Noel News 26 May

“If you don’t invest in yourself, what are you going to invest in?”

DAVID MELTZER

Welcome to another newsletter

I received feedback from some readers that my last newsletter was a bit long and complex, so this one will be shorter and hopefully less complex. Also, future newsletters will be shorter and more frequent.

Just remember that a major finding of the Retirement Income Review was that our systems are overly complex, especially in the interaction between tax, superannuation, age pension and aged care.

So, even though we can do our best to keep things simple they can quickly become complex. This is why good advice is so important.

In this edition I’ll talk about the recent federal Budget, and the battle I had with Telstra which went over eight weeks. As you will discover I did win it.

The Budget

There was no doubt the budget was framed with an election in mind. It was full of goodies for everybody, and really left little to complain about, at least in the short term.

Certainly, many people think there will be a day of reckoning when all the spending stops, but that appears to be a long way down the track. Right now, the world appears to be on a spending spree financed by borrowing.

Certainly, many people think there will be a day of reckoning when all the spending stops, but that appears to be a long way down the track. Right now, the world appears to be on a spending spree financed by borrowing.

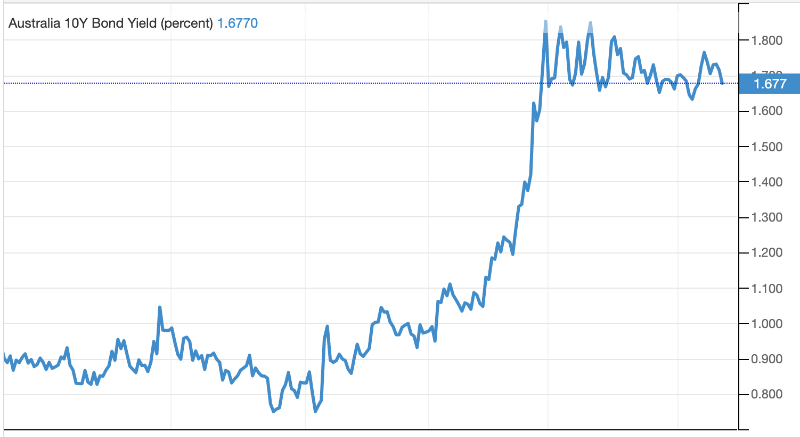

But, interest rates appear to be on the move – in six months the Australian 10 year bond rate has doubled from .8% to 1.6%. And , remember when Covid first struck everybody was scared about massive unemployment . The big problem now is nobody can get staff – this is a signal that inflation may be starting, which means prices and interest rates will start rising.

The front page of last weekend’s Financial Review featured the problems caused by material shortages throughout the world and the way costs were rocketing. The Weekend Australian of the same weekend ran a story headed “Terrible rental crisis stalls regional jobs” which talked about the pressure on rents in regional areas. This was making it impossible for workers to come to the country because there was no accommodation. To cap all that off, the Commonwealth Bank has just called the end of the bottom of the right cycle and has started moving their fixed rates upwards.

What I found surprising the budget is that most of the changes to superannuation don’t start till July 2022. Maybe the purpose was to give time for them to be legislated, though I don’t see any reasonable political party would object to them. But it does mean that extra care needs to be taken for people who may fall between the cracks if their birthdays are such that they lose the right to take part in the new rules when they come into force in 14 months. This is especially relevant if you are considering the bring forward contribution rules.

Before I start talking about superannuation I’ll give you a brief summary of the rules as they stand.

- There is no limit on the amount your super can grow to, but there are limits on contributions.

- Contributions can be non-concessional which means they come from after tax dollars, or concessional which means someone, often the employer, gets a tax deduction. The former are limited to $100,000 a year and the latter to $25,000 a year. After June 30 those numbers become $110,000 and $27,500.

- There is a term called the transfer balance cap which restricts the amount you can transfer to pension mode from accumulation mode.This is currently $1.6 million but this number will rise to $1.7 million after 30 June. Just note that once you have used up your transfer balance cap no more money can be transferred to pension mode. But, once the money has been transferred to pension mode, there is no limit on what it could grow to. For example, if you transferred $1.6 million to pension mode and the fund had a 20% year you could find yourself with $1,920,000 in pension mode.

- Once your superannuation balance reaches $1.6 million, no more non-concessional contributions are allowed. However you can still make concessional contributions as long as you comply with the age limits.

Downsizing

There were numerous headlines about the announcement in the budget that the age limit for downsizing had been reduced from 65 to 60 to enable people over age 60 to downsize and contribute up to $300,000 each into superannuation from the sale of the house.

