Do you know the difference between education and experience?

Education is when you read the fine print; experience is what you get when you don’t.

PETE SEEGER

Welcome to our March newsletter.

It’s been about five weeks since the last one, but things have been hectic in the Whittaker household. The good news is that the new book on estate planning is almost finished. It will be called Wills, Death and Taxes, and we hope to have final proofs by the end of this week. If all goes smoothly it should go on the printing presses later in the month and be available in April.

You’ll be given a chance to pre-order as soon as the book is on the printing presses. I know what the delivery date will be, but I don’t want to commit to any pre-orders until I have a definite printing schedule. It’s so easy for things to go wrong.

Image by senivpetro on Freepik

Image by senivpetro on Freepik

Talking about things going wrong, Neil, who is responsible for processing and shipping all our book orders, had a nasty fall three weeks ago and broke his hip. In his absence, the job of processing and shipping the books went to yours truly. Neil spent ten days in hospital but is now home and making good progress. My job was made harder because we had such a deluge of orders that we ran out of stock and had to ship cartons from Sydney. I’m pleased to let you know that Neil is back at work, and we are fully stocked again. Orders will be shipped promptly.

The latest pension changes

The quarterly age pension adjustments have been announced. Thanks to inflation, all pensioners will get an income boost. The pension rates are somewhat confusing because there are four changes a year: in July and January each year they adjust the thresholds, and in September and March they adjust the amount of pension paid.

Go to my website to download the new pension charts and play with the age pension calculator and the deeming calculator, both of which have been updated with the new numbers.

Image by shurkin_son on Freepik

Image by shurkin_son on Freepik

When the rate of pension goes up, the upper limit threshold cut-off point automatically increases as well. So now retiree pensioner couples have cracked the million-dollar mark in assets: the cut-off point for a homeowner couple has risen to $1,012,500.

Most wealthier pensioners are asset-tested, yet I keep receiving emails from them asking if it’s okay to earn some more money. Of course it is – the income test is not relevant if you are asset-tested. A couple with assets of $800,000, receiving a pension of $318.65 a fortnight each, could have assessable income of $62,400 a year including their deemed income without affecting their pension because they would still be asset-tested.

Your own home is not assessable, but your furniture, fittings, and vehicles are asset-tested. Many pensioners fall into the trap of valuing them at replacement value. This could cost them heavily because every $10,000 of excess assets reduces the pension by $780 a year. Make sure these assets are valued at garage sale value, not replacement value. This puts a value of $5000 on most people’s furniture.

There is no penalty for spending money on holidays, living expenses and renovating the family home. But don’t do this just to increase your pension. Think about it, if you spend $100,000 renovating your home, your pension may increase by just $7800 a year – but it would take almost 13 years of the increased pension to get the $100,000 back. Of course, the benefit of money spent should be taken into account too – money on improving your house or travelling could have huge benefits for your wellbeing. The main thing is not to spend money with the sole purpose of getting a bigger age pension.

You can reduce your assets by giving money away, but seek advice first. The Centrelink rules only allow gifts of $10,000 in a financial year with a maximum of $30,000 over five years. Using these rules, you could gift away $10,000 before June 30th and $10,000 just after it, and so reduce assessable assets by $20,000.

Superannuation is an exempt asset for Centrelink purposes until the owner reaches pensionable age or starts a pension from it. If a member of a couple has not reached pensionable age it’s prudent, if appropriate, to keep as much of the superannuation in the younger person’s name because then it is exempt from assessment by Centrelink. However, the moment that fund is moved to pension mode, it’s assessable irrespective of the age of the member.

Bequests are another trap. There is a big difference between the asset cut-off point for a single person and that for a couple. As of 20 March 2024, the single homeowner cut-off point is $674,000, whereas for a couple it is $1,012,500. Many pensioner couples make the mistake of leaving all their assets to each other, which can cause a lot of extra grief when the surviving partner finds they have lost their pension as well as their partner.

It’s a complex area – advice is essential.

From the Mailbox

“About 50 years ago, you helped me to invest in a share trust that matched the All Ordinaries Index. I am now 92 and have decided to sell the portfolio. The $25,000 invested has given me just over $2 million in return. I have given it all away to my eight grandchildren and 12 charities, so your kind help and advice given 50 years ago has made 20 people financially happy.”

It does prove the benefits of time and hanging in there.

Cheques

Cheques and bank service, or the lack of it, were major topics when I addressed a seniors group recently. The word had got out that the government was phasing out cheques, and many of the members of the audience were feeling abandoned.

One person told me he was shocked to receive a letter from his bank telling him the Federal Government were phasing out cheques. He said, ‘For years I have used cheques for donations to charities and sending family members a gift of money. Sending cash in the mail is not secure, and I have always found cheques to be a reliable and safe way to send money. How can I send a surprise gift of cash to family and friends once the cheque option is no longer available?’

