Noel News 20 April

Before you speak, listen. Before you write, think. Before you spend, earn. Before you invest, investigate. Before you criticize, wait. Before you pray, forgive. Before you quit, try. Before you retire, save. Before you die, give.

WILLIAM A. WARD

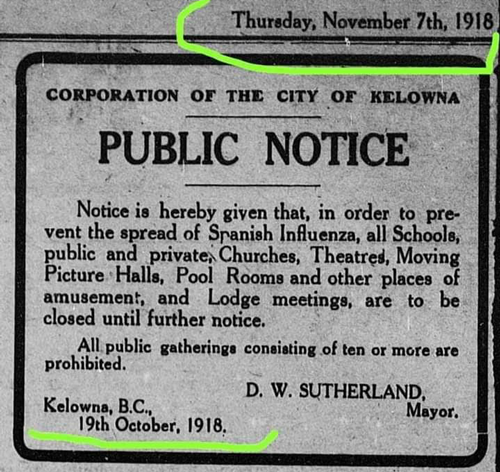

It’s been nearly four weeks since my last newsletter, and so much has happened in that short time. Even the International Monetary Fund is talking about a world depression, whatever that means, but they are forecasting a fast upturn when this is over. Let’s hope they are right, but it’s early days yet.

Governments all over the world have been pumping money into the system, and the media is referring to this action as “stimulus” but it is nothing of the sort. If you lose your income, and I pay you something to compensate for the loss, it simply maintenance of the status quo – it is certainly not a stimulus.

Markets are still all over the place. As The Wall Street Journal said:

“The Dow Jones Industrial Average has staged its best two-week performance since the 1930s, with a dramatic rebound that has left many investors with a confounding reality: soaring share prices and a floundering economy.

The explosive rally is a sign that many are positioning for the U.S. to make a speedy recovery when the coronavirus crisis eases. Investors have been encouraged in recent days by signs that several states will move to resume business, along with hopes that a viable treatment for Covid-19 could be near.

The blue-chip index rose 2.2% this week, extending its rally over the past two weeks to 15%—its best performance since 1938. The S&P 500 climbed 3% this week, while the Nasdaq Composite surged 6.1% as investors piled into highflying technology stocks.”

The Australian government is between a rock and a hard place – they are pouring hundreds of billions of dollars into the alleged stimulus packages, but at the same time tax receipts are going to be way down.

Think about it – most specialist doctors have had their income severely reduced, the majority of dentists are out of work, and many businesses have closed down, maybe for good. The landlords are screaming because of lack of rental income, and almost everybody you can think of is either out of work or working on a reduced income. I would hate to think of the size of the deficit this year.

A term favoured by the media, and one which I hate, is “investors are fleeing to the safety of bonds.” Last Thursday, the government issued $13 billion of 4.5 year government bonds at a yield of 0.47%. The ABC seemed to be saying what a safe investment these bonds were because you have a “government guarantee that in 4.5 years time you’ll get your money back, plus 0.47% interest along the way.” Are they serious!? It wouldn’t even cover inflation.

Property or Shares

And, of course, the newspapers are now featuring headlines like “property may drop 30%” which is nonsense because every property is different – some will drop and some will stay static. But all this argy-bargy between governments, landlords, and tenants highlights the difficulty of owning residential property when the going gets tough.

As I have mentioned previously, I am 85% invested in local and international shares. This means I will never get a bill for rates, insurance, maintenance, or land tax, and don’t have to worry about vacancies. Despite what the sharemarket is doing on a day-to-day basis, the dividends just keep coming in. My superannuation fund has about 10% of its assets invested in an index fund (ASX code: STW). I wrote about it in detail in the new Making Money Made Simple.

Just last Thursday, I got a franked dividend that had been automatically reinvested at $48.67 per unit. Just two months ago, those units were selling at $66.19 so I got a discount of $17.50 a unit. That’s about 27% off – an absolute bargain. As experienced investors know, the index has never failed to reach a new high at some stage in the future. In the meantime, STW is paying six-monthly distributions of 5.31% per annum 83% franked.

Bank Dividends Suspended?

Retirees suffered another blow recently with strong hints in the media that the big four banks may suspend all dividend payments for the next six months. As a result, I have received a flood of emails asking if that’s a real possibility.

It started when three of our major banks agreed to a request from the Reserve Bank of New Zealand not to pay dividends in the near future. The reasoning is that banks need to retain profits, so they stay in a position of strength no matter what happens as the Covid19 virus takes its toll.

In late March APRA said it had no plans to force banks to suspend their dividends during the coronavirus economic crisis but admitted it was in talks with them to understand their financial capacity for payouts.

Next, APRA appeared to backflip, with chairman Wayne Byres writing to the bank boards calling for restraint in dividends, buybacks, and cash bonuses for executives. While he did not explicitly tell boards of banks and insurers to freeze their dividend payments, he did say that if they do pay a dividend, it must first be cleared by the regulator and it must be at a level that is “materially reduced.”

These are uncertain times, but I believe the worst that could happen is that dividends here may be suspended for six months, but then restored after that. And if that happens, the renewed dividend may well be bigger than expected.

I do think our banks will have a tough year ahead of them, and bad debts will be on the increase. However, I am sure they will continue paying dividends in the medium to long term. The $64 question is how big those dividends will be. There seems to be an industry consensus that a 30% reduction in dividends paid by the big four would be possible, but don’t forget the banks are currently yielding around 10% per annum fully franked. If that was cut to 7% fully franked, they would still be a great investment, especially in a climate where interest rates will be low for many years to come.

