Noel News 3 Dec

The only hell I’m afraid of is that when I die, the person I

ended up as meets the person I could have been.

ANON

Welcome to December. In this edition

- Our new book Downsizing Made Simple has just been launched.

- Sophisticated versions of our e-books are now available.

- My quest to find justice for vulnerable people who have become the unsuspecting victims of toxic reverse mortgages.

- Growing pressure on Private health fund funds as older Australians live longer, and younger members forgo health insurance.

- A poignant poem from a grazier’s wife to the Prime Minister about drought relief.

Another New Book

It’s been a big year for new books. Making Money Made Simple is still hot off the presses, and just last week aged care Guru Rachel Lane and myself launched a new book Downsizing Made Simple. As the population ages and many people live much longer than their parents, many are thinking that now may be a good time to downsize. Maybe the family home is getting too big for them, possibly they are just tired of maintenance, or perhaps one or more partners are in failing health and a move is becoming essential.

It’s been a big year for new books. Making Money Made Simple is still hot off the presses, and just last week aged care Guru Rachel Lane and myself launched a new book Downsizing Made Simple. As the population ages and many people live much longer than their parents, many are thinking that now may be a good time to downsize. Maybe the family home is getting too big for them, possibly they are just tired of maintenance, or perhaps one or more partners are in failing health and a move is becoming essential.

Furthermore, there are many people who want to spend their early retirement years travelling, and are looking for a place they can lock up and leave unattended for a month or so.

There is an amazing range of options available. You may want to buy a new freehold home; move into a strata-title apartment or townhouse; choose a retirement community; explore a mobile home; or establish a granny f!at or other collaborative living arrangement. Just keep in mind that there is no right, wrong or best when it comes to downsizing decisions. There is only the one that best suits you.

In Downsizing Made Simple, we want to guide you through the maze to a future that works for you. After a lifetime of contribution to Australia, you surely deserve that in your golden years.

Part One explores the choices you’ll need to make to decide whether downsizing is for you, and how you might fund a change. With exercises and checklists to help put your own situation into the frame, you’ll gain a clearer understanding of your options — and their pros and cons.

Part Two focuses on where you are going to next: demystifying strata title homes, granny “flats, other collaborative housing options, and purpose-designed retirement communities, with the wide range of legal and financial arrangements that may apply. We share case studies that shed light on both the financial and emotional aspects of moving. And we’ll let you in on a secret right now: we often hear people say their only regret is that they didn’t downsize sooner. So don’t be one of the pack: get clear and get going.

In Part Three we explain how to navigate getting care in your own home. In doing so, we bust a few myths, clarify what services exist and the timelines involved, and show you how to access good quality, good value care.

The price is $24.99 and the book is available here:

Buy Downsizing Made Simple

It would be a great Christmas present for anybody thinking of downsizing.

E-Books

One of the most significant updates to the 2019 edition of Making Money Made Simple was a conversion of atoms to bytes for the eBook. You have a device in your pocket capable of storing vast amounts of human knowledge. It takes only a couple of clicks to add the 2019 Edition of Making Money Made Simple to that library – available for Kindle, Android, iPhones and in PDF.

All bundles, such as the Bundle of Wisdom, have also been updated with the new edition of Making Money Made Simple. So if you prefer to carry your library with you everywhere you go, tap, swipe or click your way to the eBook store.

All bundles, such as the Bundle of Wisdom, have also been updated with the new edition of Making Money Made Simple. So if you prefer to carry your library with you everywhere you go, tap, swipe or click your way to the eBook store.

Toxic Reverse Mortgages

Rising life expectancies and increasing living expenses mean that many Australians who retire in the next 30 years are going to be doing it tough. Far too many baby boomers have not taken on the thrifty habits of their Depression-scarred parents and are in for a mighty shock when their employment income ceases, and they have to get by on the Age Pension plus whatever their employer has contributed to superannuation.

One way out is to sell the home and rent, another is to take out a reverse mortgage – a loan where there is no obligation to make repayments of principal or interest. If the borrowers choose to make no payments, the debt will probably double every 12 years.

I am well aware that reverse mortgages tend to be misunderstood, but I’ve always believed they are a great tool in the right circumstances. They enable older retirees to get enough cash to replace the car, go on the world trip and attend to home maintenance and at the same time, stay in their own home.

If you took one out late in life, and only for a small amount, it’s hard to see how you could go wrong.

Unfortunately, for a cohort of retirees, nothing could be further from the truth.

Let’s go back to 2006 when mortgage rates on home loans were around 8%. That was the year where there appeared to be aggressive marketing from companies like Bluestone Equity Release who were offering a product with the interest rate “fixed for life”. It was promoted as taking away one of the biggest fears retirees had when they took out a reverse mortgage – interest rates rising. If that happened , their debt would grow quicker, at the same time as their house could be falling in value due to rising interest rates.

