Noel News 13 Dec 2021

Life can only be understood backwards,

but it must be lived forwards.

SOREN KIERKEGAARD

Welcome to our last newsletter of 2021

It has certainly been an interesting year. If you cast your mind back to March 2020 the stock market was in freefall, and most people were predicting major permanent job losses. Since then, the market has boomed and one of the biggest problems the world has are shortages.

Until recently I had never heard of AdBlue which is a diesel exhaust fluid. It’s made from urea which has become scarce, and once it runs out it will cripple a large portion of the Australian truck fleet. One of my golfing mates has a Mercedes sedan and, because of emissions control, has to add AdBlue to his diesel fuel through a separate tank in the car. He says that the car will not start if he cannot get the additive

In last Thursday’s Australian Robert Gottliebsen wrote “the software-control apparatus inserted into the trucks is built in such a way that is almost impossible to drive the truck without using the AdBlue system. But it is not difficult to adjust trucks so they can run without the system, but of course there will be a lot more pollutant which will understandably cause community outrage. However, once severe food shortages and price rises develop that outrage is likely to swing towards the food situation”. All I can say is watch this space.

Many countries are reporting serious staff shortages. This will be rectified here somewhat when borders open properly, and people from overseas will be able to come to Australia without onerous quarantine restrictions but I’m now receiving reports from restaurant owners that many staff are refusing to get vaccinated which has become a condition of employment. The big question will be how they earn an income. With critical job shortages making front-page headlines every day, I wonder how they will go at Centrelink if they apply for the dole.

But there are two things that trouble me. The first is the rise in buy now pay later. Credit cards are going out of favour, but a huge number of BNPL organisations are taking their place.

A basic principle of becoming financially secure is to spend less than you earn, and save something out of every pay. Anybody who uses buy now pay later to fund their purchases, is mortgaging their future. If you can’t live on your present income, how will you possibly survive if future incomes are reduced because of loan repayments. These buy now pay later schemes might sound great but there are heavy penalties if you get behind. Once you get trapped in debt, it’s very hard to get out of it.

The other issue is the increasing numbers of people gambling with crypto currencies. Crypto appeals to many people because it is anonymous and therefore, at least in theory, safe from the watchful eyes of the tax office. However, last week the government announced plans to regulate the crypto industry but given the slow pace the governments work I wouldn’t be holding my breath.

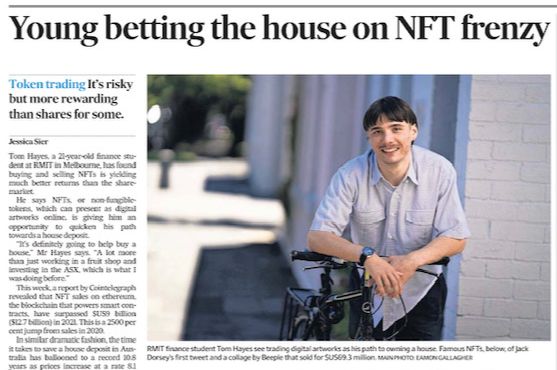

Crypto currency itself is a growing field which will develop as time passes. But what concerns me greatly is the growing percentage of Australians, especially younger ones, who are trading crypto. The Australian Financial Review of 4 December had a huge article headed “young betting the house on NFT frenzy” with a story about people who were trading crypto as a way to get a house deposit.

They need to understand that trading is high risk. The problem is that there are no objective ways to guide you in buying or selling. If I buy a property I can look at its location, price and potential, if I buy shares I can look at the financials, management and level of debt. When trading crypto the sole criterion is whether someone else will buy at a higher price than I paid from it.

Another issue for cryptocurrencies is there is no consumer protection available. If you lose your Bitcoin password, you have lost your Bitcoin – there is no head office you can ring to recover your password. If you sign up with a dud website and lose all your money, the government won’t come to your aid. Buying Bitcoin is caveat emptor: there’s no protection, or safety net, or recourse.

And the reports are growing about the number of scams in the crypto space. I get emails every day offering to teach me how to trade Bitcoin and make a fortune. But if these people are successfully trading Bitcoin and making a fortune, why would they be cold calling you and me?

Buying cryptocurrencies is a gamble. You should never “invest” money that you aren’t prepared to lose in them; and you should run a mile from anybody who offers to trade on your behalf, or teach you “the secret”.

But if you are still determined to go ahead, your first port of call should be the ASIC Money Smart website, where a search on “cryptocurrency” will provide you with loads of information, as well as an analysis of the types of cryptocurrencies that are available. There are also details of all the crypto scams that are growing in number.

The Power of Time

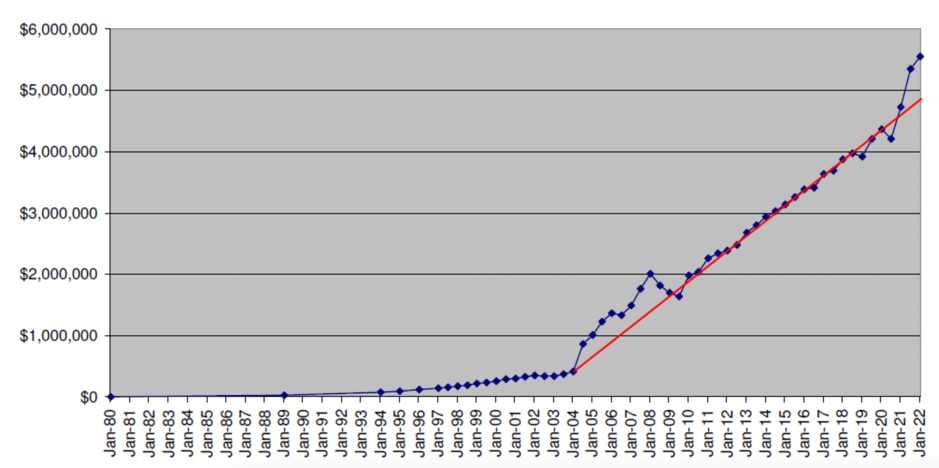

I get a lot of emails telling me how really my book has changed their lives, one that arrived last week was extremely special because even included a graph of the progress made over a lifetime of work. Above all it shows the power of compounding mixed with time.

