“Persistence is the hard work you do after you get tired of

doing the hard work you already did.”

NEWT GINGRICH

The Podcast

Renowned broadcaster John Deeks and I discuss all the big topics covered in this newsletter in detail each month.

Welcome to a new financial year.

Once again, we’ve lived through an eventful stretch – full of bold predictions about what might happen if Donald Trump returned to the White House.

My inbox was flooded with questions: Should I sell everything? Will the markets collapse? But my answer never changed. If you hold a well-structured share portfolio, the smart play is to stay the course. Long-term investing means riding out the inevitable turbulence.

Cartoon by Bob Rich for Hedgeye

Cartoon by Bob Rich for Hedgeye

And yes, we certainly got some turbulence. In early April 2025, global markets took a dramatic turn. On April 2, President Trump announced sweeping tariffs, triggering the “Trump Thump” – a historic two-day plunge that saw the S&P 500 fall 10.5%, wiping out over $3 trillion in value. But by April 9, the administration paused the tariff rollout, sparking a powerful rebound. Major indices posted their biggest gains in years, with the S&P 500 back in positive territory by 13 May. That rollercoaster week reminded us just how sensitive markets are to political shocks, and why staying informed matters.

There’s no doubt markets, especially overseas, are more volatile, with wild price swings becoming the norm. Two key drivers are behind it. First, traders chasing quick profits jump in and out, fuelling the noise. Second, investor psychology kicks in; everyday people reacting emotionally to headlines. One of the great benefits of shares is their liquidity. You can sell quickly if needed. But liquidity is a double-edged sword – it makes markets jumpier. Traders play their games, while mums and dads panic and bail out, often at the worst possible time.

