“The goal isn’t more money.

The goal is living life on your terms.”

CHRIS BROGAN

The Podcast

Renowned broadcaster John Deeks and I discuss all the big topics covered in this newsletter in detail each month.

Welcome to our August Newsletter

It’s amazing how quickly the months are slipping by.

The big news is the upcoming productivity roundtable, set to take place in the next couple of weeks. There’s no shortage of proposals being floated, but given the long history of these talkfests, I’m not holding my breath. Current headlines are dominated by ideas like reducing the 50% capital gains tax (CGT) discount and somehow taxing family trusts.

Image by rawpixel on Freepik

Image by rawpixel on Freepik

When Peter Costello was treasurer, capital gains were indexed to inflation, meaning if you’d been reinvesting dividends, calculating the base cost of each parcel was a nightmare. To simplify things, he scrapped indexation and introduced a 50% discount for assets held longer than a year, a system that remains in place today. Over the years, there’s been talk of a sliding scale of CGT discounts depending on how long you’ve held the asset – the shorter the time, the smaller the discount – but none of those ideas have ever made it off the drawing board. And as I’ve said before, any change to CGT would need a future implementation date, which could spark a wave of selling beforehand, followed by a slump. It wouldn’t be easy to manage.

When I speak to my accounting friends about taxing discretionary family trusts, nobody seems to know how it could be done. Trusts don’t pay tax themselves; they distribute income to beneficiaries, typically family members. The so-called “loophole” isn’t as wide as some think; distributions to children under 18 are taxed at the top marginal rate. There’s a brief window when the kids turn 18 and are still studying, but that closes once they earn $45,000 or more. Given that the 30% marginal tax rate applies from $45,000 to $135,000, most other adult beneficiaries are already being taxed at 30% anyway. There’s talk of applying a flat 30% tax to all distributions, then adjusting it based on each beneficiary’s actual tax rate, but that would be a complex administrative mess and unlikely to raise much extra revenue.

Upcoming seminar in Sydney

Thank you so much for your support and enthusiasm! Everything is now organised, and I’m really looking forward to seeing you there.

Admission is free and drinks and canapés will be served, but registration is essential – simply click the link to reserve your seat. Don’t delay; places are limited to 200, and I expect they’ll be snapped up quickly.

WHEN Thursday 11 September 2025 | 6.00pm – 8.30pm

WHERE Hyatt Regency | 161 Sussex Street, Sydney

ROOM Wharf room, ground floor

The Brisbane seminar for Gem Life, great memories.

It was great to see so many of you at our seminar in Brisbane last month. There’s so much information to share, and it was great to have such a fun time. Can’t wait for our next one in Sydney.

Other speakers were my business partner, Rachel Lane, the aged care guru and nutritionist, Carly Barlow. Keep in mind there are many factors to healthy ageing, but the main ones are exercise, a good diet, a social network, and a sense of purpose.

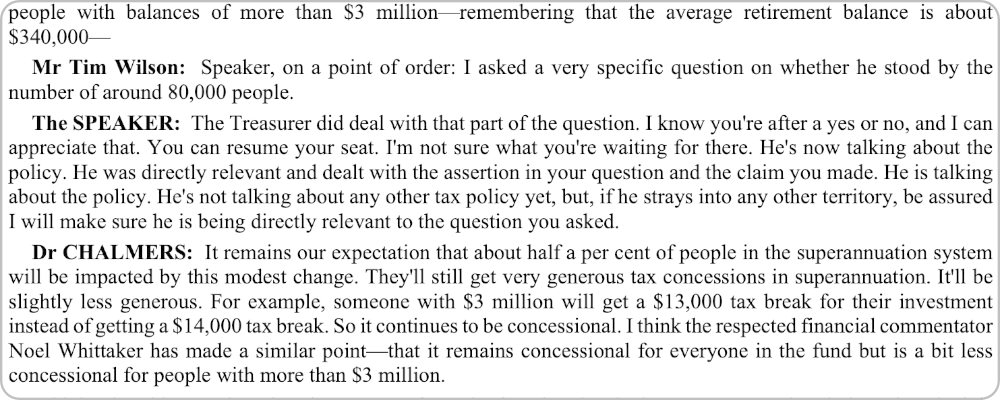

Division 296: The tax on unrealised capital gains

Staying on the tax theme, the government still hasn’t passed legislation to impose a new tax on unrealised capital gains for super balances over $3 million. I’ve written about this many times, but word on the street is that the big industry funds – Labor’s allies – say they can’t get the systems ready by 30 June 2026, and are now asking for a one-year extension. Maybe there’s a reprieve coming.

