If you wish to find you must search.

Rarely does a good idea interrupt you.

JIM ROHN

Welcome to our first newsletter of the year.

It’s hard to believe the end of January is nearly upon us. It’s going to be a big year with elections in the United States and several other American countries, the United Kingdom and Indonesia, and legislated tax cuts to take effect in Australia on 1 July. They are truly a game changer.

We’re probably only 15 months from another general election in Australia, so expect the May budget to be full of goodies. The trouble is goodies cost money, so as usual, the government will have a balancing act to deal with.

I think there are reasons to be optimistic. Inflation appears to be getting under control in most developed nations, and it’s a reasonable bet that interest-rate rises in Australia are a thing of the past – whether the RBA will start cutting rates is another matter.

A New Calculator

As requested, we now have a calculator on the website that checks your eligibility for the Commonwealth Seniors Health Card.

Cost of Living

This week, the Prime Minister announced a special caucus meeting to alleviate the cost of living pressures facing ordinary Australians. Obviously, he’s got the forthcoming by election at Dunkley in mind, but if you think about it, there’s not much they can do. Food and groceries have gone up massively, fuel is high, and many people are suffering mortgage stress, because of all the interest rate rises.

Watch this space.

Stage 3 Tax Cuts

The Stage S3 tax changes are legislated, and the Prime Minister has said several times that no changes will be made to what is now law. Thanks to the progressive tax system high income earners will receive a bigger tax saving than low income owners because they are paying a much greater share of tax.

On Channel 9 news last night it was announced the government was considering changing the legislated tax brackets so the top rate would cut in at $180,000 a year instead of $200,000 a year. This would the reduce tax savings to high income earners by $3400 a year.

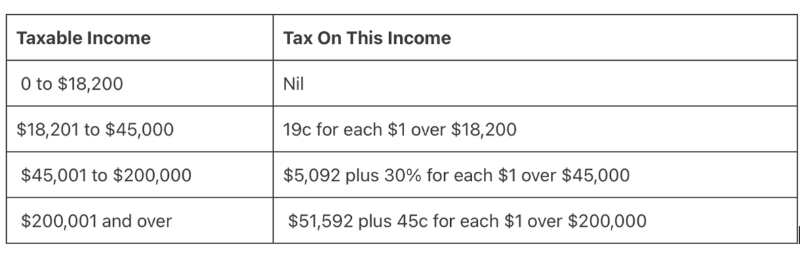

Tax Scale 2024 – 2025

Negative gearing is always under attack, but the opponents of negative gearing forget to mention that many of the tax deductions you receive while you own the property are clawed back through higher capital gains tax when you sell. Furthermore, when the tax cuts come in on 1 July, the 30% rate will go right from $45,000 a year to $200,000 a year. Almost everybody with negative gearing will therefore be in the 30% tax bracket.

It’s not going to be a good time to be a landlord. Your interest rate will have gone up and you’ll be paying 70% of all the outgoings. The problem is that if you can’t afford the cash flow, there could still be a hefty CGT if you decide to sell. The other side of the coin is a lower rate of CGT after 30 June, which is why I won’t be signing any sales contracts until 1 July.

A Property Story

Twenty years ago we decided a residential property would be a good investment and settled upon a suburban unit close to transport. We paid $220,000. Fifteen years ago, when the tenant left, we rented the property to an elderly lady who was a long-time friend. We charged her a reasonable rent, and because she was the perfect tenant, we were loathe to increase it.

Image by Wirestock on Freepik

Recently she moved to aged care, and I took the opportunity to reflect on the investment. The key to success in real estate is to add value, which is hard to do with an apartment: they tend to lose their charm as time passes and more modern units become available. Two decades have passed since we bought it, and at this stage in my life I’m over rental property, so we have decided to sell. Agents tell us $550,000 is the going rate, so we’ll have more than doubled our money.

For interest, I ran the numbers through the Stock Market Calculator on my website and discovered that if I had invested $220,000 in the All Ordinaries Accumulation Index 20 years ago, I would now have $1.23 million. That’s a compound gain of 9% per annum. And there’s more. Instead of getting a taxable income of $500 a week rent – less outgoings such as body corporate fees, rates, insurance, and land tax – that $1.23 million in an index fund would be returning $55,530 a year, or $1063 a week. The cream on the cake would be that the income would be almost tax-free, thanks to franking.

