Noel News – 4 Mar

We make a living by what we get,

but we make a life by what we give.

WINSTON CHURCHILL

I started this newsletter in November 1998. I mentioned then that I had received so many letters and emails from readers of my books and columns over the years that many of you feel like family, and having the ability to communicate with you in this way lets me give you information you would not get elsewhere. It’s always been about providing accurate information, because so much stuff in the media is incorrect or is partly true.

The newsletter has always been free because I feel that price should not prevent anybody who is keen to learn. Furthermore, I have never accepted sponsorship because I value my independence and want to feel free to make recommendations about products that I think are great, without any obligation to somebody who was paying for it.

My approach has always been holistic – just recently, when I was doing an interview for a piece in the newspaper, I was asked, “How come you devoted 50 pages in Retirement Made Simple to health and well-being?” I responded that when people are retired and are financially challenged there is seldom an easy way out. But our greatest asset is our health, and the good news is that it doesn’t take a fortune to stay in shape. Eating well, and getting regular exercise is not expensive – it just takes knowledge.

In this newsletter, apart from the usual topics, I’m including a podcast from Ashley Owen who spells out investing versus speculating, and gives us some great information on bitcoin – most of which I didn’t know. Don’t miss it.

Interest Rates

The Reserve Bank has just handed down the latest interest-rate decision and, as expected, rates are still on hold. But the big question is where our interest rates going from here. Even though the world is full of good news right now, investors are more confused than ever. The success of the COVID-19 vaccine worldwide gives us cause for optimism, and it also means a new threat: inflation. If business activity picks up again, all that stimulus pouring cash into world markets will start to be eased back. Already, many big investors are dumping sovereign bonds, with the US 10-year yield jumping to near 1.38% and the Australian 10-year yield now over 1.6%.

We currently have huge labour shortages – workers are not available either because they are too happy on Jobseeker or because they can’t get to Australia – and material shortages are rampant due to transport delays. The bottom line is that inflation is upon us, and this means interest rates will go up.

Now I know that Philip Lowe of the Reserve Bank has told us that there will be no rate rises till 2024, but markets are betting it will be one to two years earlier. My friends in the money market are even betting on the cycle turning before this Christmas, and history tells us that there may well be 10 interest rate rises in the next cycle. If we assume each rise will be 25 basis points, it would not be unrealistic to expect, over time, a 2.5% increase in the cash rate. That would take home mortgage rates to 5% per annum or more.

Of course, forecasts are notoriously unreliable, but it seems reasonable to think we are very close to the bottom of the interest rate cycle, even if it doesn’t turn upwards for a year or more.

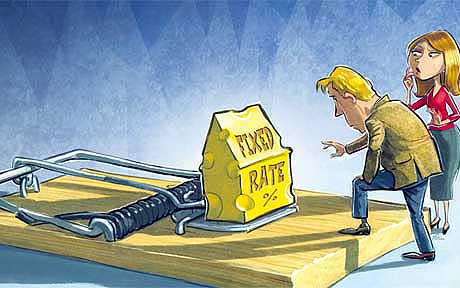

This is a warning to anybody with any kind of variable rate loan. If you agree with my reasoning, you may wish to think about fixing part of your rate sooner rather than later. But make sure you first understand the comparison rate. Right now on television, for example, Westpac are flogging a fixed rate of 1.99% for four years; but by law they must also mention the comparison rate, which is the effective rate after fees and charges – that’s a much less attractive 3.29%. Make sure you look at the comparison rate, not just the advertised rate.

A great place to start would be one of the comparison websites, where the leading variable and fixed rate loans are listed, with the comparison rate shown clearly as well. Interest rates change all the time, but at date of writing, a three-year fixed loan from U-bank at 1.75% (comparison rate 2.22%) looked to be one of the most attractive. Remember, if you are thinking of switching, you also need to be aware of what other conditions might attach to the loan.

You should also stress test your position, if you have a home loan now. Go to my website and play around with the loan calculators. You can easily work out what the repayments would be if your interest rate went up to 5%. Once you have done that, you should start to increase your home repayments until you get them to a level where you could cope easily if rates did rise to that extent.

I know that the real estate market is rocketing along right now, but if rates start to rise it may well stop dead in its tracks. It’s never been more important, if you’re in the market, to try to get an undervalued property that will hold its value in a slack market. Remember, property values can fall as well as rise.