A woman I will call Shirley went with her husband to an evening at a Senior’s Club in Perth where she was part of a large audience to hear about the money that could be obtained by releasing the equity in their home. Shirley, who is now a widow, tells me the evening was arranged by a mortgage broker. I have since spoken to the mortgage broker who tells me it was arranged by her employers with Bluestone as the principal sponsor.

Shirley and her husband liked what they heard, and signed up for an appointment with the mortgage broker at their home.

Shirley and her husband then signed up to borrow $100,000 from Bluestone with an interest rate of 8.59% per annum fixed for life. Fast forward 13 years – the debt of $100,000 has grown to $242,000 which is to be expected after that time. Shirley was horrified to find that the break costs to get out of the loan would be a further $126,500. That’s a total of $368,500 in just 13 years for a loan of $100,000.

I have all the documentation. It would appear there is a no negative equity clause which means if Shirley dies the worst that could happen is that the debt could become more than the property in which case there would be no recourse on the estate – on death the house would be taken in full satisfaction of the loan. Of course, this means her entire home would be lost to her beneficiaries. There is another option – the break fee will be waived if Shirley goes into aged care.

Another victim was 60 years of age in 2006, when she took out a reverse mortgage with Bluestone for $37,500. The debt has now grown to $110,700 In this case the rate was 8.39% fixed for life. Now 13 years later she is 73 and has been advised that the break fee will be in excess of $100,000.

I have been racking my brains to try to find ways I can help these people but it’s extremely difficult. The documentation has been immaculate, the borrowers are required to sign a statutory declaration that they had sought legal advice, and were aware there would be “significant” fees if the loan was paid out early. It appears there is no legal avenue the victims can take, and a class action is out of the question because the lender appears to have done nothing wrong.

It’s a warning about the danger of reverse mortgages. To the best of my knowledge there are no fixed rate reverse mortgages being offered any more, which means the only option is a variable rate. As I said before if rates suddenly skyrocket the retiree could be in serious trouble.

As I see it the only other option is to start a Me Too movement. I reckon if I can find enough victims we can make a lot of noise and try to convince Bluestone to come to the party. What particularly frustrates right now is at Bluestone refuses to make any comment at all.

So, if you know anybody who still has a fixed rate reverse mortgage could you please ask them to get in touch with me at noel@noelwhittaker.com.au.

Growing Pressure on Health Funds

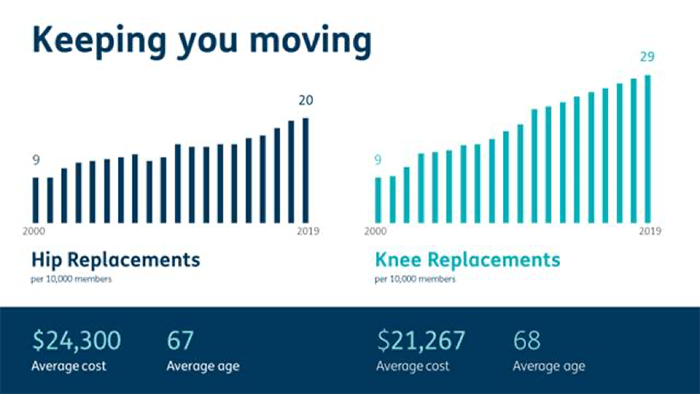

Last month I had the privilege of being the keynote speaker at morning teas arranged by HBF, the leading private health insurance provider in WA, for their long-term members. Long term members are people who have been with HBF for more than 50 years.

The fact that there were more than 1500 people at each event is clear evidence of the fact that people are living longer than ever before. And of course, it puts pressure on private health insurers, as the medical needs of these members grow. For example, the number of knee replacements covered by the fund has risen from nine per 10,000 members in the year 2000, to 29 per 10,000 members today. As each one costs around $21,000, just one uses up about four years of premiums for a couple.

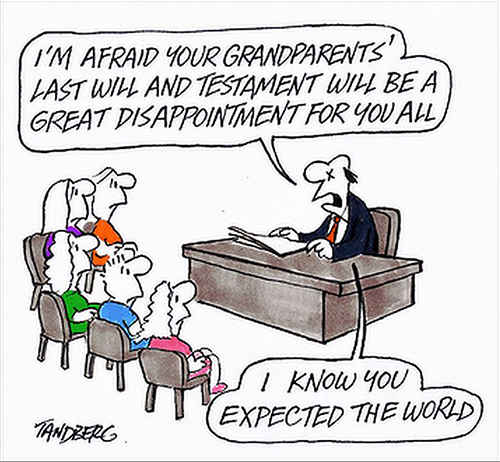

I did point out to the audience that they should not worry too much about their finances. I doubt any of them are going to die broke — which means any money they spend now is effectively being paid for by the kids, as a reduction in their inheritance. What they do need to think about now is having Enduring Powers of Attorney drawn up so that their affairs can be handled if they are absent or incapacitated. Estate planning should also be a focus. This is an area that tends to fall into the “when I get time” category. But it’s too important to take for granted.