Image by Joshua Mayo on Unsplash

Image by Joshua Mayo on Unsplash

Then I had a quick look at my capital gains tax liability: I started with a back-of-the-envelope calculation that $530,000 less a base cost of $230,000 cost would create a taxable gain of $300,000, which would come back to $150,000 after the 50% discount, and then be split between my wife and me as joint owners. That hurt, but it got worse when I checked out the purchase file. On the accountant’s advice, we had negotiated the purchase price to be split $140,000 for land and buildings and $80,000 for depreciable items. The thinking was that it is always better to take a tax deduction sooner rather than later. True, but our base cost will be only $140,000 because we have enjoyed 20 years of tax deductions; that increased the taxable capital gain by $80,000.

This experience has reinforced what I’ve been saying for years: as you get older, your best investment is shares – not property. Shares give you tax-advantaged income and can be sold in whole or in part within a few days. With property, you have income with no tax advantage, lots of regular expenses, and if you need money, you can’t sell the back bedroom.

Shares

I wrote about the above experience in one of the local papers, and one reader gave me a dressing down. He claimed that he put $300,000 into a portfolio just before the GFC and lost a third of his capital. Fifteen years later the portfolio still has not recovered. I pointed out to him that according to my Stock Market Calculator, his portfolio would now be worth $738,000 if the money had been invested in a fund that matched the All Ordinaries Accumulation Index, and assuming all dividends were reinvested.

This made him even more unhappy. He told me it’s impossible to invest in a product that matches the All Ordinaries Accumulation Index because such an animal does not exist. Furthermore, I was gilding the lily by even mentioning the Index. He claimed that it would be far more ethical to select stocks such as AMP, BHP or Telstra.

This information is wrong in so many ways, but it’s worth a discussion for anybody thinking of investing in shares. It’s true that no investment matches the All Ordinaries Index exactly. Why would you want that? It contains about 2000 companies and 85% of them could be described as businesses with no cash and no hope. Many of them are speculative mining companies.

But the essence of the index is the top 300 companies make up 85% of the total value and produce 97% of the profits and dividends. And there most definitely are products that track the top 300 companies, such as the Vanguard Australian Share Fund (ASX.VAS). This fund started on 30 June 1997, and Vanguard tell me if $100,000 had been invested when the fund started and all dividends were reinvested, the portfolio would now be worth $732,412. That’s a total return of 632.4% after management fees and transaction costs.

The Stock Market Calculator on my website is an educational tool, which shows monthly values from 1 January 1980, when the concept of the All Ordinaries was formed. It enables people who are considering investing in shares to run ‘what if’ scenarios. You can enter a notional investment sum and a notional finishing and starting date to see how an investment would have performed if it matched the Index.

To check the validity of my calculator, I ran the Vanguard numbers through it. The answer was $775,000, a compound gain of 675%. The difference between the two is insignificant. The reason I never use specific shares when I’m talking about performance is that it requires a degree of skill in picking winners, which the average person does not possess.

The main risk with picking individual stocks is buying duds. It is a risk even with household names, including the so-called ‘blue chip’ companies like ANZ, Qantas, Myer, etc. But the chances of the entire market covered by broad index funds going bankrupt is almost zero. Broad index funds have beaten the vast majority of professional fund managers most of the time.

Time and time again people tell me they want to invest in shares but they don’t know where to start, as they wouldn’t have a clue about picking stocks. My response has always been to invest in an index it pays around 4.5% annually, which is mainly franked; it cannot go broke; and over the last 120 years it has averaged around 9% per annum. That’s good enough for me.

