TAX REFORM

Tax reform is all over the news again, with the weekend papers claiming Prime Minister Turnbull will raise the GST to 15%, and possibly extend it to all items, in exchange for substantial tax cuts. It’s going to be an interesting journey because all the proceeds of GST currently go to the states, while income tax is a matter for the Commonwealth Government. Therefore, the only way that increased revenue from GST could be used to cut taxes would be for the Commonwealth to reduce the money it now gives to the states in grants. In other words, they would have to give to the states with one hand while taking it from them with the other. This is not going to happen without a lot of argy bargy.

Our current tax system certainly needs reform. Our fastest growing group is the 65s and over, and 87% of them pays no income tax whatsoever. There are only 1.5% of adults in the highest tax bracket, and they pay 26% of all income tax between them; and there are 9.5% of taxpayers in the $80,000 to $180,000 bracket – they account for 35% of the income tax. In other words, 10.9% of adults pay 61% of the income tax.

There has been a range of suggestions put about, and the GST is only one of them. Australia is one of few countries that have a large tax free threshold. Remember Julia Gillard raised it to $18,200 a year to save all the paperwork caused by low income earners preparing tax returns, most of which resulted in a small refund.

But Malcolm Turnbull has recently returned from New Zealand, where he has been visiting with his friend John Key – the Prime Minister. Key has done a fantastic job of restoring New Zealand’s economy, and much of his success has been due to his consensus approach, which Turnbull appears keen to copy.

In New Zealand, there is no tax-free threshold. The first $14,000 is taxed at 10.5%, and then slowly increases until it caps at the top rate of 33% on income in excess of $70,000 a year. To the best of my knowledge, New Zealand has no capital gains tax, no payroll tax, and no stamp duty – sounds like a tax paradise. Maybe, the Coalition would move towards the New Zealand tax system model in exchange for a GST increase.

But there are many other possibilities on the table. They could abolish the Senior Australian Pensioners Tax Offset (SAPTO) which currently allows a single pensioner to earn $32,279 a year tax free, and for a couple to earn $28,974 each a year tax free. If they earn in excess of this, the benefit reduces until it cuts out completely at $50,119 for a single or $41,790 each for a couple. It’s hard to think of any valid reason why this particular group of people should receive special tax concessions that are not available to working families.

There’s also talk about reviewing negative gearing but in my view it’s not going to happen. Interest rates are down and likely to stay that way for years, and a person who borrows at 5% to buy a property yielding 4% is hardly going to be claiming much in the way of a tax break. Also, negative gearing is a strategy practised by low-income earners because they tend to be scared of the share market.

The ACTU is calling for an increase in the Medicare levy, which is currently at 2%, but this would be unlikely to happen in the context of general income tax breaks. What they should do is abolish the Medicare levy – all the proceeds of it do not go to health care and it’s simply a tax by a different name. It would be much simpler to add 2% to the current tax rates.

There’s been much talk about raising the taxes on superannuation, but Treasurer Scott Morrison has already said publicly that any reduction in tax concessions would only affect people in the accumulation stage. In other words, the rules would not be retrospective and retirees would be unaffected. Who knows?

The one that scares me most is land tax on the family home. They already have it in the ACT, and South Australia is keen to get it as well. One of the recommendations of the Henry Tax Enquiry was that stamp duty is abolished, and universal land tax be put in its place. The theory was that stamp duty was a lumpy source of income for states because it was dependent on the property market, whereas a land tax on everybody’s home would be a predictable and stable source of income. If they did it, I’d be terrified that they would not abolish stamp duty, and we would be stuck with stamp duty as well as land tax.

But in any event, land tax fails the basic test for a tax – ability to pay. Think about a couple who bought a house on the beach for a small amount 40 years ago, and has now seen it grow to a multi million dollar property purely because the area has become popular. They could be asset rich, cash poor, and living on the age pension. How could they possibly pay $20,000 a year or more in land tax?

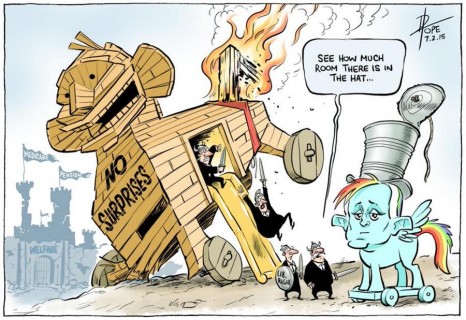

It’s going to be a long and arduous journey for the coalition, with every decision difficult to sell to the public and hard to implement. All I can say is watch this space