“The difference between greatness and mediocrity is often how an individual views a mistake.”

NELSON BOSWELL

Welcome to our September Newsletter

It’s been another busy month and the good news is that the Reserve Bank did not increase interest rates at its monthly meeting on 5 September. I do think we’re getting near the top of the interest-rate cycle, but I can’t guarantee there will be no more rate rises. The problem is that so much inflation appears to be entrenched with big backlogs in the construction industry. Increasing rates won’t fix that.

The estate planning book is moving along but taking longer than I thought due to the vast amount of research needed. I do thank you all for the fantastic anecdotes you have sent me. I’m now working through these and I think they’ll be of immense benefit to the readers of that book. We’re still hoping for release in time for Christmas.

Geraldine and I will be leaving for Los Angeles and London in a couple of weeks. We had intended to go just to Los Angeles to visit James and his family, but the travel agent pointed out it would be cheaper for us to travel business class from Brisbane to Los Angeles then on to London, and back to Brisbane, than to fly to Los Angeles and back.

Image by Benjamin Davies Webb on Unsplash

Image by Benjamin Davies Webb on Unsplash

Given we have no accommodation costs in Los Angeles because we will be staying with James, we feel it was too good a chance to miss out on. We have already booked tickets to see the musical Guys and Dolls in London; I hear it’s fantastic.

Quarterly pension changes

The quarterly age pension adjustments come into play on 20 September, and thanks to inflation all pensioners will get an income boost. The pension rates are somewhat confusing because there are four changes a year: in July and January each year they adjust the thresholds, and in September and March they adjust the amount of pension paid. These changes can sometimes produce anomalous outcomes, and savvy pensioners should keep an eye on the changes, to see if they can tweak their situation to achieve better financial outcomes.

Go to my website, www.noelwhittaker.com.au, to download the new pension charts (on the Free Downloads page) and play with the age pension calculator and the deeming calculator, both of which have been updated with the new numbers.

Image by Centre for Ageing Better on Unsplash

Image by Centre for Ageing Better on Unsplash

The last pension changes took affect from 1 July. Because they raised the thresholds but not the amount of the pension itself, only part-pensioners got an increase in their pension. This meant the most needy pensioners – those under the asset and income thresholds – got no pension increase at all, despite record inflation. In fact, they went backwards. But part-pensioners who were just over the bottom threshold ended up with a full pension because of the threshold increase.

For example, on 1 July 2023 the level of assets at which the pension starts to reduce for a couple rose from $419,000 to $451,500. That meant that pensioners who were missing out on the full pension due to a tiny amount of excess assets ended up with the full pension because of a rise in the cut-off rate.

But when the rate of pension goes up, the upper limit threshold cut-off point automatically increases as well. So now retiree pensioner couples have cracked the million dollar mark in assets: the cut-off point for a homeowner couple has risen from $986,500 to $1,000,003.

Given the sad state of government finances, there must be some who will be thinking, “Why should people with $1 million of assets, plus most likely a luxury home, be getting welfare?”

Note how the tests intersect: Centrelink tests you on both the income test and the assets test, and then applies the one that gives you the least pension. But the tests are out of kilter, which can lead to some unusual results. For example, if you’re asset-tested, deeming is not relevant – it’s only used for the income test.

A couple with $1 million of assessable assets can earn $95,000 a year income because they’re not assessed under the income test. If those assets included $900,000 of financial assets they would be assessed as having a deemed income of just $18,246 a year, but they still have scope to earn an additional $76,754 a year.

Image by Freepik

Image by Freepik

Many pensioners deprive themselves of future income by overvaluing their personal positions. The value of your furniture should be only what you would get for it if you sold it in a garage sale on a wet Saturday morning. This puts $5000 – tops – on most people’s furniture. For assets-tested pensioners, every $10,000 reduction in assets is worth about $15 a week in extra pension. So by investing $15,000 in a funeral bond and giving $10,000 to charity or your kids, your pension could be increased by $37.50 a week. That’s a 7.8% guaranteed return on your money.

