“The true soldier fights not because he hates what is in front of him, but because he loves what is behind him”

G.K. CHESTERTON

Major pension changes

There’s good news for pensioners, especially part pensioners, with the change of the assets and income test thresholds starting on 1 July. Details are below with the changed numbers shown in red. The new charts are on my website, and the age pension calculator, and the deeming calculator above both have been updated for the changes.

Image by Christian Bowen on Unsplash

Image by Christian Bowen on Unsplash

When assessing eligibility for the aged pension, applicants are given an income test and an assets test – the test that produces the least amount of pension is the one used.

Some assets are exempt – these include the family home, assets in superannuation under pension age, funeral bonds up to $15,000 for a single bond, an accommodation bond paid to an aged care facility, and gifts within the allowable limits. Home contents, cars and boats are valued at market value – not replacement value.

The assets test has different thresholds for homeowners and non-homeowners.

Income Test

Income Test

From 1 July 2023 a single pensioner can earn $204 a fortnight and still be eligible for the full single pension of $1064 a fortnight, including all supplements. They can also earn $460 a fortnight from personal exertion – this is not included in the income test. Once income exceeds $204 a fortnight, the pension reduces by $0.50 for every additional dollar earned.

From 1 July 2023 a pensioner couple can earn $360 a fortnight combined and still be eligible for the full pension of $1604 a fortnight, including all supplements. They can also earn $460 a fortnight each from personal exertion – this is not included in the income test. Once income exceeds $360 a fortnight, the pension reduces by $0.50 for every additional dollar earned.

Assets Test

Assets Test

1 July 2023 the full pension is available, under the assets test, for homeowner singles whose assessable assets are under $301,750 – for homeowner couples the number is $451,500. The numbers for non-homeowners are $543,750 and $693,500 respectively.

Once assessable assets exceed the lower threshold, the pension reduces by $3 fortnight for each $1000 by which assessable assets exceed the lower threshold.

A single homeowner can have up to $656,500 of assessable assets and receive a part pension – for a single non-homeowner the higher threshold is $898,500. For a couple, the higher threshold to $986,500 for a homeowner and $1,128,500 for a non-homeowner.

Deeming rate changes

When a person is being assessed for pension eligibility under the income test, certain of their assets are given a deemed income. This is applied irrespective of the actual earning rate of these assets.

The main assets subject to deeming include superannuation once pensionable age has been reached, cash and bank deposits, government bonds, shares, and managed funds such as share trusts and friendly society bonds. It also includes gold silver and platinum bullion. Assets such as rental properties and businesses and vacant land are not subject to deeming. Use the Pension Calculator Here

From 1 July 2023 the deeming rates will be:

Singles: 0.25% on the first $60,400 and 2.25% on the balance

Couples: 0.25% on the first $100,200 and 2.25% on the balance

Note that, despite expectations from most of us in the industry, they have not changed the notional rate used in the deeming rates. As you can see, they are way below market rates.

Interest Rates

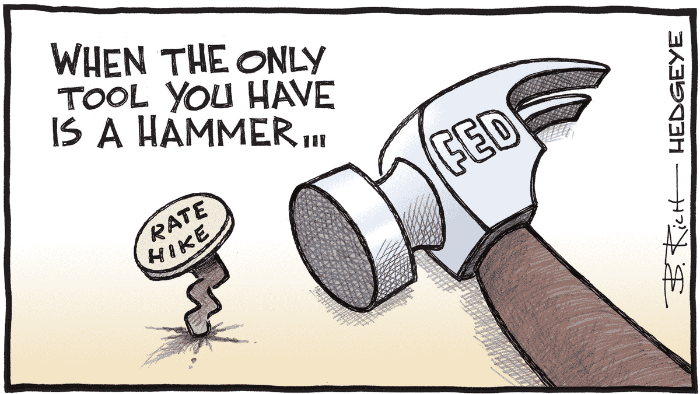

Last Tuesday the Reserve Bank lifted the cash rate a further 25 basis points taking the cash rate to 4.1%, – this is a full 4% rise over 12 hikes since April last year.

Different economic data throughout the month led to a mixed outcome, making it difficult to predict whether there would be a change in the cash rate. On one hand, there was a decrease in consumer confidence, an increase in the unemployment rate, and no significant change in retail trade. These factors suggested that the rates might remain the same. However, these negative indicators were balanced out by the April monthly Consumer Price Index (CPI), which showed a substantial increase of 6.8%. Additionally, the Fair Work Commission’s decision to raise award wages by 5.75% and minimum wages by 8.6% in the next financial year also influenced the outlook.