As I’ve said before, in dollar terms, the tax isn’t that massive; someone with a $4 million balance would pay around $12,000 a year. But it’s the principle of taxing unrealised gains that has everyone up in arms.

Image by pch.vector on Freepik

Image by pch.vector on Freepik

On a lighter note, I was quite chuffed to be quoted in Parliament last week for the first time in my life. During a debate on Division 296, Treasurer Jim Chalmers said that “respected financial commentator Noel Whittaker” said that very good concessions would still be available.

Watch this space.

Willow Voice: The app that changed my life

I’ve been writing professionally for over 50 years, but typing has always been a challenge. At best, I’m a 40-words-per-minute typist, and prone to errors. My first attempt to solve this was to hire a casual stenographer. The problem? They were expensive and rarely available when I needed them.

Next, I tried Dragon Dictate. It was a major improvement but worked only on Windows and required a high-end microphone or headset to function properly. Then I moved to Apple’s built-in dictation tool – better, but still far from perfect.

The biggest challenge in my day was answering emails. I average at least 75 emails a day from readers. Those needing a longer or more thoughtful reply often got put on the back burner. And then, of course, they’d get forgotten as other work took over. I always felt bad about this; if someone takes the trouble to write to me, they deserve a reply.

Three months ago, my son James emailed me about a new app called Willow Voice, which was receiving glowing reviews in the US I gave it a try, and it changed my life.

These days, every time I write something in the paper, I receive over a hundred responses asking for more detail. With Willow, I simply tap a key and speak my reply. It types everything for me with no training, no special microphone and astonishing accuracy. It runs quietly in the background on my Mac, and it’s made email a joy instead of a chore.

Since I started using Willow, my entire workflow has changed. I no longer struggle to compose replies or waste time checking for typos, only to be asked later if I really meant what I wrote. I just talk, and the job gets done.

I’m now in regular contact with the Willow team in the US, and they’ve kindly offered my readers a free one-month trial. If it suits you, wonderful. If not, that’s fine too. Just note that Willow only works on Apple computers and needs an internet connection while in use. That’s never been an issue for me, as I have Wi-Fi wherever I work.

After just a couple of months, it tells me I’ve already dictated 35,000 words, saved 15 hours and achieved an effective typing speed of 118 words per minute.

Quite simply, Willow has changed the way I work and I think it could change yours too.

Here’s your referral link:

I’m very keen to hear of your experiences if you take up the offer.

The Senior webinar

Our recent webinar with The Senior was a huge success, and the feedback has been terrific. Many people have asked for a replay because they couldn’t watch it live. Now it’s ready for you.

If you missed out, here’s your chance to catch up. Just click the link, sit back, and enjoy the session at your convenience.

Retirement made simple

As life keeps changing, so must our knowledge. Don’t forget there is now a brand new a brand-new edition of Retirement Made Simple — updated with all the latest superannuation thresholds and rules that took effect on 30 June 2025. It’s available now from my website, and as always, the best value is in the bundle deals—because we pay the postage when you buy more than one.

Grab a Bundle & Save!