Hands Off Our Super

The amount of money held in superannuation has now topped $3 trillion, making Australia the fourth-largest holder of pension fund assets in the world. Sadly, when this amount of money is mentioned, all the vested interests come out of the woodwork to suggest ways to “improve the system.”

The amount of money held in superannuation has now topped $3 trillion, making Australia the fourth-largest holder of pension fund assets in the world. Sadly, when this amount of money is mentioned, all the vested interests come out of the woodwork to suggest ways to “improve the system.”

Last month the Association of Super Funds of Australia (ASFA), who represent some of Australia’s biggest funds, made several recommendations. One of them was that if a person had a balance of more than $5 million the surplus should be removed from the superannuation system. Another was that indexation should be abolished for both the non-concessional contribution cap and the transfer balance cap. Both are currently $1.6 million and which, due to indexation, will rise to $1.7 million on 1 July.

These recommendations are not unexpected, because ASFA is not a fan of self-managed superannuation funds. But they are unrealistic and unworkable. For starters, less than 1% of self-managed funds have balances of more than $10 million, and the assets of these funds are usually in big, illiquid assets.

Let’s work through a hypothetical example to see how it may work.

Jack and Jill are both aged 75, and have an SMSF with a balance of $16 million. Apart from some listed shares, the principal asset is a large industrial building from which they have been running their business for more than 30 years, and which is now worth $15 million. Thanks to improvements and renovations over time the cost base is $10 million. ASFA argues that this is not fair, as they are taking advantage of the 15% tax environment, but the bulk of the value is in unrealised capital gain which will contribute nothing to government coffers until the property is sold.

Admittedly, when they do dispose of the asset the capital gains will be taxed at 10% instead of the 22.5% that would apply if the asset was held in their own names. But the tax saved is only $625,000.

These continual attacks on the relative few with large balances miss a major point: within two decades, almost all these funds will be gone. Jack and Jill, like most trustees of large self-managed funds, are in their senior years – their life expectancy is likely to be about 15 years. When they die, the most they can leave to a dependent within superannuation would be $1.7 million. Any remaining funds have to be removed from the system. So the bottom line is that within 15–20 years almost all the big funds will be a thing of the past.

I also fail to see the reasoning in ASFA’s suggestion that indexation of the superannuation caps be abolished. The purpose of indexation is to preserve the status quo in real terms; in a perfect world, income tax rates, payroll tax and stamp duty thresholds would all be indexed. The reality is that governments are quick to index items that produce revenue, such as fines, but slow to use indexation in tax areas, because this would benefit taxpayers and not the government. The classic example in Queensland is the land tax thresholds, which have not been indexed for 13 years. This has hit landlords hard, as land tax bills have been increasing in line with their assessed site value.

Superannuation should be the cornerstone of Australia’s retirement system. For God’s sake, leave it alone, and let people accumulate money for a welfare-free future, free from continual tinkering. Continual changes to the system lead to distrust in it. Did I mention that we have the fourth-biggest system in the world? That’s a major achievement!

Indexation

Thankfully indexation is still with us and the new numbers that will take affect from 1 July have been announced.

The concessional cap – which is the amount that is tax deductible – will go from $25,000 a year to $27,500 a year. This could have implications for anyone who is trying to reduce capital gains tax by making tax-deductible contributions to superannuation. In some cases, the catch up contribution rules could enable a much bigger deductible contribution in the year the capital gain is made. This is an area where expert advice should be taken.

The limit for non-concessional contributions will increase from $100,000 to $110,000 and in addition the maximum amount a member who was under 65 at the start of the year can contribute under the bring forward rules will increase from $300,000 to $330,000 . Also note that the $1.6 million non-concessional threshold is also changing due to the indexation of the general transfer balance cap to $1.7 million. For example, from 1 July a person’s non-concessional cap will be nil if their total super balance on 30 June 2021 was $1.7 million or more.

Investing or Speculating or Bitcoin?

It’s great to read stuff, but sometimes you learn better by hearing a good conversation. In this newsletter I’m privileged to include a conversation between Vincent O’Neill – the CEO of Stanford Brown, a boutique Sydney financial advisory firm, and their chief investment officer Ashley Owen – who has been a close friend of mine for more than 20 years. His knowledge of financial markets is unique; he is my go to man whenever I have a serious question. The entire podcast was recorded verbatim – there were no prepared questions.

The topics discussed are listed below, but I think the two you really need to focus on our investing versus speculating, and bitcoin. This is a really educational podcast and I know you will benefit greatly from it.