I must confess it caught me by surprise. It’s been years since I’ve sent or received a cheque, and I have never given much thought to them. They are one of the most inefficient methods of payment around. To send someone a cheque you have to write the check out in legible handwriting, find their address and write that on an envelope, also legibly, add a postage stamp and then take the letter to a post box. If you receive a cheque, you’ve got the hassle of finding a bank branch that’s still open, making out a deposit form, standing in line for the teller and then waiting a week for the funds to be cleared.

I spoke to the Reserve Bank, who told me that cheque use has declined drastically in recent decades. At its peak in the 1980s, cheque payments accounted for 85% of all non-cash payments; today, cheques are used for just .01% of total payments. One of the main reasons is how easy the system is to defraud. Common cheque frauds and lost or stolen cheques (sometimes a whole chequebook has been stolen).

The government has a timetable for phasing out cheques. Next year will see the end of bank cheques, 2026 will be the end of commercial and government cheques, and by 2027 there will be no more personal cheques. By the end of 2030, the entire cheque system should be over and done with.

The reality is that there are now much better methods of payment available. For domestic transfers I love Osco, which appears on many transfers I make through St George Bank. Once you press the confirm button, a message comes up that the payment has been successfully received by the payee. It’s instantaneous. And of course, you get an immediate receipt. Almost all my bills now come by email, and I just make an electronic payment through the bank account, print off a confirmation receipt, and staple that to the bill itself.

When I told all this to the audience, they were not all convinced. One pointed out that some elderly people have never learnt to do internet banking, and plenty of people in the bush have no access to the internet and wouldn’t know how to use it. They were good points, and I had no solution for them.

A more contentious issue is the phasing out of cash. The main functions of cash are as a means of exchange (to buy things), and as a store of value (you can safely tuck away a few $100 notes knowing that they will retain value into the future as legal tender).

Image by wirestock on Freepik

Image by wirestock on Freepik

The Reserve Bank’s sixth triennial Consumer Payments Survey found that most in-person payments are now made by tapping cards or mobile devices, even for small purchases. This means the share of in-person transactions made with cash halved — from 32% to 16% — over the three years to 2022. The demographic groups that traditionally used cash more frequently for payments, including the elderly, people on lower incomes and regional residents, had the largest declines in cash use. Cash usage has generally been replaced with card payments. While Australians are aware of and use a range of other newer payment methods, such as digital wallets and buy-now-pay-later services, they still make up a small share of payments.

When things get risky, like during the pandemic, people tuck $100 notes away as a risk management strategy. So people now use cash less often as a means of exchange, but still value it highly as a store of value. And the numbers are big. It’s estimated there are now $60 billion worth of bank notes in circulation — that’s about $2600 a person. There must be somebody with plenty – there are none at my place.

The next issue was the refusal of banks to accept overseas cheques. One woman said her SMSF owns several properties in the USA and last year received two cheques for insurance claims on those properties. Both St George/Westpac refused to accept the cheques as, like almost every other Australian Bank, they no longer accept cheques in overseas currencies.

The Australian Bankers Association say the remedy is to ask the overseas institution to use the SWIFT (Society for Worldwide Interbank Financial Telecommunication) system, which facilitates secure and swift international payments between financial institutions worldwide. It ensures efficient transfer of funds, enabling businesses and individuals to conduct cross-border transactions seamlessly. SWIFT is utilised by over 11,000 financial institutions across more than 200 countries and territories globally.

There is a glimmer of hope, as both HSBC bank and Heritage Bank tell me that they will accept cheques in US dollars on behalf of customers. Maybe it’s worthwhile opening an account with them.