I just didn’t get the hype. The average retiring couple would be pushed to have $800,000 in super between them, so they could already both contribute $330,000 using the normal contribution rules. They don’t need to access the downsizing contribution. The only winners from the new rules will be the wealthy, who have more than $1.7 million in super now.

Think about it. The work test is being abolished for non-concessional contributions from 1 July 2022 which means nearly everybody will be able to contribute to super in some shape or form up to age 75, whether they are working or not. The only limitation is that once you have $1.7 million in super you cannot make more non-concessional contributions apart from the downsizer special contribution.

What was not publicised is that the work test was abolished for non-concessional contributions, but not for concessional contributions – they can only be made by salary sacrifice after age 67. By definition a salary sacrificed contribution is paid by your employer through your wages, which means you must be working. If you are working, you have passed the work test. My spies in Canberra tell me that the reasoning behind this was to prevent retirees aged between 67 and 75 making concessional contributions to avoid paying capital gains tax.

As always care needs to be taken. Nobody can make a non-concessional contribution, apart from a once only downsizing contribution, if their superannuation balance exceeds $1.6million at 30 June in the previous year. So, if you were 63 with a large superannuation balance, the only way you can get a chunk of money in superannuation is by using the downsizing contribution.

Government Contributes To Cycle Of Rising House Prices

A bigger issue facing Australia is the thinking by both major political parties that ‘something must be done’ to make housing more affordable. Yes, right now we are in the middle of an extraordinary residential real estate boom, but this has been caused by our Reserve Bank cutting rates to historic lows.

Low rates increase the number of people who can qualify for a housing loan, and at the same time turbo charges their loan potential. The rush started as soon as mortgage repayments became cheaper than rent, and of course, once a rush starts, everybody wants to jump on the bandwagon for fear of missing out.

And so it goes on and on.

Every government initiative to help first home buyers simply increases the number of buyers in the market fighting over a rapidly declining amount of residential housing stock. This feeds the vicious cycle of prices going up.

Any asset is only worth what somebody is prepared to pay for it, and how much they are prepared to pay is governed by how much they can borrow.

This budget has also further increased the number of people who are eligible for a housing loan by enabling them to take part in the First Home Loan Deposit Scheme, which is really a lottery allowing them to buy a home on a minimal deposit. This was a disaster in the UK and may well become a disaster here. The interest rate cycle around the world is turning upwards and at some stage homebuyers will face an increase in their mortgage repayments. This will put many under financial pressure, which may well cause a downturn in the housing market.

The Government also announced that more money can be saved in the superannuation system for a deposit on a first home (the First Home Super Saver Scheme, or FHSSS). The maximum releasable amount of voluntary concessional and non-concessional contributions will rise from $30,000 to $50,000. Basically, first home buyers can make additional personal contributions of up to $15,000 a year as a tax deduction, and then withdraw the money when needed to buy their first home. The sting is that the contribution loses 15% going in and is taxed at marginal rates less a 30% rebate on the way out.

The rate of return on the investor contribution is interesting. It will be a “deemed” rate of 3% per annum plus the 90 day bank bill rate. This is what your fund will be required to pay you – no more and no less. Therefore, if your fund achieves better than this, the fund will get the increased return for the period your special home Saver contribution is in the fund, and if the fund earns less than 3% per annum the other money you have in the fund will be used to subsidise the home Saver contribution. I would certainly hope that a good superannuation fund will do better than 3% per annum which means that the home Saver contribution may give a tiny boost to the other money in your fund.

For example, someone earning $85,000 putting $15,000 of gross salary into super for a home deposit would save $5,175 in income tax and Medicare levy up front while losing 15% or $2,250 in contributions tax. However, the maximum in the FHSSS has been left at $15,000 a year per person, and it does not start until 1 July 2022, so the change is of no benefit to anyone who wants to buy anytime soon. It’s a relatively small amount to most first home buyers, especially given the huge amount of paperwork involved.

Another Event

It was great to see so many subscribers to this newsletter at our event at Riverbend Books in Oxford Street Bulimba Brisbane last Wednesday night. The good news is there is another event next week.

This is being put on by Alondra Residences a premium inner-city retirement living community in Nundah, Queensland who are hosting a free retirement living seminar.

Over morning tea I’ll be sharing my thoughts about the financial challenges and opportunities facing older people. Will be plenty of time for questions as well.

Admission is free, and you may well get one of my books as a gift, but you must register to ensure there is a place available for you.

WHEN: 10-11.30am, Wednesday 2 June 2021

WHERE: Chermside Bowls Club (468 Rode Rd, Chermside QLD 4032)

RSVP essential: Register online here

Battling with Telstra

Everybody wants to pick a share price winner, and there is no shortage of information. There is a plethora of investment newsletters, stockbrokers always have recommendations and the papers feature share buys and sells continually.