The topics include:The Democrat clean sweep in Washington and what it means for global markets

- Inflation fears and how they impact share and bond markets

- When will the Fed and RBA hike rates?

- How to tell if you’re an investor or a gambler?

- The GameStop short squeeze – what really went on?

- Bitcoin – is it the new ‘safe haven’ currency?

- Outlook for company profits , dividends and share prices

- Why they are still relatively bullish on shares

Listen to it here.

Listen to it here.

Aged Care

This week, after more than two years, 10,000 submissions and 600 witnesses, the Aged Care Royal Commission provided its final report titled “Respect, Care and Dignity”. I have asked my business partner Rachel Lane for her comments on what is proving to be a controversial report.

Rachel writes:

The report contains 148 recommendations that could revolutionise aged care, including:

- A new Act that places the rights and needs of the individual to receive high quality aged care at the centre.

- A single assessment and funding programme that incorporates all home care and residential aged care services, providing funding based on the individual’s needs and enabling flexibility and choice across providers.

- Bolstering governance, safety standards, and prudential arrangements including minimum education and staffing levels and an Independent Pricing Authority to ensure consumer fees and government subsidies are in line with costs.

- Changes to means testing arrangements so that people, whether they receive care at home or residential aged care, would not be required to make a contribution towards the cost of their care. Contributions would be made towards accommodation and everyday living expenses with a safety net for people of low means but no Lifetime Cap.

- Phasing out of lump sum Refundable Accommodation Deposits (RAD’s), moving to a rental style model, due to the liquidity issues they create for providers and the belief that investment in the sector should come from capital markets not residents.\

- The introduction of a tax levy to assist in funding the system.

- Clearing the more than 100,000 people on the waiting list for a Home Care package that has seen some people waiting for 34 months and an estimated 30,000 die over the last 2 years.

- Immediately provide an increase of $10 per day to the Basic Daily Fee in residential aged care to cover meals and nutritional needs with the cost being met by the government.

While the big picture vision for the system is clear, the Commissioners could not reach a united view on how best to achieve it.

Commissioner Pagone supports an Independent Commission Model for aged care with greater independence from the Government while Commissioner Briggs favours a Government Leadership model which provides independence on some aspects such as pricing and quality regulation.

The establishment of an independent pricing authority to remove the inherent conflict the government faces in trying to fund care and control spending saw a similar divergence in opinion with Commissioner Pagone believing the prices set should be binding on the government while Briggs thinks it should be an advisory role.

Similarly, when it comes to the levy Commissioner Pagone wants the levy funds to be dedicated to aged care spending and the amount determined by the Productivity Commission while Commissioner Briggs supports a less formal model with a levy of 1%.

There is also a divergence in views on when and how to phase out RAD’s.

While much has been made of the fact that the Commissioners could not reach a united view, let’s not believe for a minute that if the government was given a clear and direct single option they would have adopted it all. The fact that there are alternative ways of achieving the desired outcome may actually work in favour of reform. It’s like a choose your own adventure book. While the path may not be a straight one, when it comes to aged care reform I think most of us can agree this isn’t about the journey but the destination and we need to get there quickly.

Personal Growth

I have been hooked on personal growth since I read Think and Grow Rich when I was 34. That started a journey which included attending live events to see Norman Vincent Peale, Og Mandino, Wayne Dyer, Brian Tracy, Zig Ziglar, Denis Waitley, Jim Rohn, Anthony Robbins and Stephen Covey.

But let’s face it, most of these events cover the same basic principles presented in different formats. When James and I wrote The Beginner’s Guide to Wealth we condensed the basic success principles and put them in a form where young people could understand them easily. They include goalsetting, understanding that anything worthwhile takes time, the power of persistence, and understanding that failure is a part of success because, if you never fail, you have never stretched yourself.

