A credit card is an anaesthetic which simply delays the pain.

HELEN MASON

Welcome to our last newsletter of 2023

It’s been another eventful year with no progress with the war in Ukraine and the unexpected attack by Hamas on Israel. I don’t think either of these battles will end soon. Next year’s presidential election in the United States will further complicate matters. The good news in Australia is that the interest rate cycle is getting very close to the top, with some economists even predicting a drop in rates within 18 months. I doubt that will happen, but I do think we won’t see many more rises.

Keep in mind that the Albanese government is about 18 months from an election, so expect the May 2024 budget to have more sweeteners than nasties. The controversial topic is the personal tax cuts that have been legislated to take effect from Monday, 1 July 2024. Of course, there are the predictable claims that the personal tax cuts are unfair, as high income earners will get a bigger tax cut than low-income earners. That is always the situation when the rate of tax rises with income. Most reasonable people would agree that the cuts are overdue.

It’s a major reform with the 30% tax bracket going from $45,000 a year right up to $200,000 a year. It’ll save workers being pushed into higher tax brackets every time they get a pay rise. On my website there are two income tax calculators – one gives the present tax rates and the other the proposed tax rates. Have a go with them for yourself and see what a difference the tax cuts may make to your after-tax income.

As I have said many times, if you take charge of what you can control, you shouldn’t need to worry unduly about what you can’t control.

Lessons for life

Last Saturday was a big day for me. It was graduation day at QUT Brisbane and I was thrilled to be awarded an honorary doctorate from the Faculty of Business and Law. After the honour was conferred, I was asked to address the entire graduation class. It was a challenge to ‘convey the secrets of success’ to a thousand students in just eight minutes. I started off by pointing out there are no secrets – success in life depends on following certain principles that have been known for millennia.

My dad always taught me that if you do one good turn you get two good turns back, which is really a variation of the Golden Rule, ‘Treat others as you would like them to treat you.’ Andrew Carnegie, the wealthiest man in the world in the 19th century, added that success is about more than just blindly following the Golden Rule; it’s about practising it. Once you start to make a habit of treating people as you think they would like to be treated you are practising one of the biggest success principles of all: going the extra mile.

Think about it – the people whose company you enjoy, and the people you want to do business with are people who go out of their way to take care of you. The principle of ‘Doing more than you are paid for’ is an extension of this. Some time ago I went to breakfast at the Sheraton Hotel in Townsville and asked the waiter where I could buy a copy of The Courier Mail, as I knew it would be featuring an event I had spoken at the day before. He replied that the papers wouldn’t be coming in until 8 am. To my surprise, just after 8 am he came to my table with a copy of the paper. That is going the extra mile. When I remarked on this behaviour to the manager, the response was, ‘We train our staff to anticipate what guests want.’

Carnegie says that going the extra mile develops a more attractive personality and friendly cooperation from others, and eliminates the dodgy desire to get something for nothing. Furthermore, it provides a person with an influential reputation for honesty and fair dealing, which is the basis of all confidence.

At the graduation last Saturday, I also made the point that compensation for our efforts can come from two sources: money and personal satisfaction.

I then told the QUT students that I believe in trusting the universe. Time and time again I have wanted an outcome, but that much desired outcome did not eventuate. Looking back, I now understand that I’m in a much better place than I would have been if I had got what I wanted. Life is a bumpy road, and we all face headwinds along the way. Reframing the situation as, ‘That was not meant to be – the universe has a better plan for me’ gives you the strength to move on. Ask any successful person what was their reaction to failure, and the reply is almost always, ‘It was a great learning experience.’

There is nothing radical about these ideas, but every successful person I know would agree with them. I did also remind the graduates that success is not having the biggest house in town or the most expensive car; it’s about becoming fulfilled and having a purpose in life. My experience is that the greatest happiness comes in helping other people and going the extra mile – the more you do this, the more successful, happier and more fulfilling your life will be.

Downsizing

Downsizing remains one of the hottest topics as people get older and try to work out their retirement finances. When I was in Sydney during our book tour. I recorded a 10 minute segment for Ausbiz. It explains a lot about it. Just click here:

Downsizing Made Simple

Downsizing Made Simple

Downsizing is now a big topic and it’s been the subject of our national tour in the last two weeks. Downsizing Made Simple is the updated version of the old edition, but it’s 100 pages longer and contains much more information.

This is such a complex topic and one of the main goals Rachel Lane and I had when we wrote this book was to highlight the things people need to take advice on. It also links to the special calculators on the downsizing made simple website.