FREE SHIPPING ON ORDERS OVER $35 IN AUSTRALIA

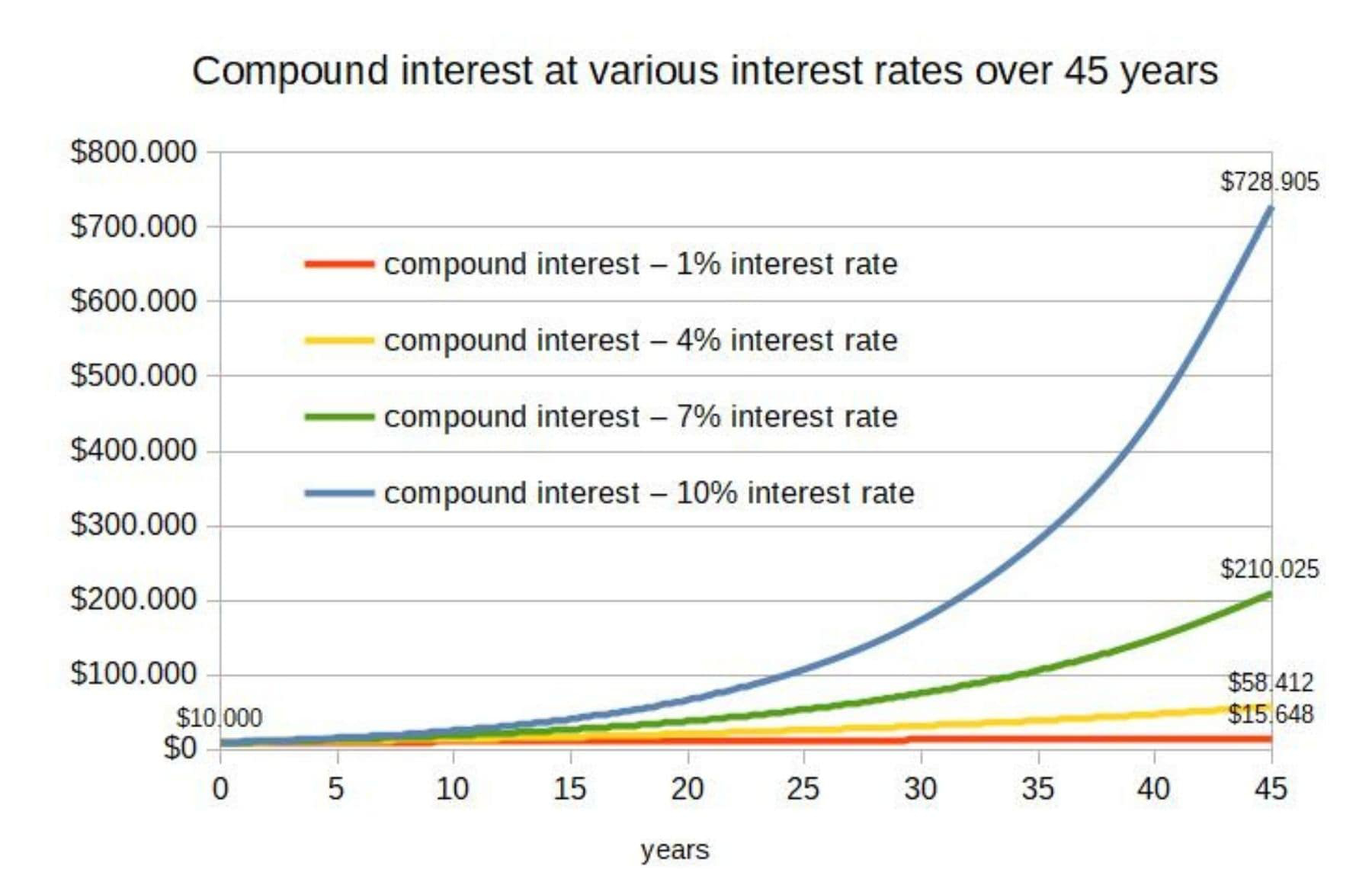

The miracle of compound interest

For more than half a century, I’ve been extolling the power of compound interest to build wealth. But a recent email suggests the message doesn’t always get through. It read:

You’ve long promoted the power of compounding, but frankly, I don’t see the point. If it just means letting bank interest build up – and nearly half gets lost to tax – surely there are better strategies. Am I missing something?

Let’s start with the maths: the Rule of 72. This simple rule tells you how long it takes for your money to double: divide 72 by your expected rate of return. If I have $100,000 earning 8%, it will double every nine years. But if I leave it in the bank and earn just 3% after tax, it will take 24 years to double. So your rate of return is vital.

Image by slon.pics on Freepik

Image by slon.pics on Freepik

And the other crucial bit? Time: every time your money doubles, the final doubling adds more than all the earlier ones put together. Let’s say you start with $100,000 earning 8%. After nine years, it’s $200,000. After 18 years, $400,000. Then $800,000 after 27 years, and by year 36, it’s grown to $1.6 million. That’s the magic of compounding.