Superannuation

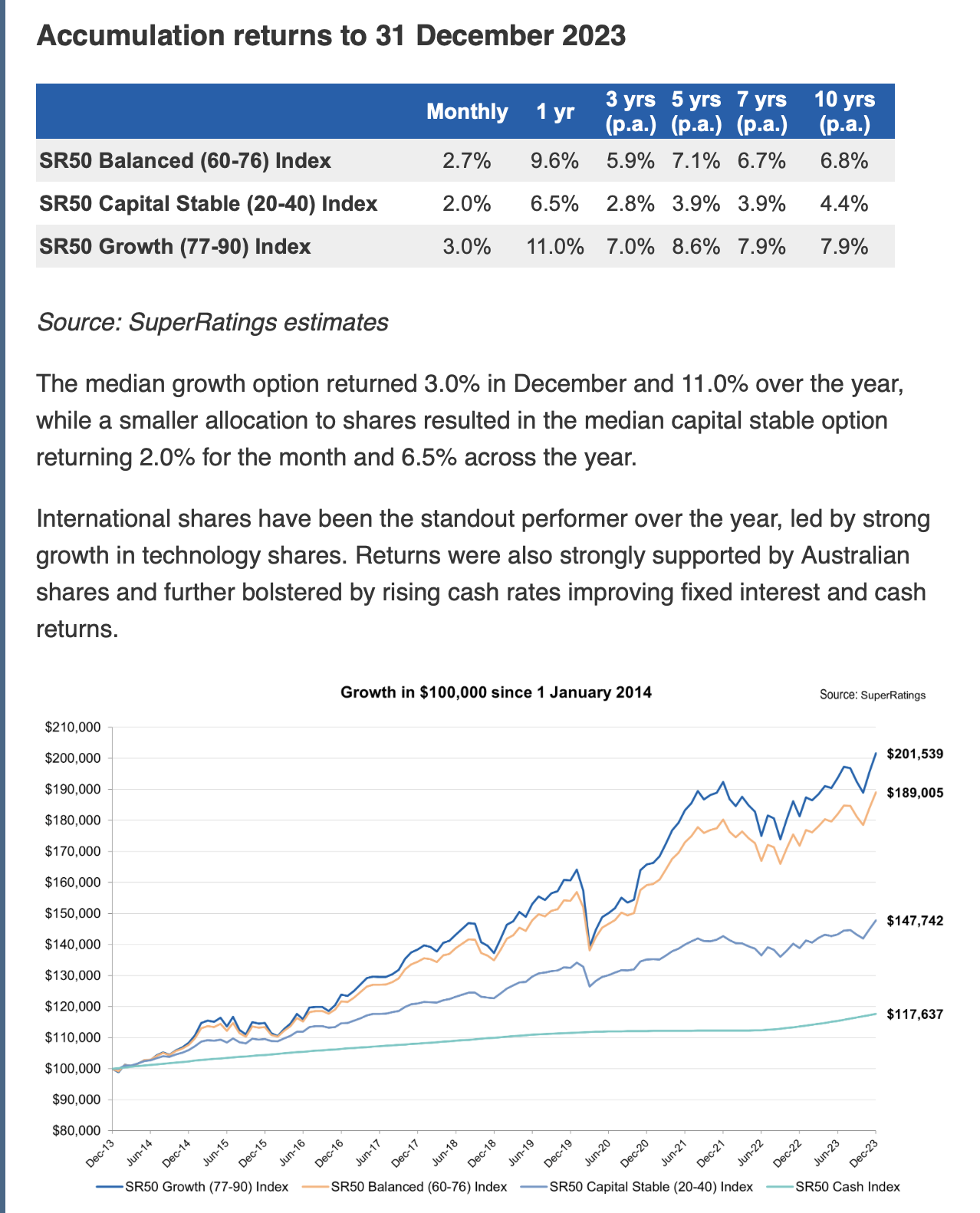

The latest numbers are out, and as you can see, it ended up a good year.

The above information is written by SuperRatings and highlights the importance of getting a good rate on your superannuation. This is why I always urge people to check that their money is in the right asset class. As you can see Growth and Balanced are areas to be in. At least for most of the money.

But here is something interesting – and it’s purely hypothetical. Suppose in January 2014, I started a self-managed superannuation fund (SMSF) with a contribution of $100,000 and put the entire balance of the fund into an index fund that matched the All Ordinaries Accumulation Index, which assumes all dividends are reinvested.

My Stock Market Calculator tells me my SMSF would now be worth $209,000 – more than the top-rated funds mentioned above. The difference is probably fees because index funds have minimal fees.

But there’s something else to think about. My super fund would’ve been paying 15% tax on all its dividends but the franking credits would’ve been in excess of that. The return would’ve been even better than above due to the benefit of the tax refund from the excess franking credits when the funds tax return was lodged.

I appreciate this is a hypothetical exercise, because in the real world contributions would have been made to the super fund, and it would’ve enjoyed the benefit of dollar cost averaging. But it does prove what a good investment the All Ordinaries has been provided all dividends are reinvested.

A stock taking sale (kind of)

When we launched the film Think and Grow Rich the Legacy in 2015, James wrote a book to accompany it. It takes the 13 timeless principles of the book Think and Grow Rich and illustrates them with real-life examples of people today. They are wonderful stories and the book is a great learning experience.

It’s a hardcover book in high-quality paper of about 300 pages. It was published by the American publishing company Sound Wisdom, but when James launched it in Australia at that time, Sound Wisdom gave us the right to print 3000 copies. That was six years ago, and I thought all books had been sold. Just a month ago, when doing a stock take, we discovered we still had 250 copies in stock and because we own them, we have the right to sell them.