There are more rate rises to come – the RBA is stuck between a rock and a hard place. They claim the goal is to get inflation down to between 2% and 3% per annum but, as Westfarmers Chairman Michael Chaney pointed out last week, inflation is imbedded until at least 2025. Hitting struggling families with more and more mortgage costs won’t do a thing to contain costs which are rising everywhere. One option for the Reserve Bank is to leave rates as they are, ignore the inflation target and adopt a wait-and-see attitude. The other option is to keep increasing interest rates.

Image by Bob Rich for Hedgeye

Image by Bob Rich for Hedgeye

There are some economists who claim that inflation is the biggest danger of all because our money is being devalued at such a fast rate. But despite the recent pay increases the real rise is less than 4% after tax comes out of the pay packet – the worker is still going backwards if inflation stays at 7% or 8%, which I think it will. The sad reality is, there is no easy way out.

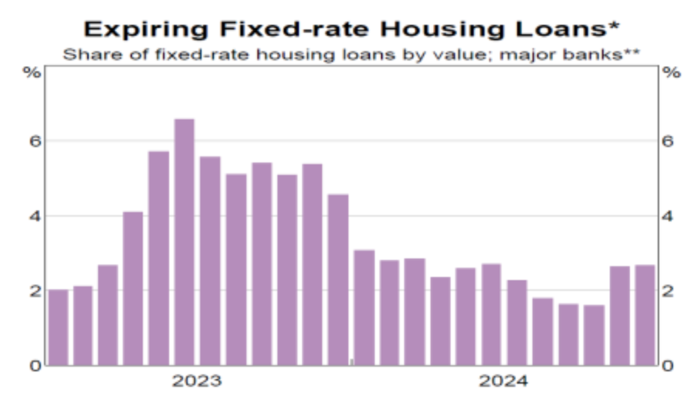

To make matters worse, this year will see a record number of borrowers moving from fixed rates to much I fixed rates. This will make it even tougher for many people.

In my April newsletter I wrote the following:

I don’t resile from those comments. You must do what’s right for your own situation, but I believe that however you look at it, it is reasonable to conclude that inflation is still rampant and interest rates will keep on rising.

If you have a mortgage, your main focus now should be to get ahead in your repayments to create a safety buffer. The last thing anybody wants is to lose their home. And remember there may be a way out for people who are battling with their mortgage payments – they could always rent their house out, which means the interest will become tax-deductible, and find cheap accommodation elsewhere. This may be moving back in with the in-laws, which is better than losing a house.

Image by Bob Rich for Hedgeye

Image by Bob Rich for Hedgeye

Not so super

Why the next Your Future, Your Super test could fail millions of Australians

Over the last decade, actions by successive federal governments have played havoc with the financial advice industry. The result of their efforts to “protect consumers” has been thousands of advisers leaving the industry and the cost of financial advice being pushed out of the reach of the ordinary person.

It gets worse. This year, the government plans to extend the Your Future, Your Super performance test to a sub-set of what are commonly referred to as “Choice” superannuation products. These are products that enable an individual, often with the help of a financial adviser, to actively make an informed choice about the products in which to invest their hard-earned retirement savings.

Image by Raquel Martinez on Unsplash

Image by Raquel Martinez on Unsplash

If an option fails the test, the trustee must issue a prescribed notice to all super members holding the option, recommending that the member consider moving their money to a different product. The notice does not differentiate between marginal and significant cases of underperformance, nor does it clearly explain that the “failure” is limited to one or more options and not the entire product. Worse still, it includes misleading statements that there are no fees for switching, does not include any warning about possible tax consequences or loss of benefits, and does not recommend seeking financial advice.

These Choice funds are tightly regulated products, with extensive disclosure requirements about their structure, fees and investment objectives. Objectives vary from fund to fund because they are designed and chosen by individuals to meet their particular financial objectives and match their risk appetite. Yet the government and APRA appear determined to apply a blanket performance test to all of these products, forcing them into the same square hole, despite their deliberate and well-communicated differences. The logic of the test simply doesn’t stack up, and the risks are considerable.

Someone approaching retirement and wanting more certainty about their retirement savings might invest in a relatively low-risk product designed to provide a specific return above inflation. During periods of strong market performance, this product could outperform its stated objective but underperform market benchmarks. Such products would likely fail the performance test, because the test is based solely on net return, inexplicably ignoring the fundamental investment principle that with greater return comes greater risk.