Now think about the person who just parks their money in the bank at 3%. It takes 24 years to reach $200,000, and 48 years to get to $400,000. Meanwhile, the long-term investor is sitting on $4 million. These examples highlight just how vital both time and rate of return are.

Let’s dig a little deeper. Compounding simply means reinvesting your earnings instead of spending them. Take a share portfolio returning 9% – 5% from capital growth and 4% from income. The investor who reinvests everything will enjoy the full 9%, meaning their portfolio doubles every eight years. But the one who spends the dividends captures only the 5% growth component, and their money doubles only every 14 years.

But the cream on the cake for anyone investing in growth assets like shares is that capital gains tax isn’t payable until the asset is sold. And if the portfolio leans towards Australian shares – with their franked dividends – there’s virtually no tax on the income either. That means you’re enjoying the full power of compounding, with no annual erosion from tax.

So, to answer the email: compounding absolutely works, but it would be a mug’s game to leave it sitting in the bank earning a pittance, especially after inflation and tax have taken their slice.

Here’s a visual illustration:

CASE STUDY

Jack and Jill are both 25 and earning $65,000 a year. Each has employer super contributions of 12%. Jill is money-smart and ensures her super is invested in a high-growth option to maximise returns. Jack loves betting on the footy and doesn’t think much about super. He leaves his funds in the default investment. As a result, his fund earns just 4% a year. Fast-forward 40 years: Jill’s super has grown to around $3.3 million; Jack’s is just $1.3 million. These figures were worked out on my Super Contributions Calculator, which is available on my website.

That’s a dramatic example of the power of compounding. Failing to use it cost Jack $2 million. It’s the difference between a comfortable retirement and one spent counting pennies.

And compounding is just as important in retirement as it is while you’re building wealth. Not only does the rate of return determine how much you retire with but it also dictates how long it lasts.

Picture someone who retires at 65 with $1 million in super and plans to draw $60,000 a year, indexed. If their portfolio earns 8%, the money will last until age 99. But if they play it too safe and earn just 4%, they’ll run out of funds by age 82 – and may have to rely entirely on the age pension.

From the Mailbox

“We’ve just returned from six weeks travelling through the UK, Ireland, Norway, Portugal and Spain.

We started by loading $6,000 onto our Wise card and topped it up as needed along the way.

Every time we used it, I’d instantly get a message on my phone showing how much we’d spent in the local currency, what that was in Australian dollars, and the Wise fee, which was always just cents, not dollars.

When we got back to Australia, we simply transferred the remaining balance back into our Australian bank account. It was BRILLIANT. Easily the best card we’ve ever used! I’ve recommended it to all my travelling friends.”

Interest rates dropping, what to do now?

Interest rates are on the way down. That raises a big question for anyone with a mortgage: what should you do next? Lenders may offer to reduce repayments, but if you’ve been coping comfortably, why cut back?

The more you repay, the quicker you’ll build wealth and the sooner you’ll be out of debt. By maintaining your current repayments when rates fall, you can slash years off your loan and save thousands in interest. You won’t miss the money; you’re already used to living without it.

CASE STUDY

Jack and Jill took out a $600,000 loan two years ago, with monthly repayments of $3,800 over 30 years at a 6.5% variable rate. With a 0.50% cut already in place and another 0.25% likely, they could soon be paying 5.75%, reducing repayments to $3,501 a month. If they took that option, the loan would run its full course and cost $660,000 in interest. But if they stick with $3,800, they’ll cut five years off and save over $160,000 in interest.

And there’s more they can do. Back in 1987, I made headlines promoting fortnightly repayments. The banks scoffed, but paying fortnightly pays off your loan faster without noticeable strain. If Jack and Jill paid $1,900 a fortnight, they’d repay $49,400 a year instead of $45,600. The term would drop to just over 20 years. There are 26 fortnights a year – it’s like paying an extra month painlessly. Combining both strategies would save them $250,000 and wipe out the loan 10 years early.

Image by kues2 on Freepik

Image by kues2 on Freepik

Refinancing to a lower interest rate is another powerful way to cut interest costs. But many borrowers are trapped by Lenders Mortgage Insurance, a one-off premium that protects the lender against borrower default and can’t be transferred between lenders. This often makes refinancing too expensive.

However, with recent sharp rises in property values, there may now be a way out. Mortgage insurance is usually only required when your equity is under 20%. If your property has risen in value, you may now own more than 20%, allowing you to refinance without incurring another round of mortgage insurance.