Picking winners

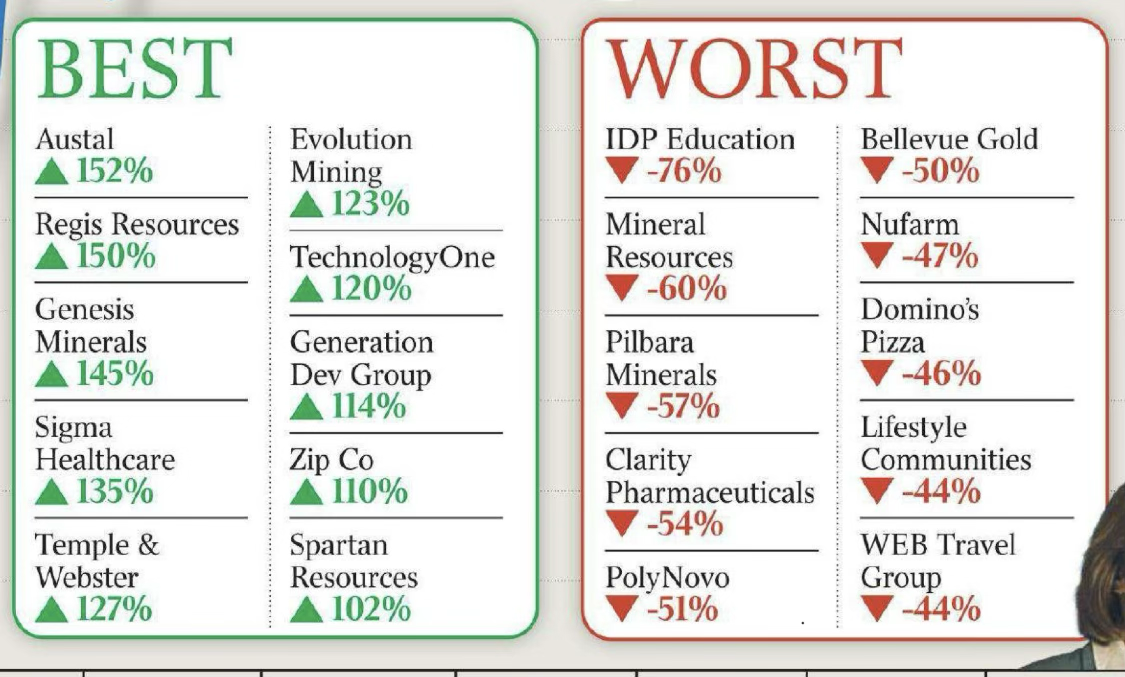

Often when I talk about investing in shares, the most common response is, “I don’t know where to start.” For me, the simplest approach is to invest in the index, using low-cost funds like STW or VAS. Of course, everyone wants to pick a winner. But if you look at the table below, you’ll see the reality: while a few shares had spectacular gains, many delivered terrible results.

In contrast, the index delivered a solid return of 13.3% for the year – a great outcome, especially when you take a long-term view. And no stock picking decisions to make! The reason 13.3% differs from the newspaper headlines of 10% is that the papers didn’t include the dividends paid to investors. And of course, franking made them even more valuable.

Visit to Adelaide

Geraldine and I had a wonderful visit to Adelaide, even though the weather was much colder than in Brisbane. I spoke to three groups of mainly older citizens and received the usual barrage of questions. It was particularly satisfying to have audience members come up and tell me how much my books have changed their lives and those of their children.

For quite a while, I’ve been doing a regular morning talkback program on ABC Adelaide, but this visit gave me the time to do it directly from the studio. It was great fun.

There’s nothing difficult in what I talk about. It’s really about the basics: spending less than you earn, investing regularly, having compound interest work its magic, investing in a diversified portfolio, and keeping in mind that the most important factor that determines how much money you’ll have when you retire is the rate of return you can earn on your finances.

But I’m still concerned about the lack of financial literacy that exists. Whenever I speak to an audience, irrespective of the numbers or the demographics, I ask them which tax they would prefer to pay: income tax, GST or capital gains tax.

Very few pick the obvious answer, which is capital gains tax. It’s the best tax because you don’t pay it till you dispose of the asset, and as long as you’ve had that asset for over a year, you get a 50% discount on the amount you are required to pay. Furthermore, there is a range of strategies – such as catch-up contributions – that can alleviate it.

The final advantage is that death does not trigger CGT. It passes the liability to the beneficiaries who will only pay CGT if and when they dispose of the asset that’s been bequeathed to them.

Another question I ask the audience is who understands franked dividends. Usually only a couple of hands go up. It’s a sad fact that franking credits are one of the best ways to boost the rate of return on your portfolio and also give yourself tax-advantaged income.

If your kids were earning $100,000 a year and they had income from franked dividends, that income would be tax-free because the franking credit of 30% would wipe out their 30% tax.

As an example, take a portfolio worth $200,000 in an index fund, using the numbers of 4% franked income and 5% growth. If that portfolio produced a total return of $18,000 over 12 months, there would be no immediate tax on the $10,000 of capital gain because the asset was not disposed of, and the dividends would be tax-free thanks to franking.

It’s the best wealth-building strategy in the country.

Talking tax

For the umpteenth time, tax reform is back on the agenda, this time as the centrepiece of Treasurer Jim Chalmers’ latest talkfest aimed at boosting productivity. Chalmers is now positioning himself as a crusader against red tape, but it’s hard to take that seriously when, according to recent reports, the Albanese government has introduced 5,000 new regulations in its first term.

Beyond the usual story of wasteful government spending at every level, the deeper issue lies in changing demographics. The number of non-taxpayers is rising rapidly as more Australians retire and live longer – 90% of retirees pay no income tax at all. Add to this our skewed personal income tax system, where just 12% of taxpayers are footing 62% of the bill, and the imbalance becomes clear.

The problem is that any taxation changes will be difficult to implement. Just look at the current system. Once a person earns $135,000 a year, they start losing 39% of every extra dollar. That jumps to 47% once they hit $190,000. These are hardly high-income figures by today’s standards. Yet, we’ve created a system where someone earning $190,000 loses almost half of every additional dollar they earn. There’s something fundamentally wrong with that. It shifts the focus from earning more and being more productive to finding ways to minimise tax, and that’s a dead weight on the economy.

