The Power of Compounding

I strongly believe that the easiest way for anybody to make a significant difference to their financial situation when they retire is to understand the importance of getting the best return possible on their superannuation. This is why I have placed such importance on it in the new Making Money Made Simple, and have encouraged readers to go to my website and play with the Compound Interest calculator, the Retirement Drawdown calculator, and the Superannuation Contributions calculator.

If you happened to watch Channel 7 news last Friday night you would have seen me talking about it, and discussing what a huge difference that a rate can make to your final balance.

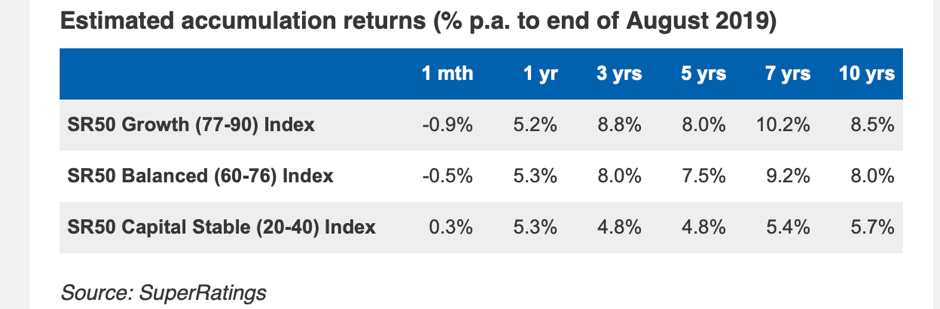

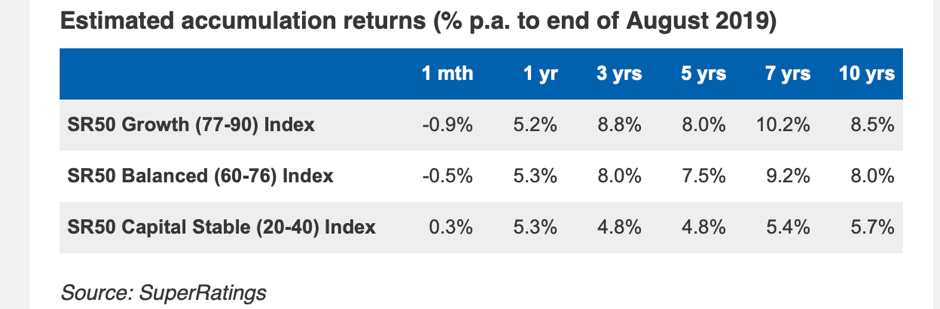

The table below from SuperRatings demonstrates it superbly.

It shows estimated returns for superannuation funds in accumulation mode for various time periods.

I have long recommended that anybody under 55 have the bulk of the superannuation in the Growth option, and then possibly move part of it to Balanced as they get older, after a discussion about goals and risk profile with your adviser. The third one is Capital Stable which is a conservative option, and which many younger people end up in by default because they have not taken the trouble to check where their super fund has put them.

Let’s go now to the Super Contribution Calculator on my website and run two scenarios. The constant is the individual. So, let’s assume it’s a person aged 25, with $15,000 in super now, on a salary of $35,000 a year, and the employer contribution is 9.5%. The contributions tax is 15%, and salary increases at 4% per annum.

We will run the numbers first using 5.7% because we will assume they spend their working life in the Conservative option. After 40 years their superannuation balance will be $907,811. Now leave all those assumptions the same but change the estimated rate of return to 8.5% – notice after 40 years their superannuation balance is predicted to be $1,845,618. The difference in rate has been worth over $937,000 to their superannuation in retirement.

I can’t think of an easier way for a young person to earn nearly $1 million, than by contacting their superannuation fund, and moving their asset mix to growth. What you should do now, after reading the newsletter to the end, is to run the numbers for your own superannuation fund and take action if necessary.