Many couples have wills that leave all their assets to each other, but this can cause serious problems if they are receiving the age pension when one dies. Think about a couple with assets of $700,000 who are receiving a pension of $245 a fortnight each, or $12,740 a year. If one of them died suddenly, the surviving partner would be pushed over the assets test cut-off point for a single, which is $574,500. They would lose the pension, health card and their partner all in one go. This could be avoided, if appropriate to their situation, by drafting their wills so that sufficient monies in their estate were left to beneficiaries, such as their children, to keep the residue to the survivor under the single pension cut-off figure.

When you are drafting your will, take particular care with assets such as property and shares, because the introduction of capital gains tax (CGT) in 1985, and the propensity to divorce and re-marry, have added complications. You may own two investment properties of equal value, but if one is pre-CGT, and the other is post-CGT, two beneficiaries may not receive legacies of equal value. Furthermore, if some properties are mortgaged and some are debt free, your will would need to spell out whether the beneficiaries are to take the properties subject to the existing mortgages or whether the loans are to be paid off by the estate before the properties are transferred.

While you are checking that, investigate having a Testamentary Trust included in your will. This can give your trustee control of assets that may otherwise pass directly to your children.

I told the HBF members the story of the couple who died leaving an estate of $4 million to be divided equally between their four children. One was a builder on the verge of bankruptcy, which meant the creditors got the money; the second was a gambler, whose legacy went very quickly; the third was a daughter who was having matrimonial problems – most of her legacy went out the door when the partner left. The remaining child was a medical specialist on a high income – the legacy caused her tax problems.

If the money had been left via testamentary trusts, it would have been safe from the builders’ creditors, out of the reach of the gambler and the daughter’s husband, and able to be arranged strategically for tax effectiveness.

Think about it. You’ve spent all your life working for your money. Doesn’t it make sense to have some control over where it goes when you are gone? Even Howard Hughes couldn’t take it with him.

And Finally

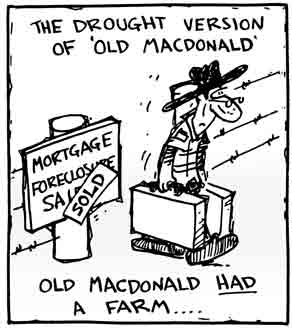

I do have some good jokes saved up for you but I thought this poem was so important it should take priority today.

It has gone viral after NSW farmer Joanna Collett posted it on the Prime Minister’s facebook page:

G’day Mr Morrison, I trust that you are fine,

Sorry to be bothering you, but there’s something on my mind

I listened to a bloke last week; he had a bit to say

You lot may have heard of him? He delivers all that hay?

He spoke of countless hours and the distances they drive

Feeding starving stock, to keep bush hopes alive

They do not get assistance from your tax funded hat

They do it on their own, all off their own bat

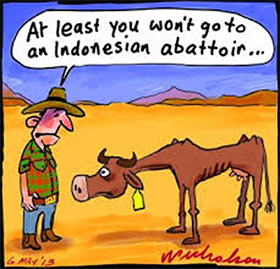

I’m not politically minded and I don’t have any clout

And I know you’ve done a tour, to learn about the drought

But there’s just some burning questions, that have left us feeling beat

Why did we fund a foreign land, to learn to cut up meat?

And what about those soccer boys, who went and got all lost

You pulled out all the bloody stops, plain just showing off

You’ve bigger problems here at home, there’s drought up to our necks

So what does your mob go and do ? Give them big fat cheques!

Don’t they have a government to deal with all this stuff?

Why should it be up to us, what’s with all your fuss?

Should we not be reigning in and look after our own

Have you never heard the phrase “charity starts at home”?

I realise there’s many things, that need an allocation

And I also can appreciate, complex trade relations

I’m not sure if you realise, but if our stock all die,

There won’t be any trade you see, your deals will all run dry

As a rule we’re not a whinging lot, our requests are but a few

Most of us who work the land, are tested, tried and true

We respect that we are guardians, and sustain it for the kids

But I often have to wonder, what future will it bring?

I guess all that I’m wondering, is “where’s the Aussie aid”?

Wrapped up in a swag of tape, only then to be repaid!

There’s Aussie blokes and chicks out there, putting you to shame

Helping fellow Australians, in their time of pain

I’m just a simple farmer, grazier, wife and mum

And even though we’re feeding stock, we’re better off than some

I’ve never had to shoot a cow, who could no longer stand

But many have before me, and I pray, I’m not dealt that hand

So will you take another look; admit that we’re in strife?

And do more than bloody empathise, before another farmer takes their life?

I’d like to think you’ll do what’s right and put Australia first

And help your own damn country, before this drought gets any worse

Joanna Collett

Wee Waa NSW

I hope you have enjoyed the latest edition of Noel News.

I hope you have enjoyed the latest edition of Noel News.

Thanks for all your kind comments. Please continue to send feedback through; it’s always appreciated and helps us to improve the newsletter.

And don’t forget you’ll get much more regular communications from me if you follow me on twitter – @NoelWhittaker.

Noel Whittaker