Image by macrovector_official on Freepik

For years there’s been talk about eliminating the capital gains tax exemption on the family home, but that’s a practical impossibility. No government would dare to do it, and even if they tried, the massive disparity in house prices across Australia would make it unworkable.

There’s also ongoing discussion about reducing the capital gains tax discount, but again, implementation is tricky. A fundamental tax principle is that you shouldn’t tax for inflation. Yet, removing or reducing the discount without addressing inflation would do just that. And even if they phased it in by applying the change only to assets acquired after a certain date, you’d see a frenzy of purchases before the deadline, followed by a slump. The result? Distorted markets, disrupted planning and more confusion than clarity.

Super is always a target, and now there’s talk that the government might slap a 15% tax on pension-phase accounts that are currently tax-free. But there’s a major flaw in that plan: super’s entire purpose is to provide a low or zero-tax haven. A couple with $800,000 invested in their own names would pay no tax anyway, thanks to offsets and franking credits. Tax their super, and they’ll just pull the money out and invest it themselves.

Image by jcomp on Freepik

Image by jcomp on Freepik

As always, there are rumours about changing the way family trusts are taxed. Many of the country’s wealth producers run small businesses, and with so many going broke in the first five years, asset protection is a top priority. If you’re a sole trader or in a partnership, all your personal assets are at risk if things go wrong.

That’s why most business owners use a trust or company structure. A trust doesn’t pay tax itself – it distributes profits to beneficiaries, who are then taxed at their marginal rates. While trusts can offer some tax advantages, these are limited for most business owners. Typically, the beneficiaries are mum, dad and the kids, but distributions to children under 18 are taxed at the top marginal rate once they exceed $416 a year. With the 30% tax bracket now stretching to $135,000, there’s little point in targeting trusts with a special tax – owners would simply start paying distributions as wages instead.

The only practical solution is to increase the GST to 15% with no exemptions. That would strike a blow to the black economy and ensure retirees contribute something towards the rising cost of supporting them.

Any GST increase will be slammed as regressive – hurting the poor more than the rich – but that argument applies to most embedded taxes. Petrol tax, liquor excise and cigarette duties are all regressive, yet widely accepted. The real strength of GST is that it’s almost impossible to avoid. It captures a large slice of the cash economy and, while it may hit low-income earners, it hits big spenders hardest – those with the most disposable income.

They call us “The Elderly”

A friend sent me this. I think it may touch a chord in most of you.

From the mailbox

“I was always interested in investing and listened to Bruce Bond and 3LO back in the day. I then read your book Making Money Made Simple in the 1980s while in my late 20s. It really made so much sense to me and gave me a vision.”

Image by Freepik

Image by Freepik

“So I started saving and investing – I remember buying NAB shares in 1988 and that was the start! My initial goal was to hit $1m and retire at 55. I certainly surpassed the first and extended the second but could have easily done that. I am now just over 60 and basically do what I like – a great way to live. My kids follow in their thinking.

Regretfully, I’ve just discovered your newsletter, but it was too late to come to your recent presentations in Adelaide.

A big thank you from a very happy family.”

