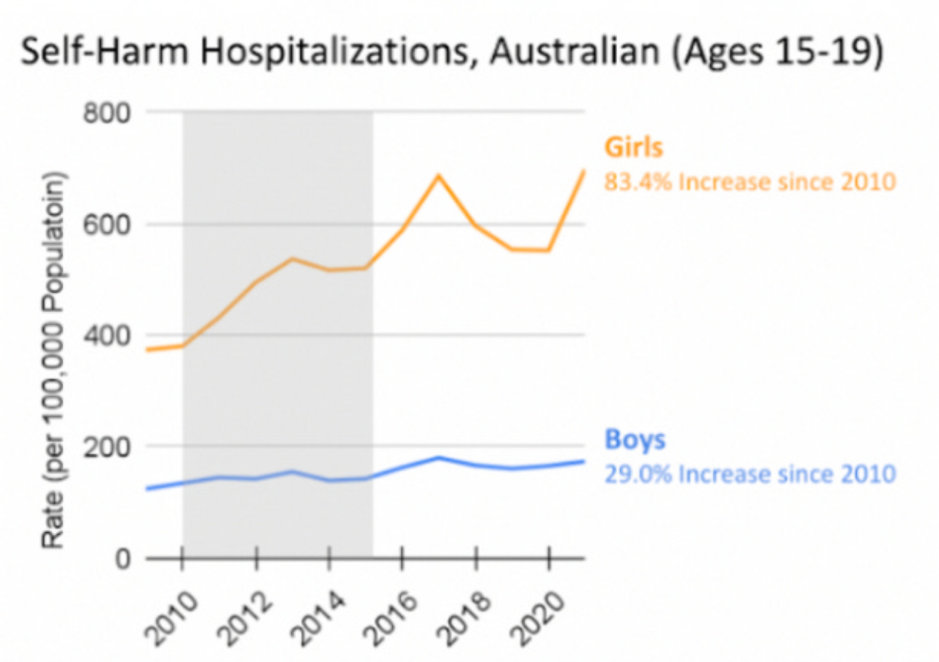

It would be comforting if there was room to argue with the data social psychologist Jonathan Haidt presented to a conference in London earlier this month. Sadly, there is not. We were not jumping at shadows when we suspected that ubiquitous access to social media had fundamentally reshaped childhood in mostly damaging ways.

Something happened across the Western world a decade ago when teenagers began using smartphones in significant numbers.

“If you plot out the trend lines for depression and anxiety, self-harm, and suicide, they’re relatively flat until 2010,” Haidt told the conference. “And then all over the English-speaking world, they start shooting up around 2012, plus or minus a year.”

Suicide rates are at peak levels across the Anglosphere and Nordic countries, for teenage girls. Not all are at equal risk. For kids who are religious conservatives, mental health conditions have hardly changed. For girls on the left and secular conservatives less grounded in traditional values, it is a very different picture.

The number of girls aged between 15 and 19 hospitalised for self-harm has increased by 78 per cent since 2010 in Australia. In the US, the number of 10-14-year-old girls admitted to hospital for non-fatal self-harm rose by 188 per cent in the same period. The trend is consistent in every jurisdiction where data is available.

“This is the biggest mental health crisis in known history for kids,” said Haidt. “The increased number of suicides since 2010 is so large that I suspect this is among the largest public health threats to children since the major diseases were wiped out.”

Haidt distinguishes between social media primarily used for networking, like Facebook and LinkedIn, and those that serve as platforms on which kids are compelled to perform.

“Social media platforms should never be accessed by children until they’re 18,” Haidt said. “it’s just insane that we let kids do these things that can ruin their lives.”

He singles out Instagram as the worst platform for bullying and TikTok as the worst for their intellectual development.

“It literally reduces their ability to focus on anything while stuffing them with little bits of stuff that was selected by an algorithm for emotional arousal,” Haidt said. He declares TikTok and Twitter incompatible with liberal democracy as it’s developed over the last few hundred years.

Yet access to social media is not the only behavioural change encouraged by smartphones.

“For all of human history, for millions of years, all mammals play,” Haidt said. “Mammal childhood is about building up your brain, and you do that through play.

“Once they all got phones, childhood stopped being play-based. It becomes phone-based.” He notes a significant decline in the habit of kids visiting other kids’ houses to play. Social interactions have become virtual, asynchronous, disembodied and transitory.

Some suggest that the rise in teenage anxiety might be because of greater self-reporting since mental health has been de-stigmatised. Haidt categorically rules that out.

“Right around 2013, in the U. S., Canada, Britain, Australia, and New Zealand, all these girls suddenly start checking in to psychiatric in-patient units.

“They’re making many more suicide attempts. Their level of self-harm goes up by two or three hundred per cent, especially for the younger girls, age ten to fourteen.”

These, says Haidt, are not self-reporting variables. This is real.

“It’s the great rewiring of childhood. It happened between 2010 and 2015. It hit the U. S., Canada, Britain, Australia, New Zealand exactly the same way. New Zealand’s a little bit later, but the US and Canada are exactly in lockstep about what happened to our kids mental health.”

Haidt is writing his next book on the subject. Life After Babel is scheduled for publication early next year. In it, he will recommend the introduction of four norms to solve what he says is a collective action problem.

The first: “Don’t give a smartphone to your 10-year-old. Wait until 14.

“Rule number two, no social media before 16.

“The third rule: phone-free schools. That does not mean you can keep it in your backpack. Otherwise the kids will go to the bathroom. They’ll find ways to get their fix.

“Rule four is far more free play, unsupervised play and childhood independence.

“If we do those four things, and if, even if half of us do them, we solve the collective action problem.”

And finally

I wanted to get my pants hemmed quickly, so I called Taylor Swift

I finally watched the documentary on clocks – it was about time

A tombstone with a typo? Well, that’s a grave mistake

My wife and I can’t count calories and we have the figures to prove it

I made a chicken salad last night – apparently they prefer grain

Fruit farmers eat what they can and can what they can’t

Taking steps to overcome my hiking addiction – I’m not out of the woods yet

Women’s roofing Expo this weekend – all the shingle ladies will be there

My wife told me to put ketchup-up on the shopping list; now I can’t read anything

When the dentist married the manicurist, they fought tooth and nail

I have a black eye in karate

The banana went to the doctor because it wasn’t peeling well

Great hide-and-seek players are really hard to find

James Bond sports grey hair in his latest film – no time to dye

I married my wife for her looks, not the ones I’m getting late

When you dream in colour it’s a pigment of your imagination

It doesn’t make any sense but volunteering is rewarding

I think my wife is putting glue on my firearms. She denies it but I’m sticking to my guns

Man in boxers leaves police in brief chase

I hope you have enjoyed the latest edition of Noel News.

I hope you have enjoyed the latest edition of Noel News.

Thanks for all your kind comments. Please continue to send feedback through; it’s always appreciated and helps us to improve the newsletter.

And don’t forget you’ll get more regular communications from me if you follow me on X – @NoelWhittaker.

Noel Whittaker