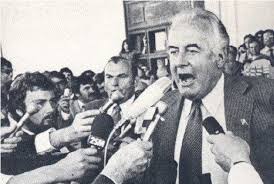

THE WHITLAM YEARS

It’s almost 40 years since the dismissal of the Whitlam government. In the last few days much has been written about the accomplishments and the failures of that government, yet only we older Australians who lived through it have a sense of how different the country was then.

I think the article by John Stone in the Financial Review was one of the best that was written. He was head of Treasury when Whitlam was in power, and eventually became a National Party Senator. I had the privilege of doing a couple of speeches with him, and found him to be an erudite and charming person.

He pointed out that relations between the Whitlam government and the Treasury started out well, and they initially accepted Treasury’s recommendation on December 23, 1972 of 7% appreciation of the Australian dollar. (Remember rates were pegged then). However, between 1973/74 and 1974/75, private investment in dwellings plunged 22.5%, and non dwelling commencements crashed by 34%. The main reason was skyrocketing labour costs. In 1973/74, the minimum weekly wage for an adult male jumped by 18%, then the following year by 30%. This meant a rise in wages of 48% in just two years. Imagine the effect on anyone running a business having your wages increase by nearly 50% in just two years.

This rise in wages caused a bonanza of income tax for the government – household income tax rose 125% in just three years.

The consumer price index jumped 49% in three years, and interest rates almost trebled to 17.2% by June 1974.

The above is from John Stone, and below is what I wrote in the Sunday papers yesterday.

Right now, every time I make a speech there is a plethora of questions that show a fear of the future, and a belief that things are about as bad as they can get. And these feelings are not unreasonable – most developed countries are still struggling to get over the global financial crisis, while the Ebola epidemic and the strife in Iraq, Ukraine and Hong Kong are certainly cause for concern.

If you are worried now, you would have been more worried in the 1970’s. The Vietnam War had ended in 1973 but the billions of American dollars spent to fund that war had created worldwide inflation. The money had been borrowed, and these borrowings had put such a strain on the American budget that in 1971 they had to suspend the convertibility of US dollars into gold.

Australian markets had been in terrible trouble. The 1960’s mining boom ended with a thud in 1971 and this was followed by a property and finance crash in 1973 and 1974. I was working for a property development company at that time and I remember vividly the night all finance in Australia dried up. It was almost impossible to obtain a loan for any purpose whatsoever, and consequently almost impossible to sell a property. We thought the end of the world had come.

But markets have a habit of rebounding. By the end of 1975 Australian shares were up by 48% for the year, despite inflation running at 17%.

The official cash rate was around 7%, with banks charging around 10.5% for home buyers. These rates do sound high today but in 1975 the average house in Brisbane cost just $24,000, which was less than three times the average male wage of $8600 a year.

Even though interest rates today are 5%, the average house price has risen to $460,000 – almost six times the average income of $79,000 a year.

The big lesson in all this is that good and bad times are always with us. It’s always easy to find something to worry about, and there is always a reason to put off investing in case something goes wrong. You may well have been put off investing for life at the end of 1974 – it was one of the worst market times of world history. Yet, in hindsight wouldn’t it have been wonderful to have bought Westpac shares in 1975 when they were just $6.60, or a parcel of blue chip shares when the All Ordinaries index was just 299.

I think the quote from Margaret Thatcher that heads this newsletter is appropriate for the Whitlam years.