There are further pitfalls. For many Choice superannuation products, especially older products now closed to new investors, the performance test would not be determined based on the actual administration and investment fees charged to an individual, but on the average or highest fee charged to a member holding an interest in the same underlying investment. This will understandably confuse people who are told they are in an underperforming product, when in fact their individual investment may pass the government’s own assessment.

Additionally, members who move their entire balance to a different superannuation product in response to receiving a “failed test” notice may be hit with a large capital gains tax bill, if their superannuation is in accumulation mode. If they move to another fund, they may lose any insurance cover they hold within their current fund. And there is a very real risk that they may never be able to get the same level of cover, or the same terms. Worse still, they may not be able to get insurance at all.

These are all very real issues for many Australians, to which the government and APRA appear to be wilfully turning a blind eye. They need to stop and reconsider. Choice is not always a bad thing, particularly when it comes to investing for retirement. Many Australians are keen to actively and carefully manage their risk in their retirement savings portfolio, which the test, as currently proposed, would make harder.

Preparing for 30 June

30 June is rapidly approaching, which means it is time to seek advice about ways to save tax.

The end of the financial year is critical for capital gains tax purposes. Remember, CGT is not triggered until you dispose of the asset and you must have owned that asset for over 12 months to get the 50% discount. In this context, the appropriate date for CGT purposes is the date of the contract, not the date of settlement.

If you’re thinking of selling a property, talk to your accountant and decide whether it’s better to have the contract dated before or after 30 June. If you choose after 30 June, you have 12 more months to pay the CGT, but the most important thing is which tax bracket you’ll be in when you trigger it.

CGT is calculated by adding the capital gains to your taxable income in the year the sale has been triggered – often you can reduce the CGT by making tax-deductible contributions to superannuation. A little-known strategy that can be great for retirees under 67 is to use catch-up contributions. Provided your superannuation balance was under $500,000 on June 30 last year, you may be able to make tax-deductible catch-up concessional contributions right back to 2018. This could give rise to a personal tax deduction of $100,000 and wipe out some CGT. It’s a bit complex, so take advice if you think it may be appropriate for you.

Image by kstudio on Freepik

Image by kstudio on Freepik

Making tax-deductible superannuation contributions up to your maximum concessional cap of $27,500 a year is a no-brainer.

Once you have reached that cap, consider making a contribution for your spouse. If they earn less than $37,000 this financial year you may even get a tax offset as a bonus. Get advice on your particular circumstances, as this tax offset is unlikely to be a better option than making a deductible contribution for yourself. To qualify for the spouse contribution tax offset of $540 all you need to do is make a $3000 non-concessional contribution on their behalf. Your spouse may also like to consider making a non-deductible super contribution for themselves of $1,000 if they are eligible for a $500 government co-contribution.

A re-contribution strategy is worthwhile if you have access to superannuation and are still eligible to make contributions. You could withdraw up to $330,000 tax-free and re-contribute it as a non-concessional contribution, on which there would be no entry tax. By doing this you would convert a large chunk of the taxable component of your fund to non-taxable, and so alleviate substantial taxes for your inheritors if you died suddenly and your superannuation went to a non-dependent.

The cap for concessional superannuation contributions is $27,500 and for non-concessional superannuation contributions is $110,000 for the 2022 financial year. To make contributions to superannuation and to utilise these caps, your fund must receive your contributions by 30 June. If you have more than one fund, all contributions made to all of your funds are added together and counted towards contribution caps. You may also be eligible to carry forward any unused contribution caps to a later financial year (if your total superannuation balance is less than $500,000 on the previous 30 June).

Take advice if you are nearing age 75 because apart from the downsizing contribution, it may be your last chance to boost your superannuation. You could still use the bring-forward rule, which will allow you to contribute up to $330,000 as a non-concessional contribution and so move funds to an area where tax will be zero once you start to draw a pension from your fund. Keep in mind that no non-concessional contributions can be made if your balance was $1.7 million or more on 30 June last year.