Image by gpointstudio on Freepik

Image by gpointstudio on Freepik

There are now pension-friendly products that may enable self-funded retirees to get a part pension and all the concessions to go with it. For example, a couple with $1.1 million of assessable assets could invest $300,000 in an approved lifetime income product. The term “approved” means that only 60% of its value is assessed for the assets test – it’s as if they’ve disposed of the other 40%. Their assessable assets would drop by $120,000 to $980,000 and they would qualify for a pension of $68 a fortnight plus all the concessions. They would also receive a lifetime income from the new product, which could be worth $20,000 a year, indexed, depending on their situation.

If you think these sort of strategies may benefit you, talk to a good financial adviser for more details.

Shares

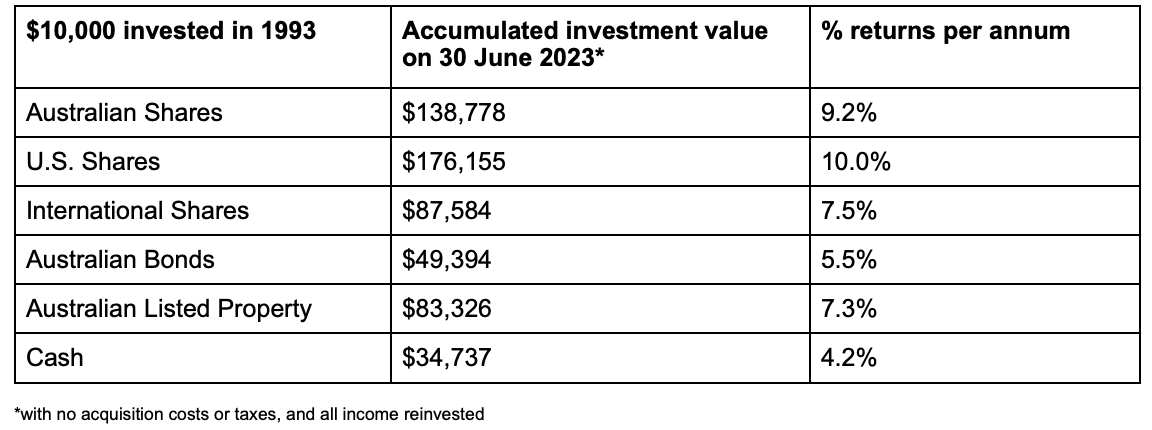

Vanguard has just released its 22nd annual Index Chart plotting the performance of major asset classes over the last 30 years, affirming that despite significant downturns, markets typically trend upwards over time.

Over the last 30 years, Australian shares on average have returned 9.2% per annum despite market events such as Russia’s invasion of Ukraine in 2022, the COVID-19 pandemic in 2020 and the Great Financial Crisis in 2007.

This financial year, Australian shares returned 14.8%, a marked improvement on the previous year when the same asset class returned -7.4%.

“Vanguard’s annual Index Chart puts into perspective the importance of approaching investing with a long-term mindset,” said Balaji Gopal, Head of Financial Adviser Services at Vanguard Australia.

Cartoon by Bob Rich on Hedgeye

Cartoon by Bob Rich on Hedgeye

“While investors shouldn’t rely on past performance, 30 years of market history has proved that the impact of geopolitical, economic and social events on performance is usually short-lived, and markets will typically recover and rise over time.

“Looking back over the last few decades, bear markets on average last only 0.9 years and are generally followed by a bull market, averaging 6.5 years. Investors who stay invested through downturns are therefore best poised to benefit when markets inevitably bounce back”.

Also illustrated in the chart is how an initial investment of $10,000 invested in broad Australian shares in 1993 would have grown to nearly $138,800 today, an average of 9.2% return per annum. The same $10,000 in U.S. shares would have grown to $176,200, returning 10% per annum.

Don’t forget you can track the Australian share market right back to 1980 using the stock market calculator on my website. You have the choice of choosing a starting and a finishing date.