Value Bundle:

Value Bundle:

Downsizing Made Simple + Retirement Made Simple

Only $49.99

Save $9.91

Superannuation

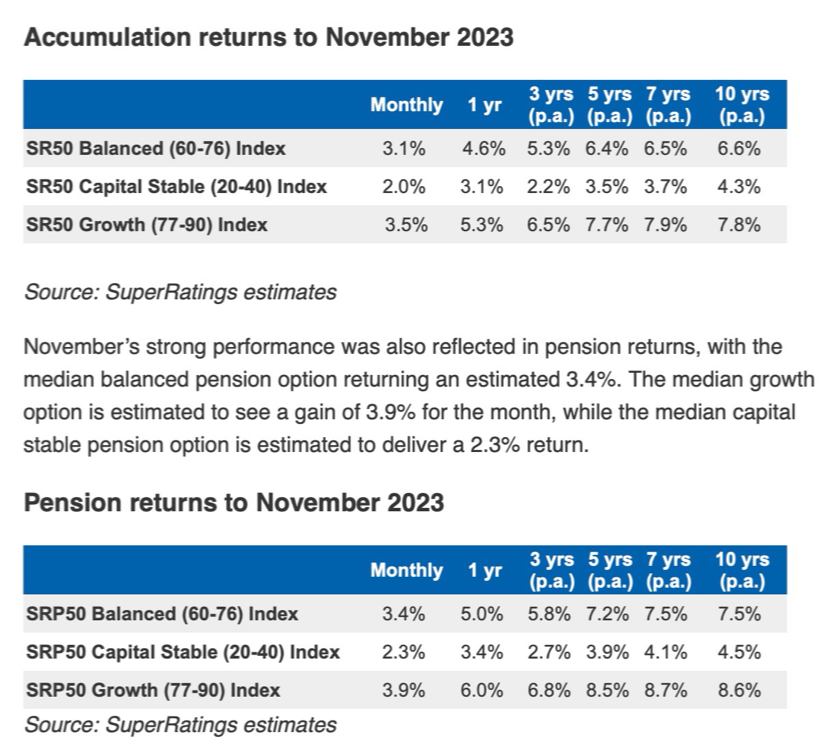

It hasn’t been the best year for superannuation, but according to the latest estimates from SuperRatings, we did enjoy strong returns in November. The strong result came after three months of decline for the median balanced option, with falls of -0.1% in August, -1.8% in September and -1.6% in October.

The median growth super option delivered an estimated return of 3.5% for the month, while the median capital stable option generated a more modest return of 2% due to its lower exposure to shares.

According to SuperRatings, November’s estimated returns have offset most of the losses observed in recent months, ‘setting up a modest, but positive, scene for most members as they approach the halfway point of the financial year.’ For the first five months of the financial year, the median fund is estimated to be up by 1%. Meanwhile, over the first 11 months of the calendar year, SuperRatings said that the median balanced option is up by 6.8%.

While December’s performance remains to be seen, the firm said that fund members will likely see a ’reasonable positive return’ over 2023, which may be similar to the estimated 6.4% p.a. return recorded for the median balanced option since 2000.

SuperRatings believe ‘inflation will be a strong driver of markets in 2024, coupled with softening consumer demand; however, most members should remain reassured by super funds ability to navigate the range of market conditions we’ve seen over the past few years.’

Win The Day Podcasts

James’ podcasts continue to flourish with over 40 million views to date. We are looking forward to welcoming him and his family in Brisbane next Friday.

His recent podcast number 166 would be invaluable listening for you all over Christmas. It goes for just 25 minutes, but it summarises a selection of clips of great advice which have been chosen from his guests over the last 12 months.

Listen with Spotify above, or listen on Apple Podcasts here.

Bank Service!!

Bank customer service standards have been sliding for years, as has been well aired during a Senate enquiry into bank behaviour. Bank branches have been closing in droves, and their call centres have been restructured so that it’s typically a 30-minute wait if you try to ring them.

Image by wayhomestudio on Freepik

Image by wayhomestudio on Freepik

I was stunned when I couldn’t bank a check for James to his BankWest account via the Commonwealth Bank (who own BankWest) – they sent me to the post office!

There are other issues that highlight their indifference to customers. Jack wrote:

“I am 91, and recently received an email from ANZ asking for details of bank deposits in two of my accounts, both were tax refunds from the ATO. The super fund refund was $67,368, and the personal refund was $23,129.

ANZ wrote to me demanding documentation about these deposits, how the refunds are to be used and if I’ll be receiving further deposits in the future. There was a clear threat that if a satisfactory reply was not received within 30 days my accounts may be closed.

I responded that, given I am 91 years of age and in God’s hands, I cannot verify I’ll even be alive in 12 months. I also pointed out that all accounts are in credit and I have been a loyal customer of ANZ for more than 55 years.”

I told Jack that this would probably be an AUSTRAC requirement. In the interests of general consumer education, I contacted the Media Unit of ANZ bank and asked if they could tell me, for general information, what information AUSTRAC requires from bank customers. The media people replied that they would contact ‘the team’. But they came back to me with the response that the customer had been notified, and ‘the team’ had no wish to make any further comment – they were just not interested.