In 2015, I published what I thought was going to be my legacy book. It was called 25 years of Whitt and Wisdom and featured extracts from my columns from 1988 to 2015. It’s a hardcover book, 450 pages on high-quality paper and printed in two colours. It was the highest quality and most expensive book I’ve ever produced and was always going to be a one-off.

We also discovered that we had 300 copies of this book still in stock. I appreciate the fact that the information stops in 2015, but the history of the financial services industry in this book is just priceless. It’s also a great reference book. When I was doing an article on deeming to be published this week, I looked it up to find the history of deeming. It’s also great to see how often history repeats itself. It’s full of property booms and busts, share market booms and busts, governments changing the rules and banks behaving badly.

Special Bundles added for $49.95:

Think and Grow Rich the Legacy is timeless, and 25 years of Whitt and Wisdom is a magnificent history book. Today we’re having our first-ever stock take sale, and putting them in bundles. This is a one-off opportunity, as these books will never be reprinted.

Here’s one for you

I never thought I’d see this. Jumbo, a grocery chain with more than 700 locations in Belgium and the Netherlands just reported that the value of items stolen from its stores by shoplifters was 25% greater than last year’s profits.

Image by Freepik

Image by Freepik

I think, unfortunately, this is a sign of things to come here as well.

Downsizing Made Simple

In last months newsletter, I mentioned our new book Downsizing Made Simple which was launched nationwide last month. We’re getting wonderful feedback and we thought you might like to know that we have also launched a new companion website www.downsizingmadesimple.com.au that accompanies the book.

Many people are asking for more information, so we’re now giving you the opportunity to read the first chapter of the book which covers some of the most important considerations in your downsizing decisions from ‘Why’ you want to downsize to aspects to contemplate about ‘Where’. It also gets into the nitty gritty of understanding the costs and just as importantly the key considerations of your contracts and fees.

To access the first chapter of Downsizing Made Simple, simply click on the link below:

Where to Buy

Downsizing Made Simple

Downsizing Made Simple

Downsizing is now a big topic and it’s been the subject of our national tour in the last two weeks. Downsizing Made Simple is the updated version of the old edition, but it’s 100 pages longer and contains much more information.

This is such a complex topic and one of the main goals Rachel Lane and I had when we wrote this book was to highlight the things people need to take advice on. It also links to the special calculators on the downsizing made simple website.

Value Bundle:

Value Bundle:

Downsizing Made Simple + Retirement Made Simple

Only $49.99

Save $9.91

And Finally

Ponderances

So now cocaine is legal in Oregon, but straws aren’t. That must be frustrating.

Being popular on Facebook is like sitting at the ‘cool table’ in the cafeteria of a mental hospital.

You know you’re over 50 when you have ‘upstairs ibuprofen’ and ‘downstairs ibuprofen’.

Photo by Drazen Zigic on Unsplash

Photo by Drazen Zigic on Unsplash

I woke up this morning determined to drink less, eat right, and exercise. But that was four hours ago when I was younger and full of hope.

How did doctors come to the conclusion that exercise prolongs life, when the rabbit is always jumping but only lives for around two years, and … the turtle that doesn’t exercise at all lives over 200 years.

If only vegetables smelled as good as bacon.

When I lost the fingers on my right hand in a freak accident, I asked the doctor if I would still be able to write with it. He said, “Probably, but I wouldn’t count on it.”

Still trying to get my head around the fact that ‘Take Out’ can mean food, dating, or murder.

Dear paranoid people who check behind their shower curtains for murderers. If you do find one, what’s your plan?

Anyone who says their wedding was the best day of their life has clearly never had two chocolate bars fall down at once from a vending machine.

We live in a time where intelligent people are silenced so that stupid people won’t be offended.

The biggest joke on mankind is that computers have begun asking humans to prove they aren’t a robot.

If Adam and Eve were Cajuns they would have eaten the snake instead of the apple and saved us all a lot of trouble.

You know you are getting old when friends with benefits means having someone who can drive at night.

After watching how some people wore their masks, I understand why contraception fails.

I have many hidden talents. I just wish I could remember where I hid them.

Apparently, exercise helps you with decision-making. It’s true. I went for a run this morning and decided I’m never going again.

I hope you have enjoyed the latest edition of Noel News.

I hope you have enjoyed the latest edition of Noel News.

Thanks for all your kind comments. Please continue to send feedback through; it’s always appreciated and helps us to improve the newsletter.

And don’t forget you’ll get more regular communications from me if you follow me on X – @NoelWhittaker.

Noel Whittaker