I don’t fancy myself as a stock picker which is why over 95% of my portfolio is in managed funds. However, the successes I have had were based on observation. I got into Magellan at $1 a share way back in 2010 when I noticed that every time they ran a session for advisers, there would be double the numbers of advisers present versus the previous time. The six-monthly dividends now from that purchase are more than the original investment.

Then there was Iress, which I bought for $4 a share about 15 years ago. I knew that the ‘Holy Grail’ of the financial planning industry was software and also knew that every piece of software I had been shown was a dud. Then suddenly Xplan appeared and it was a winner. Iress was behind Xplan.

A friend told me recently how he made a nice chunk of money as a result of taking his granddaughter to a morning tea. She told him they had to go to Smiggle to buy some merchandise that was in hot demand by young people. He had never heard of Smiggle but when they arrived, he was astounded to see the long queues of people outside their store. He bought a parcel of shares in Premier Investments which have appreciated rapidly in just seven months.

But there is also the opposite. You can dump a share because your dealings with the company are so bad you wonder why they are still are in existence. And this is how I came to sell my Telstra shares an hour before I wrote this.

We have persevered with Telstra for many years despite the difficulty of communicating with them. Earlier this year, when the NBN became available in our area, Telstra rang us continually to convince us to remain with them by switching our Telstra cable internet service to Telstra NBN. We declined and moved the home service to Aussie Broadband.

The Telstra service was discontinued and the associated landline number ported over to a new provider. The problem was that Telstra kept sending us bills telling us that the direct debit to our account would continue.

I rang Telstra where a recorded message told me to use the MyTelstra app on my phone. That was a disaster. Naturally they start the conversation by asking for my full name, date of birth and account number which I duly provided. The next message advised me I was on a contract and there were termination fees. When I asked for a copy of said contract and what the termination fees were for, there was no reply.

What followed was a nightmare. Every time I re-joined the message conversation the cycle re-started with the usual request for name, date of birth etc. and what was I calling about. After having provided the details more than six times, I finally gave up and made my first ever complaint to the Telecommunications Industry Ombudsman. It took three minutes online.

In less than 24 hours after I lodged the official complaint, Telstra had emailed me an apology and promised to refund all the disputed charges. I then tweeted what had happened and within five minutes, Telstra tweeted another apology.

The lesson is obvious – don’t spend weeks fighting with your telecommunications provider. Use Twitter or go straight to the ombudsman. Through either action you’ll get your fast results.

PS As I was writing this I noticed Telstra had just debited my account. Instead of cancelling the debit and refunding my money they have done the opposite of what they had promised. This time I didn’t muck around – it took just three minutes to lodge a new complaint with the ombudsman.

Watch this space.

A Must Watch

This video is less than four minutes long but I think it’s a fantastic watch – it would be great to share with the family. It provides a wonderful summary of the world from 1900 to the present day. Puts what we are living through right now in context.

An interesting view from a different time :

Vale Belle

Some of you will understand the sadness of losing a family pet. Last week our beautiful Rhodesian Ridgeback died after sharing 12 years of her quirky, loving, energetic life with us. All family members had bonded with her. She was patient with grandkids climbing over her, and was adept at stealing sandwiches, prawns, cake and watermelon. She is sadly missed by all of us.

This is one of their favourite photographs – Belle with our son James on his last trip to Australia 18 months ago. It perfectly captures their beautiful natures.

And finally…

Who was the fastest runner in the bible?

Adam because he was the first in the human race.

What did Adam say on the 24th of December?

It’s Christmas, Eve!

What kind of car did the disciples drive?

A Honda, because the Bible says they were all in one Accord.

Who was the greatest financier in the Bible?

Noah – he was floating his stock while the rest of the world was in liquidation.

Who was known as a mathematician in the bible?

Moses – he wrote the book of numbers.

Who does the Bible say should make the tea?

He brews.

Why didn’t they play cards on the ark?

Noah was standing on the deck.

Who was the greatest comedian in the Bible?

Samson – he brought the house down.

How long did Cain hate his brother?

As long as he was Able.

What was Boaz like before he got married?

He was Ruth-less.

Why was everyone so poor in biblical times?

Because there was only one Job.

I hope you have enjoyed the latest edition of Noel News.

I hope you have enjoyed the latest edition of Noel News.

Thanks for all your kind comments. Please continue to send feedback through; it’s always appreciated and helps us to improve the newsletter.

And don’t forget you’ll get much more regular communications from me if you follow me on twitter – @NoelWhittaker.

Noel Whittaker