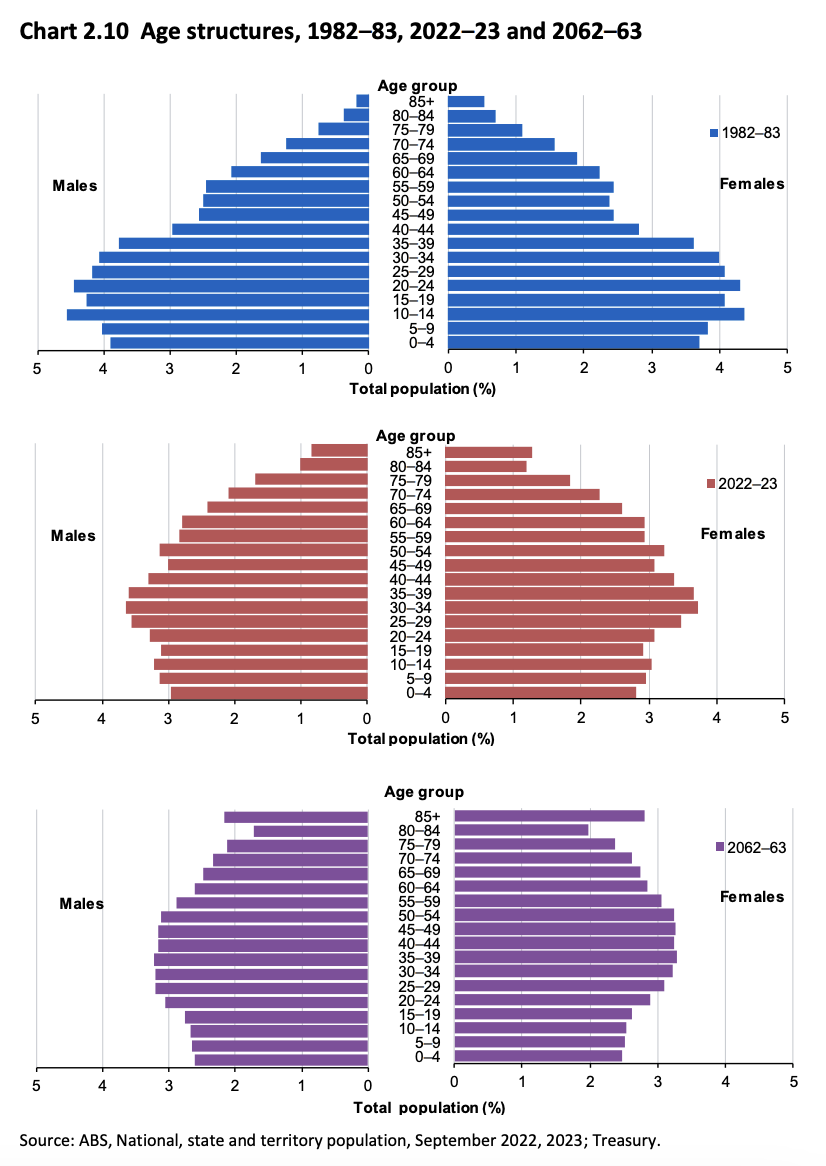

Sixth Intergenerational Report

Last week we saw the release of the sixth Intergenerational Report (IGR). These reports were introduced 21 years ago by the treasurer of the time, Peter Costello, to give governments an idea of what the future may look like in 40 years, and to put in place appropriate strategies to handle a changing country.

Unfortunately, any action that should occur as a result of the IGRs has usually been put in the too-hard basket.

When the fourth IGR was released eight years ago, I wrote:

“Last Thursday’s Intergenerational Report contains some scary statistics. Within 40 years the life expectancy of the average male will be 95.5 years, and for a female 96.6 years. The population will be almost 40 million and include more than 40,000 people aged over 100. The bad news is that there will be just 2.7 people aged between 15 and 64 — potential taxpayers — for every person aged 65 and over.

“This imbalance will get worse as the ratio of dependants to workers grows over time. Our taxation system presents grave challenges too. Currently, 61% of personal income tax is received from a mere 11% of taxpayers, leaving the bulk of taxpayers contributing very little. In addition, 87% of those aged 65 and over pay no tax whatsoever.