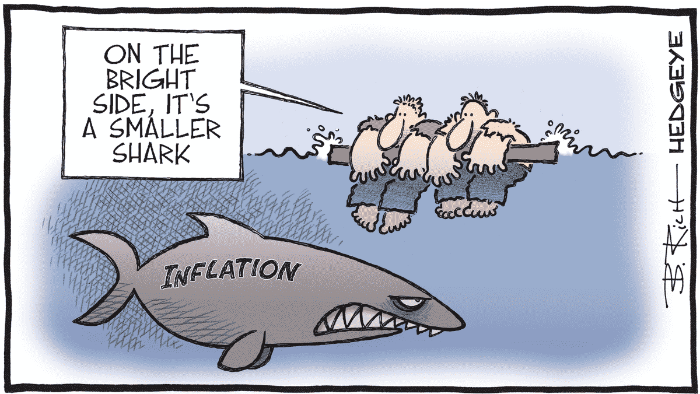

Mandatory pension drawdowns

As I predicted in the last newsletter, it’s been confirmed that the payments will return to what they were pre-Covid. Anybody who is drawing an account-based pension should make sure there are adequate funds in their superfund to make the payments, but also be aware that they rise with age. For example, in the next financial a 74-year-old has to draw 5% of the balance by 30 June but once they turn 75 this rises to 6%.

I’m always surprised when people complain about having to withdraw so much money out of their super. There is no compulsion to spend it and withdrawals from superannuation to your bank account will not affect any age pension entitlements because they’re both financial assets for the assets test and deemed for the income test. Furthermore, you can now contribute non-concessional contributions to superannuation up to age 75 provided your balance is not over $1.7 million. This will rise to $1.9 million after 30 June.

Keep in mind you can’t make contributions to an account in pension mode, but there’s no problem opening an accumulation account within your existing superannuation fund. As always, take advice.

Tightening the squeeze

The quick growth in residential rents is making headlines every day. Of course, we keep hearing all sorts of ridiculous suggestions to solve the problem – think freezing rents.

But the reality is that when you let in hundreds of thousands of immigrants, they need somewhere to live. To make it worse, there have been more and more rules passed that make investment property less attractive. In most states now a landlord can’t refuse any reasonable request, and this could include having a pet or installing air conditioning.

Image by Bob Rich for Hedgeye

Image by Bob Rich for Hedgeye

Then you’ve got the ever-increasing costs of owning a rental property, and it’s not just the interest rates. In Queensland the land tax thresholds have not been indexed for 15 years, and when property values go up, the land tax bill goes up with it.

The ACT was the first state to embrace the concept of imposing a land tax on every residential property instead of stamp duty. They promised to phase out stamp duty over 20 years while simultaneously ramping up land tax. You can guess what has happened: they introduced land tax and kept the stamp duty.

If a person has a property, they pay land tax, but if they convert that property to an investment property, they pay two lots of land tax. I hear the combined land taxes on a standard family home in a middle-class suburb can be up to $14,000 a year. That’s a massive chunk out of the rental income.

In the recent Victorian state budget they imposed higher rates of land tax with a lower threshold on businesses and investors, and those otherwise liable to land tax. The changes, proposed to commence from 1 January 2024, will also temporarily decrease the tax-free threshold for general land tax from $300,000 to $50,000.

Those liable to pay land tax will incur the following additional amounts:

- a fixed charge of $500 for landholdings between $50,000 and $100,000

- a fixed charge of $975 for landholdings above $100,000

- and an increase in the land tax rate by 0.1% for both general and trust taxpayers with holdings above $300,000 and $250,000 respectively.

The family home will continue to be exempt from land tax.

For more information have a watch of the video I recorded recently with property guru, Margaret Lomas. We talk about the state of the rental market, how landlords are doing it tough and then take a look at my new book 10 Steps to Financial Freedom.

Property Investing Matters 23-05-2023 – Margaret & Noel

When you watch it, you will notice I am described as Noel Whittaker – Whittaker Macnaught. It was a glitch in the system – I sold Whittaker Macnaught 16 years ago.

Great news for travellers

We all know about the frustration of lost luggage, which is why the Apple AirTag is a must have the Geraldine and myself whenever we fly. But since Apple launched the AirTag in early 2021, the button-sized Bluetooth trackers have only been able to be owned be owned and used by a single person.

That’s about to change – the forthcoming iOS 17 software update for iPhones will allow AirTag owners to share their AirTags with others. Frequent flyers who’ve long been requesting AirTag sharing will welcome this feature, which will be accessible through the Find My app by selecting a specific AirTag and choosing the ‘Share This AirTag’ option.

From the mailbox

The good news is, we are now back every Wednesday in the Sydney Morning Herald/Age. Thanks so much to all of you who wrote to the papers asking that the status quo be returned. I thought these two questions would be of great general interest:

Question

Can you tell me which time period Centrelink use when looking at the last five years of your financial history if you are making a pension application? Is it based on a financial year or a calendar year? I am looking at my options and I haven’t been able to locate this information.