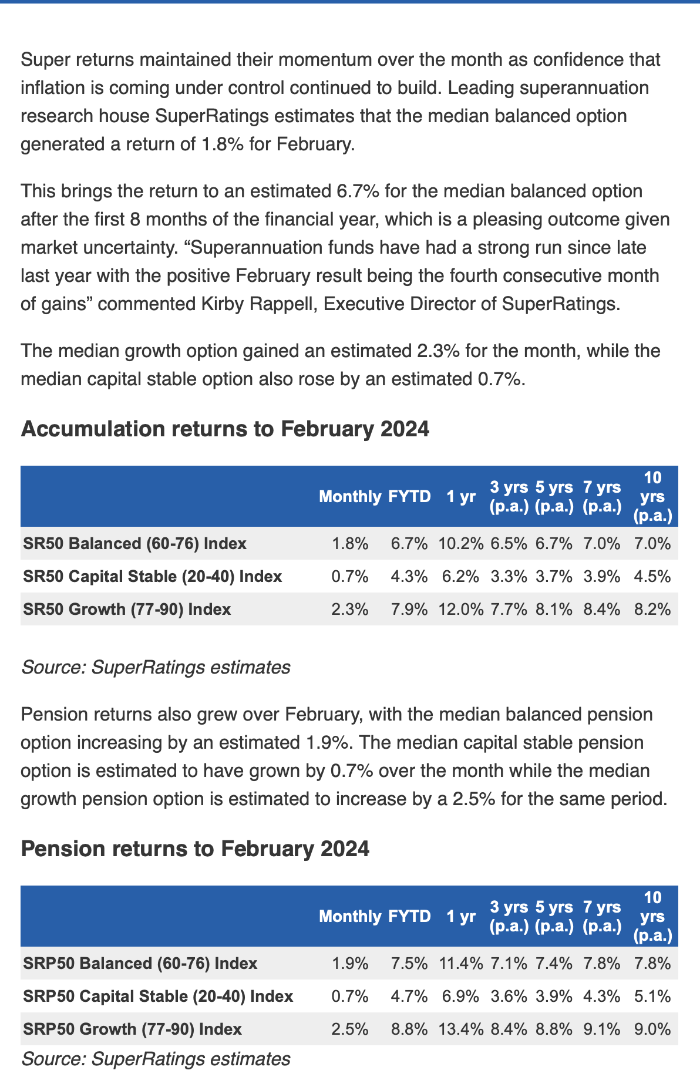

Superannuation

January was another good month for superannuation, but I’m getting a lot of emails now along the lines of ‘My Superannuation is earning about 6.5% but I’ve also got a mortgage at 6.5%. Do you think I should take money out of Superannuation and reduce the mortgage?’

I like to see Superannuation buildup, but if you can reduce your mortgage by withdrawals from your Superannuation, you can make a bonus out of it – pay off the mortgage, then make the repayments you don’t need to make by tax-deductible contributions to Super. That’s a real win-win.

You couldn’t make this up!

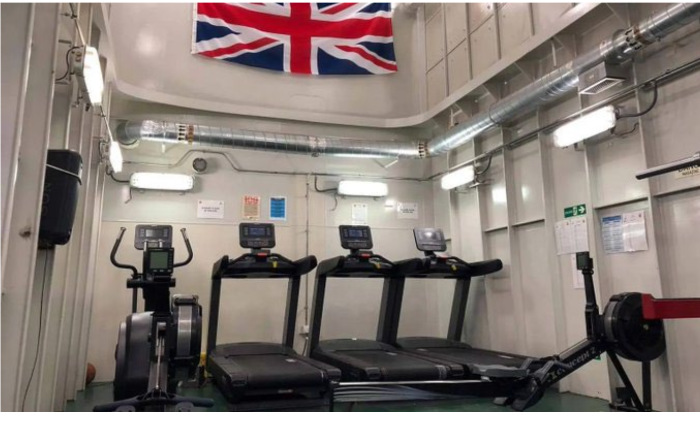

Meanwhile, as joint-force action continues to diminish the Houthi attacks, we have been reminded British warships lack the firepower to attack Houthi land targets.

This is not news, but also not without irony: The Royal Navy’s (not making this up) Daring Class consists of six Type 45 destroyers that were purpose-built for anti-aircraft and anti-missile warfare.

Due to budgetary constraints, the Type 45 destroyers were famously designed ‘for, but not with’ 16 strike-length Mk 41 Vertical Launch System cells (ship-to-land missiles), between the 4.5-inch gun and the Sylver A50 VLS for Aster (ship-to-air missiles).

Instead, the Type 45s ended up with a gym with a very high deckhead – the fabled ‘Mk 41 Gym’ – which was very much cheaper than Mk 41 VLS and its contents, and great for the health of the crew in peacetime, but perhaps less great for both health and the ships’ utility in wartime.

And Finally

Just had a warning from Facebook about writing Ibuprofen on people’s posts. They said I was making anti-inflammatory comments.

Swallowed a bottle of Tippex last night. Woke up this morning with a massive correction!!!

A judge jailed a man with a stammer but said he was unlikely to complete his sentence.

I bought my wife a smart car. It won’t let her in.

I used to be in a band called ‘Missing Cat’… you’ve probably seen our posters.

My dad worked on roadworks for twenty years before he got fired for stealing. At first, I didn’t believe it … but when I got home all the signs were there.

I tried to get in a nightclub, but they wouldn’t let me in unless I had a tie. So, I went back to the car to find one, but all I could find was some jump leads. They let me in with them on, but the bouncer warned … “you can come in, but don’t start anything”!

I’ve been diagnosed with kleptomania – I’m taking a lot of stuff for it.

I said to my wife: ‘If you could have sex with one celebrity dead or alive, which would it be?’ She said: “Alive!”

Can you believe a bloke ran into a supermarket today and threw toilet cleaner over some fruit? He’s being charged with bleach of the peach.

If any of the males out there is interested, there’s a documentary on late tonight about erectile dysfunction. Sadly, I won’t be able to stay up for it.

Locksmith found dead!!! Police appeal for a key witness.

I hope you have enjoyed the latest edition of Noel News.

I hope you have enjoyed the latest edition of Noel News.

Thanks for all your kind comments. Please continue to send feedback through; it’s always appreciated and helps us to improve the newsletter.

And don’t forget you’ll get more regular communications from me if you follow me on X – @NoelWhittaker.

Noel Whittaker