“A full review of our tax and welfare system is overdue, but the adversarial nature of politics does not make for optimism. Right now, the federal government reminds me of a dysfunctional family. Dad and Mum (the two major parties) spend all their time abusing each other and promising the world to their children (us, their constituents) while well-meaning but inexperienced relations (the minor parties) add to the turmoil by telling the kids that their parents don’t know what they are talking about.”

Does that sound familiar?

Taken from Intergenerational Report 2023

Taken from Intergenerational Report 2023

The latest IGR points out that the share of the taxation burden will increasingly fall on ordinary workers. Yes, they will get some tax relief provided the legislated text cuts happen on 1 July next year, but already the Greens are claiming the tax cuts are far too generous and should not happen. Given the emphasis in the IGR on the burden that will be faced by future workers unless the tax brackets are adjusted, it would be a brave government who reversed the legislation and decided not to bring those tax cuts in. The proposal is that for taxable incomes from $45,001 to $200,000 there will be a flat tax of 30%. These cuts are long overdue and go a long way to aligning the personal tax rate with the company tax rate.

One way to reduce the burden of an ageing population is to encourage people to stay in the workforce much longer than they do now. But despite much lobbying from National Seniors, no government has done much to encourage pensioners to work.

In recent articles I mentioned that one way to get everybody paying their fair share of tax would be to raise the GST. I notice the Teals and Senator David Pocock are now pushing for just that, but Labor has always been opposed to a GST, so there may not be much chance of it happening. But remember the outcry when John Howard introduced a GST – then the main tax brackets were 34% from $20,700 to $38,000 a year and 43% for incomes between $38,000 and $50,000 a year. Imagine where we would be now if the GST had never happened, and the tax brackets were not adjusted.

Retirement Village Contracts

By Rachel Lane

If you’re thinking about moving into a retirement village it is crucial that you understand your contract. The recent 2023 Retirement Living Census shines a light on how retirement village contracts are changing. The census shows a significant swing towards contracts that base the exit fee on the purchase price and don’t share capital gain with the resident. Almost three quarters (73%) of the industry is now using this form of contract, up from around half (55%) of contracts in the previous year and more than triple what it was in 2017 (20%). This change is likely to be a result of residents preferring certainty and recent legislative changes.

Image by karlyukav on Freepik

Image by karlyukav on Freepik

In most states, retirement villages are now required to provide a guaranteed buyback to residents if their home in the village has not sold within a certain period. The timeframe varies across the states and does not apply to all contracts. For example, in New South Wales the buybacks are 12 months in regional areas and 6 months in metropolitan but do not apply to strata, company title or community title contracts.

While a move away from contracts that share capital gain with residents may appear to be a huge disadvantage, it’s important to understand the distinct differences between retirement villages and the broader property market. The average price of a two-bedroom unit went from $32,000 to $516,000, an increase of 6% for the year. If we look at the longer-term numbers the price increased from $398,000 in 2016, with no negative years, so retirement village properties are averaging a gain of around 4% p.a.

Retirement village contracts that give you some or all of the capital gain normally require you to meet some or all of the costs associated with achieving it. Such costs typically include renovation costs, marketing expenses and selling fees. The biggest of these is normally renovation costs. The census showed that half (49%) of renovations for retirement village units more than 15 years old cost at least $40,000 with 6% exceeding $80,000.

Interestingly, the reason why residents left a village changed significantly over the 12 months. In the previous census, the most common reason for leaving a village was to enter aged care (44%). In this census, entering aged care and moving to another village were the most common reasons for leaving (31% and 30% respectively). The increase in residents moving to another village was the highest ever recorded and a staggering 600% greater than the previous year (5%). The removal of the costs and uncertainty inherent in contracts that share capital gain has seen a number of village operators give residents the option to move between villages without restarting their exit fee calculation. This flexibility enables residents to move between villages within the same organisation to be closer to family or to change their accommodation as their circumstances change.

While not captured by the census, the move to contracts without capital gain has also enabled greater flexibility around how and when residents pay their management fee. Many of the new contracts offer residents the choice of paying their management fee upfront (for a discount) when they leave or in some cases paying a higher purchase price and not paying a management fee at all. Such payment options give residents the ability to pay in a way that suits them; it also creates transparency around the true price.