Retirement made simple

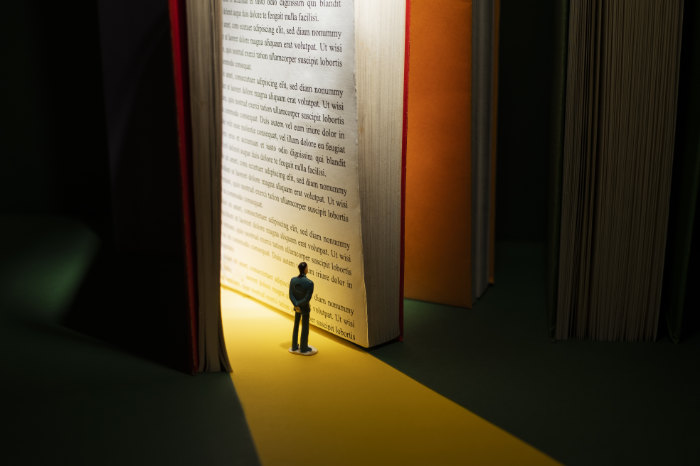

As life keeps changing, so must our knowledge. That’s why I’m pleased to announce the release of a brand-new edition of Retirement Made Simple—updated with all the latest superannuation thresholds and rules that took effect on 30 June 2025. It’s available now from my website, and as always, the best value is in the bundle deals—because we pay the postage when you buy more than one.

Grab a Bundle & Save!

FREE SHIPPING ON ORDERS OVER $35 IN AUSTRALIA

At 454 pages, Retirement Made Simple is a comprehensive guide to thriving in the years beyond work. But rather than lug around a weighty tome, save some money and the risk of carpal tunnel syndrome with Retirement Made Simple in Ebook form. The 5th edition of my Retirement Made Simple Ebook has just the servers and you can be reading just a few minutes on your kindle, computer, tablet or phone.

The 5th edition is fully updated with 2025/2026 super and pension information and will help guide you through the jungle of retirement decision making. What sort of assets to invest in? How long will your money last? Are you eligible for any age pension? Is downsizing right for you? How much should you be investing now? How much would you like to leave to your kids?

It will help you understand new products that keep evolving, estate planning, strategies for surviving volatile markets and unexpected events such as financial crises and pandemics, not to mention continual changes to our tax, superannuation, age pension and aged care regulations.

Above all, it will help you protect and nurture your greatest assets – your health and your relationships.

So head over to the Ebook store now for your copy of Retirement Made Simple 5th Edition Ebook.

Goals for the coming year

The start of a new financial year is the perfect time to take stock and set goals for improvement. The best map is useless if you don’t know where you are. So start by listing your assets and liabilities. That simple exercise often shows exactly where to focus.

Image by rawpixel on Freepik

Image by rawpixel on Freepik

If you’ve got a housing loan, ask yourself: could you shop around for a better rate? It’s worth doing, especially if you have strong equity in your home. But if your equity is under 20%, lenders mortgage insurance (which isn’t transferable) will likely kill the deal, so don’t bother.

If you’re 50 or over, your goal should be to have your mortgage paid off – or at least well under control – by the time you retire. The most effective strategy is to maximise your concessional super contributions, now capped at $30,000 a year. That includes what your employer pays, so if they’re putting in $12,000, you can top up with another $18,000. It’s far better than making extra mortgage repayments, because those come from after-tax dollars, whereas super contributions are pre-tax and tax-deductible.

For senior Australians, another essential question Where do I want to be living in a few years? As we age, care may be needed. Is your current home suitable if your health or mobility changes? If you love the area, you might be able to modify the home and stay put. But for many, especially those in big older houses with rising maintenance costs, downsizing may be the smarter long-term option.

And finally

What do all these items have in common?

Photo album

Address book

Phone book

Encyclopedia

Dictionary

Filing cabinet

Typewriter

Calculator

Compass

Alarm clock

Stopwatch

Sound recorder

Camera

Torch

World atlas

Movie projector

Adding machine

Movie camera

Radio

Emails

Calendar

TV channel programs list

Plus some I have probably missed.

Image by Freepik

Image by Freepik

Yes, that is correct!

You keep ALL THESE ITEMS IN YOUR POCKET

as a MOBILE PHONE

I hope you have enjoyed the latest edition of Noel News.

I hope you have enjoyed the latest edition of Noel News.

Thanks for all your kind comments. Please continue to send feedback through; it’s always appreciated and helps us to improve the newsletter.

And don’t forget you’ll get more regular communications from me if you follow me on X – @NoelWhittaker.

Noel Whittaker