At some stage we will get through all this, and the stock market will surge.

Mayfair Platinum

For over 12 months, a group called Mayfair Platinum has been running huge ads in most of the daily newspapers advertising way above market returns. Any companies taking out big advertisements advertising breathtaking returns have always triggered warning signs. Some of you older readers may remember Estate Mortgage who were offering 18% per annum “capital guaranteed.”

When Estate Mortgage went broke, the “capital guarantee” proved to be useless.

Remember the ads from Nant Whiskey featuring sporting star Matthew Hayden and advertising 9.5% capital guaranteed? That also went belly up. In my newspaper column on 22nd December 2019, which featured my annual awards, I mentioned Mayfair as follows:

“The Nant Whiskey Award for the record number of full-page ads offering breathtaking returns goes to the Mayfair Platinum group – a newcomer on the Australian investing scene. My suspicions had been raised by the advertisements themselves, then on 6th December online newsletter Crikey published an article by Adam Schwab who reckons Platinum “raises more red flags than a North Korean military parade.”

Schwab is the author of the brilliant book Pigs in the Trough: Lessons from Australia’s Decade of Corporate Greed. Next day, a two-page article in the Financial Review pointed out that Mayfair’s own pronouncements “show it is making speculative plays on everything from an Indian accounting software firm to a Dunk Island transformation.”

As the old saying goes: “You pays your money and you takes your chances”.

Well, I do hope none of you fell for it. On 16th April 2020, the Federal Court made interim orders restraining Mayfair Wealth Partners Pty Ltd (Mayfair Platinum) and Online Investments Pty Ltd (Mayfair 101) from promoting their debenture products and prohibiting the use of specific words and phrases in their advertising. This follows an application made by ASIC for an interim injunction on 3 April 2020.

ASIC mentioned that Mayfair had suspended redemptions to investors because of “liquidity issues”.

Withdrawing Money from Super

During the COVID-19 crisis, people suffering financial hardship will be allowed to withdraw up to $20,000 from their superannuation, but keep in mind that you must satisfy various criteria that include, but are not limited to, being unemployed, or eligible to receive a job seeker payment.

Alternatively, on or after 1st January 2020, you were made redundant, or your working hours were reduced by 20% or more or, if you are a sole trader, your business was suspended or there was a reduction in your turnover of 20% or more.

This has been one of the more controversial strategies in the government’s response to the chaos caused by the pandemic. Objections mostly revolve around the fact that withdrawing a big chunk of your super – potentially many years before retirement – could have a massive effect on your retirement balance.

Analysis by Industry Super Australia (ISA) points out that withdrawing $20,000 over the next year could cost a 30-year-old $100,000 at retirement, and a 40-year-old $63,000. But that’s an oversimplification. The reality is that the accuracy of these estimates depends very much on the superannuation balance now, and the net earning rate assumed. To evaluate it for your own situation, you need to stay focused on the major factor that determines how much you retire with: the net rate of return on your funds.

Think about a person aged 30 now who is earning $50,000 a year and has $35,000 in their fund. If the fund earns just 6%, after fees and taxes, they may have $1.07 million at age 65. A withdrawal of $20,000 would reduce today’s balance to $15,000 and leave the member with $915,000 at retirement.

However, the figures change dramatically if the fund can achieve 9% per annum. If the $35,000 was left untouched there should be $2.17 million at retirement – a withdrawal of $20,000 could slash that to $1.8 million. So, withdrawing $20,000 could have a significant effect on the end benefit – though in theory, at least the member could possibly make up for the withdrawal by making sure the fund had the right mix of assets, and minimal fees.

Insurance cover may be a much bigger issue. Thanks to recent changes in the law, which were labelled “Protecting your Super,” default trauma, life, and income protection insurances are cancelled automatically if you are under 25 and failed to opt in, or if you have less than $6,000 in your fund, or if your fund has been inactive for 16 months or more. Therefore, if your fund balance slips below $6,000, due to a range of factors which could include you withdrawing money from it, insurance, or ongoing administration fees you could find yourself with no life or TPD insurance at a time when the risk of death or a crippling illness are at an all-time high.

There are still many Australians who have just never got around to amalgamating multiple superannuation funds. The opportunity to grab two chunks of $10,000 may be tempting, but they may find it necessary to first roll all their funds together to get the total balance over $20,000. And when you close a fund, you automatically lose any insurance that went with it. So before choosing which fund/s to close and which to keep, look at your insurance. Remember, it may be impossible to replace insurance you cancel, if you have health issues now.

Anybody considering early withdrawal from their superannuation should investigate all other options available before making that choice. One option that springs to mind is using the six-month “holiday” offered by some banks on mortgage payments. Yes, it does mean paying interest on interest, but this may be a far better option than losing a big chunk of your superannuation and the insurance that goes with it.

And Finally

I hope you have enjoyed the latest edition of Noel News.

I hope you have enjoyed the latest edition of Noel News.

Thanks for all your kind comments. Please continue to send feedback through; it’s always appreciated and helps us to improve the newsletter.

And don’t forget you’ll get much more regular communications from me if you follow me on twitter – @NoelWhittaker.

Noel Whittaker