What you are losing on the merry-go-round of capital gain can be more than offset by what you pick up on the swings of certainty and flexibility. Ultimately your retirement village contract is a balance of rights, responsibilities and costs; you need to look at it through those three lenses and make sure it works for you. A village guru can take the headache out of crunching all the numbers by showing you the village costs upfront, while you live and when you leave combines with an estimate of your age pension and rent assistance entitlements and home care package costs. It can show up to 3 options side by side, enabling you to easily compare different homes, villages or payment options.

Never Let Age Stop You

If you’re after an interesting podcast to listen to, or simply in need of some motivation, my son James just released a podcast with skydiving cinematographer Norman Kent who has spent a lifetime breaking world records.

Don’t miss the intro to the podcast episode – a world record in itself and must surely be one of the most unique things ever seen in podcasting. It involved 100 skydivers, all aged 60+ years old, jumping out of a plane together. It’s an extraordinary piece of filmmaking.

Before you ask, no, I do not intend to go skydiving anytime soon!!! However, I do feel that it’s an exceptionally powerful reminder that age should never restrict our belief in what we’re capable of.

The full episode is fantastic. Norman shares a lot of lessons on the relationship we should have with fear, what to do when it all goes wrong, and even anecdotes on how actor Tom Cruise is able to master skills in the fastest possible time so he can do all his own stunts that we see on the big screen.

You can watch the full episode here: https://youtu.be/rbuL2ZfOE54

And finally

Question: If you could live forever, would you and why?

Answer: “I would not live forever, because we should not live forever, because if we were supposed to live forever, then we would live forever, but we cannot live forever, which is why I would not live forever,”

– Miss Alabama in the 1994 Miss USA contest.

“Whenever I watch TV and see those poor starving kids all over the world, I can’t help but cry. I mean I’d love to be skinny like that, but not with all those flies and death and stuff.”

– Mariah Carey

“Smoking kills. If you’re killed, you’ve lost a very important part of your life,”

– Brooke Shields, during an interview to become spokesperson for federal anti-smoking campaign

“I’ve never had major knee surgery on any other part of my body,”

– Winston Bennett, University of Kentucky basketball forward.

“Outside of the killings, Washington has one of the lowest crime rates in the country,”

– Mayor Marion Barry, Washington , DC .

Image by Mona Eendra on Unsplash

Image by Mona Eendra on Unsplash

“That lowdown scoundrel deserves to be kicked to death by a jackass, and I’m just the one to do it,”

– A congressional candidate in Texas …

“Half this game is ninety percent mental.”

– Yankee HOFer Yogi Berra

“It isn’t pollution that’s harming the environment. It’s the impurities in our air and water that are doing it..”

– Al Gore, Vice President

“I love California. I practically grew up in Phoenix …”

– Dan Quayle

“We’ve got to pause and ask ourselves: How much clean air do we need?”

– Lee Iacocca

“The word “genius” isn’t applicable in football. A genius is a guy like Norman Einstein.”

– Joe Theisman, NFL football quarterback & sports analyst.

“We don’t necessarily discriminate. We simply exclude certain types of people.”

– Colonel Gerald Wellman, ROTC Instructor.

“Your food stamps will be stopped effective March 1992 because we received notice that you passed away. May God bless you.. You may reapply if there is a change in your circumstances.”

– Department of Social Services, Greenville , South Carolina

“Traditionally, most of Australia’s imports come from overseas.”

– Keppel Enderbery

“If somebody has a bad heart, they can plug this jack in at night as they go to bed and it will monitor their heart throughout the night. And the next morning, when they wake up dead, there’ll be a record.”

– Mark S. Fowler, FCC Chairman

I hope you have enjoyed the latest edition of Noel News.

I hope you have enjoyed the latest edition of Noel News.

Thanks for all your kind comments. Please continue to send feedback through; it’s always appreciated and helps us to improve the newsletter.

And don’t forget you’ll get more regular communications from me if you follow me on X – @NoelWhittaker.

Noel Whittaker