Answer

The five years relates to the last five years from the date of age pension application. For example, if you lodge an Age Pension application on 25/05/2023, you must advise Centrelink of any gifts you made between 25/05/2018 and today. It has nothing to do with calendar or financial years.

Question

Earlier this year, I opened a Superannuation Pension account and used the full transfer balance cap (TBC) of $1.7 million. Now I understand the TBC is likely to be increased in line with inflation to $1.9 million.

Is it a valid and reasonable strategy to roll the $1.7m back into the accumulation fund, therefore recovering 100% of the TBC, and then shift it back into the pension fund after the $1.9 million limit becomes effective?

Answer

If it sounds too good to be true, it probably is. The transfer balance cap is a once-in-a-lifetime opportunity. Having used up the $1.7 million cap previously, you can’t benefit from it rising to $1.9 million; for you it remains locked at $1.7 million.

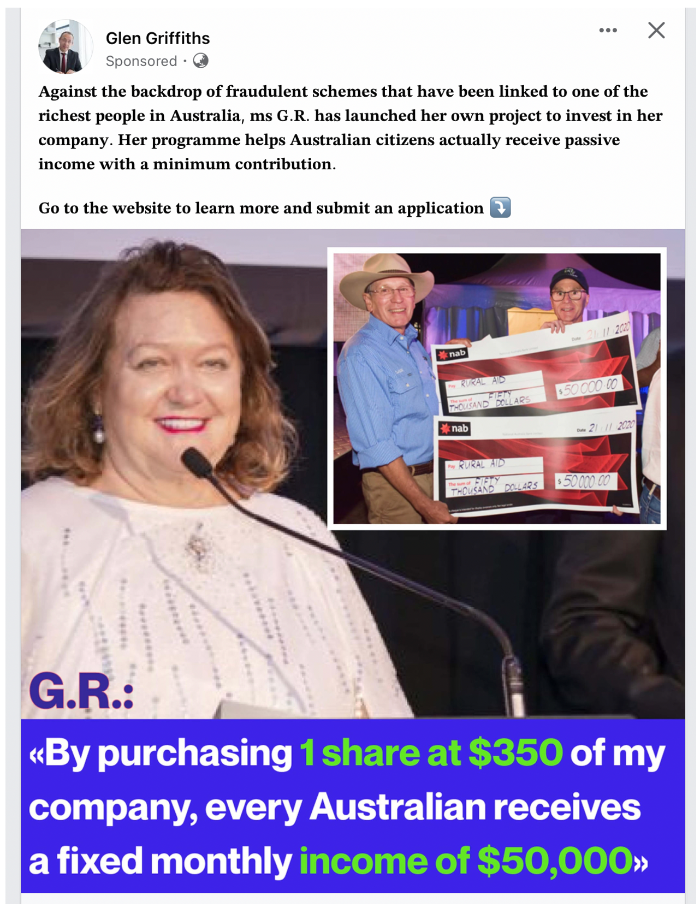

More scams

The scams just keep on coming. We were bombarded by the ad below on Facebook and the characters varied from Ms Rinehart to Twiggy Forest to Dick Smith. Another one featured David Koch. They are all cons – don’t fall for it.

And finally

Let’s face it. English is a crazy language.

The bandage was wound around the wound.

The farm was used to produce produce.

The dump was so full that it had to refuse more refuse.

We must polish the Polish furniture.

He could lead if he would get the lead out.

The soldier decided to desert his dessert in the desert.

Since there is no time like the present, he thought it was time to present the present.

A bass was painted on the head of the bass drum.

When shot at, the dove dove into the bushes.

I did not object to the object.

The insurance was invalid for the invalid.

There was a row among the oarsmen about how to row

They were too close to the door to close it.

The buck does funny things when the does are present.

A seamstress and a sewer fell down into a sewer line.

To help with planting, the farmer taught his sow to sow.

The wind was too strong to wind the sail.

Upon seeing the tear in the painting I shed a tear.

I had to subject the subject to a series of tests.

How can I intimate this to my most intimate friend?

I hope you have enjoyed the latest edition of Noel News.

I hope you have enjoyed the latest edition of Noel News.

Thanks for all your kind comments. Please continue to send feedback through; it’s always appreciated and helps us to improve the newsletter.

And don’t forget you’ll get more regular communications from me if you follow me on twitter – @NoelWhittaker.

Noel Whittaker