If that’s your situation, ask a local agent for a free appraisal to estimate your home’s market value. If your loan is now less than 80% of that, don’t call your bank – speak to an experienced mortgage broker. A good broker will know which lenders offer better rates and whether you qualify to refinance without extra mortgage insurance.

What about people wanting to buy a home but put off by mortgage insurance, which can exceed $20,000 for first-home buyers? It’s a question of strategy—and what other resources may be available to you.

If prices keep rising—and most signs suggest they will—every month of delay makes buying harder. In that case, it may make sense to buy now and wear the insurance premium, rather than keep saving and risk being priced out. It’s a gamble either way, but in many cases the numbers favour acting sooner.

Of course, if the Bank of Mum and Dad is available, a financial gift or loan from parents might drop your loan-to-value ratio under 80%, sidestepping that $20,000 cost and starting your homeownership journey on stronger footing.

The bottom line? Whether you already own a home or hope to buy one, interest rate movements create both risk and opportunity. A little smart thinking now can mean major savings later.

Keeping your bank honest

Peter Cooper is a former state manager of one of the major banks, with over 50 years of experience in banking. He has always been concerned about the advice and information the self-employed receive, given they have little time to keep up to date with rates, fees and bank conditions.

Image by pch.vector on Freepik

Image by pch.vector on Freepik

Take control of your bank and your business finances

Control Your Bank is a smart, user-friendly platform created to help self-employed business owners secure better rates, fees and terms from their existing bank without the hassle of switching (unless you want to).

Here’s how it works:

Upload the following documents to the Control Your Bank website:

- Your current or new loan offer

- A copy of your old or updated property valuation or a complete copy of your rates notice

- Details of property leases (if applicable), including expiry dates.

What happens next?

We’ll review your documents and respond promptly in writing, letting you know if your current bank is offering you a competitive deal.

✅ If your bank stacks up, great! You’re all set.

❌ If not, we’ll provide tailored insights and advice to help you negotiate better terms on rates, fees and security.

And if your bank still isn’t willing to come to the table? We’ll help you explore better banking options that value your business and your future.

👉 Visit www.controlyourbank.com.au today and take charge of your financial future.

And finally

Some amusing perspectives about age

Image by Freepik

Image by Freepik

“If you want to know how old a woman is, ask her sister-in-law.”

— Eva Gabor

“Old age comes at a bad time.”

— Ed Sullivan

“Inside every older person is a younger person wondering what happened.”

— Stevie Wonder

“Old age is like a plane flying through a storm. Once you are aboard, there is nothing you can do about it.”

— Golda Meir

“The older I get, the more clearly I remember things that never happened.”

— Mark Twain

“I’m at that age where my back goes out more than I do.”

— Phyllis Diller

“Nice to be here? At my age, it’s nice to be anywhere.”

— George Burns

“You spend 90 percent of your adult life hoping for a long rest, and the last 10 percent trying to convince the Lord you’re not that tired.”

— Princess Grace

“Old people shouldn’t eat health foods. They need all the preservatives they can get.”

— Bob Hope

“At my age, flowers scare me.”

— George Burns

“The important thing to remember is that I’m probably going to forget.”

— Martin Scorsese

“It’s paradoxical that the idea of living a long life appeals to everyone, but the idea of getting old doesn’t appeal to anyone.”

— Andy Rooney

“The older I get, the better my golf used to be.”

— Lee Trevino

“I was thinking about how people seem to read the Bible a lot more as they get older—and then it dawned on me: they’re cramming for their final exam.”

— George Carlin

“Everything seems to slow down with age—except the time it takes cake and ice cream to reach your hips.”

— Elizabeth Taylor

“Looking fifty is great—if you’re sixty.”

— Joan Rivers

“Time may be a great healer, but it’s a lousy beautician.”

— Zsa Zsa Gabor

I hope you have enjoyed the latest edition of Noel News.

I hope you have enjoyed the latest edition of Noel News.

Thanks for all your kind comments. Please continue to send feedback through; it’s always appreciated and helps us to improve the newsletter.

And don’t forget you’ll get more regular communications from me if you follow me on X – @NoelWhittaker.

Noel Whittaker

Featured image by Freepik