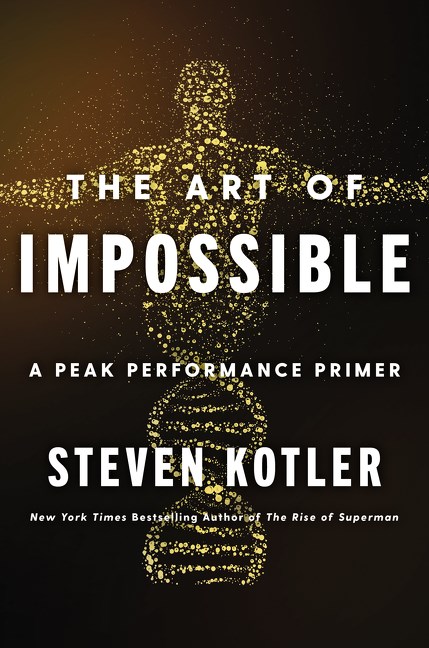

Last week I discovered a book which is unique. It’s called The Art of Impossible by Steven Kotler. He calls it a peak performance primer, but what makes it so special is that he explains the neuroscience and the physiological implications of the actions that successful people normally do.

Last week I discovered a book which is unique. It’s called The Art of Impossible by Steven Kotler. He calls it a peak performance primer, but what makes it so special is that he explains the neuroscience and the physiological implications of the actions that successful people normally do.

In Retirement Made Simple I stress the importance of having a purpose in life, because every book I have read on life expectancies makes this point. But Kotler takes this a step further – he says neurobiologically, purpose alters the brain. It decreases the reactivity of the amygdala, decreases the volume of the medial temporal cortex, and increases the volume of the right insular cortex. A less reactive amygdala translates to less stress and greater resilience. The medial temporal cortex is involved in in many aspects of perception, suggesting that having a purpose alters the way the brain filters incoming information. A larger right insular cortex has been shown to protect against depression and correlate with a significant number of well-being measures.

He writes that all these changes seem to have a profound effect on our long-term health. Having a purpose in life has been shown to lower incidences of stroke, dementia and cardiovascular disease. Additionally, from a performance standpoint, purpose boosts motivation, productivity, resilience, and focus.

I’m the kind of person who is more likely to follow a recommendation if I know the reason for it. Geraldine and I desire our meals around having a healthy gut – because we now know the impact the gut has on our health and immune system. Obviously, the same can be said for having a purpose.

Highly recommended.

And Finally

Moments of clarity

As I sat, strapped in my seat waiting during the countdown, one thought kept crossing my mind … every part of this rocket was supplied by the lowest bidder. – John Glenn

When the white missionaries came to Africa, they had the Bible and we had the land. They said, ‘Let us pray.’ We closed our eyes. When we opened them, we had the Bible and they had the land. – Desmond Tutu

America is the only country where a significant proportion of the population believes that professional wrestling is real but the moon landing was faked. – David Letterman

I’m not a paranoid, deranged millionaire. I’m a billionaire. – Howard Hughes

After the game, the King and the Pawn go into the same box. – Italian proverb

The only reason they say ‘Women and children first’ is to test the strength of the lifeboats. – Jean Kerr

I’ve been married to a communist and a fascist, and neither would take out the garbage. – Zsa Zsa Gabor

When a man opens a car door for his wife, it’s either a new car or a new wife. – Prince Philip

Wood burns faster when you have to cut and chop it yourself. – Harrison Ford

The best cure for sea sickness is to sit under a tree. – Spike Milligan

Lawyers believe a man is innocent until proven broke. – Robin Hall

Kill one man and you’re a murderer. Kill a million and you’re a conqueror. – Jean Rostand.

Having more money doesn’t make you happier. I have 50 million dollars but I’m just as happy as when I had 48 million. – Arnold Schwarzenegger.

We are here on earth to do good unto others. What the others are here for, I have no idea. – W. H. Auden

If life were fair Elvis would still be alive today and all the impersonators would be dead. – Johnny Carson

Hollywood must be the only place on earth where you can be fired by a man wearing a Hawaiian shirt and a baseball cap. – Steve Martin

Home cooking. Where many a man thinks his wife is. – Jimmy Durante

America is so advanced that even the chairs are electric. – Doug Hamwell

The first piece of luggage on the carousel never belongs to anyone. – George Roberts

If God had intended us to fly, he would have made it easier to get to the airport. – Jonathan Winter

I have kleptomania, but when it gets bad, I take something for it. – Robert Benchley

The weather person is the only person that I know, that can be wrong 99.9% of the time and still have a job the next day. – Johnny Carson

I hope you have enjoyed the latest edition of Noel News.

I hope you have enjoyed the latest edition of Noel News.

Thanks for all your kind comments. Please continue to send feedback through; it’s always appreciated and helps us to improve the newsletter.

And don’t forget you’ll get much more regular communications from me if you follow me on twitter – @NoelWhittaker.

Noel Whittaker