I got back to Jack, who responded that he had not heard a word from the bank and that he found their initial and subsequent attitudes, ‘quite disgusting’.

I am left wondering … would it really have been too difficult for ANZ to write to Jack along the following lines?

‘We appreciate you have been a loyal customer for more than 50 years, but under government regulations we are required to get details of certain deposits. Two recent deposits into your accounts, namely, $67,368 and $23,129, come under this ambit, and we would appreciate your advising us more details of them. We regret the imposition and are happy to help you in need. We look forward to hearing from you.’

Mary emailed to say that she had paid $5,112 to a bullion company for 110 Britannia Silver coins at $44.70 each. She says, ‘So far, although I have supplied bank account details, driver licence, etc. to this company for identification, they now say they want details of how I obtained the money, i.e: details of inheritance, property sales, etc. Now I worry that I’m being scammed. I contacted my bank’s fraud squad, but they did not return my phone calls. I then sent a letter of demand to the bullion company, demanding they refund my money within seven days. That deadline passed without result. I am a 71-year-old self-funded retiree with mobility issues and I’m scared I have lost all my money.’

Image by Freepik

Image by Freepik

AUSTRAC were more helpful than ANZ. They said that, under Australian anti-money laundering and terrorism financing (AML/CTF) laws, financial institutions and other businesses need to identify and mitigate financial crime risks in their business. This includes ongoing monitoring of transactions to identify suspicious activity and, where appropriate, seeking further information from the customer.

Similarly, the efforts of financial institutions to protect their customers from the risks of frauds and scams are largely at their discretion. AUSTRAC does not have any powers to request banks or other entities to freeze accounts. So there’s no good reason why the banks should threaten this when requesting information from individual customers. It seems to all be part of the current attitude that the customer is always wrong, and banks can do whatever they please.

From a reader (this was news to me)

‘I discovered something today that I thought I’d share with you, as I don’t think many people know about this and think maybe they should!

I am a very small employer and today I processed my first termination pay for a permanent staff member who’s been with me for four years. The payroll software makes this job very easy, but what instantly caught my eye was that no super is payable on unused annual leave, i.e., she was paid the SG for her hours worked this pay cycle, and received all outstanding accrued annual leave. The anomaly is that when annual leave is taken, 11% super is paid on top. However, when unused annual leave is paid out upon termination, super is not paid on it.

Image by gpointstudio on Freepik

Image by gpointstudio on Freepik

This struck me as both nonsensical and quite unfair. It is all the more inequitable as anyone who happens to know about this bizarre rule can easily circumnavigate it! Those who don’t know, and who ‘do the right thing’ by their employer, on the other hand, will miss out.

Supposing an employee has 4 weeks accrued annual leave and is required to give two weeks’ notice. Assuming their employer approves a long holiday for them, they can simply give notice two weeks before their holiday ends. By doing so, they will receive the SG on all their annual leave.

If however they simply give notice and the leave is paid out, they miss out on an extra 11% of their pay!

If I’d known about this, I would have given my staff member the option of whether to have their leave paid out with SG on top or to take it earlier as a lump sum without the SG. The choice is theirs. As it currently stands, I feel as though they have been short-changed for no apparent logical reason.’

My accountant has confirmed this is correct. It’s worth knowing.

And Finally

I’ve just finished reading a book about the world’s greatest basement … It was a best cellar.

It’s my first week working at the bicycle factory and they already made me a spokesperson.

Horses have lower divorce rates. It’s because they are in stable relationships.

Photo by Mona Eendra on Unsplash

My laptop caught pneumonia, apparently because I left Windows open.

I thought swimming with dolphins was expensive until I went swimming with sharks … It cost me an arm and a leg.

The main function of your little toe is to make sure all the furniture in the house is in the right place.

It’s pretty obvious that if I run in front of a car I will get tired but if I run behind a car I will get exhausted.

My teachers told me I’d never amount to much because I procrastinate so much. I told them you just wait.

90% of bald people still own a comb; they just can’t part with it.

Every morning I get hit by the same bicycle … It’s a vicious cycle.

The word incorrectly is spelled incorrectly in every dictionary.

I’ve been experimenting with breeding racing deer. People have accused me of just trying to make a fast buck.

What do you call a row of rabbits hopping backwards? A receding hare line.

When I was a kid, we played spin the bottle with the girls, if they didn’t want to kiss you, they would have to give you a dollar. By the time I was 12, I owned my own home.

Always trust a nudist … They have nothing to hide.

Geraldine, the team and I wish you a wonderful Christmas and a healthy, prosperous and happy 2024.

Geraldine, the team and I wish you a wonderful Christmas and a healthy, prosperous and happy 2024.

The estate planning book is now with the editor, so expect notification of pre-sales in March.

As always, if you’re having any queries, don’t hesitate to email me.

Noel Whittaker