Here is the email.

“Just a note of thanks. Many years ago, back in the late 80’s, read Making Money Made Simple. As best I could, tried to put your guidance into practice. A mortgage and very high interest rates made it difficult to save money to invest. I did push money into superannuation along the way, and it has served me well. Over 30 years later, I turn 60 at the end of the year, and retirement is knocking on the door. Luckily, there should be enough money to enjoy my retirement years. I did take to recording net wealth, refer attached chart.

It shows what can be done, even without a university education. Interestingly, my net worth after 10 years in the workforce compared to what I had after 40 years was 1%. And the net worth after 20 years in the work force compared to what I had after 40 years was 6%. Money makes money I guess.

So keep up the good work of educating people out there. There are a few young people I’d like to help, if they will listen. And the recommendations will be to start by reading your book. And for them to live not just within their means, but well within their means, save and invest the balance. And keep repeating.

Thanks again”

Electric Vehicles

I’m going to devote a fair bit of space in this newsletter to electric vehicles. The world is moving very quickly to replace internal combustion engine (ICE) vehicles with environmentally friendly electric vehicles (EVs). But as always, the devil is in the detail.

A major problem is generating the electricity to power EVs on our roads in the next few years. EVs are only zero emission if they are made and powered with electricity from renewables, but that’s a long way off. In the meantime, coal-fired stations will continue to do the heavy lifting. At least EVs are more efficient than ICE vehicles.

An issue that appears to have been overlooked is how EV charging points will be supplied to people living in apartment complexes. Chargers would have to be in the building’s car park; will special meters need to be installed to record the extra power use? And when EVs are the norm, will the entire building’s electricity supply have to be upgraded to cope with the EV charging needs of its residents? If so, who will pay the cost? Imagine the headaches for residents of an older building with hundreds of apartments!

There is a huge potential effect on apartment valuations. Almost certainly, apartment buyers will be looking for EV facilities already in the building – if the building has no such facilities now, will sellers find themselves forced to discount the price in expectation of future costs to bring the building up to speed? Worse still, what if the building is not able to be converted to cater for electric vehicles?

My own EV experience

As electric cars are the way the future I thought it may be useful to you all if I related my own journey with them. Just keep in mind I am not a car expert, but I have no axe to grind as nobody is paying me, so what follows is simply what I have experienced.

We have been Lexus owners for many years and they have served us well. But in 2019 I was having a chat to a friend who was raving about his Tesla. We ended up having a drive in it and I was hooked on its comfort, speed, and smoothness.

It is well accepted that human beings make decisions on emotion and try to justify with logic later. My logic was that I was approaching 80 years of age, and a self-driving car must be a much better proposition than doing it all myself as the years passed. So, I traded in my beloved Lexus SUV for a Tesla model X. That’s their big SUV and we chose that because we have 11 grandchildren in Brisbane and thought it would be useful to take them around.

The much hyped self driving did not live up to expectations and I doubt that truly self-driving cars will be available in my lifetime. For starters, the Tesla needs roads with white lines to guide it, which rules out most suburban streets and it really has trouble with traffic lights and roundabouts. I noticed there has also been a subtle change in terminology – what was once auto drive has now become auto steer.

The good news is that it’s a delight to drive, is extremely comfortable, and is brilliant on freeways, and tunnels. It’s also great in the rain. Last week I had a speech at the Gold Coast and was driving home at 4 PM in rain so heavy it was almost impossible to see. I just put the car on auto steer and it did all the work. It turned out there was a major incident up further and the car quickly diverted me to another freeway so I still made it home on time. It’s also very cheap to refuel but as my father always taught me – the cheapest part of the car is the petrol.

Two and a half years later I am still enjoying the car but next year we will be changing our vehicles. The Tesla X is way too big for us, and it’s almost impossible to drive it into a shopping centre car park because the way they design the ramps, scratching the wheel rims is almost a certainty. And we never seem to have more than four grandchildren at once so the extra space is not needed.

The major problem is range. Currently, there are about 3000 public charging points in Australia, but not all EV chargers are equal. The one I have in my garage at home, which cost about $1500 and requires three-phase power, has a charge rate of around 100 km an hour. Public charging stations vary — the best I have encountered will charge at about 200 km an hour: if your vehicle has a top range of 400 km, that’s a wait of at least two hours to continue your trip. And that assumes you can find a fast charger on your preferred route, and there are spaces available for you to use right away.

So as much as we love the Tesla we have decided we need an SUV with a decent range. We keep talking about all the country trips we would like to make, but the practicalities make an electric vehicle an impossibility until their range improves and charging stations replace service stations. We have decided to replace Geraldine’s Lexus sedan with a new Lexus NX hybrid which has a range of at least 900 km and can be refuelled quickly at any service station. This will enable us to do all the country trips that have been denied to us for the last two years. I love Teslas so will be buying the new Y when is arrives next year. It’s a much smaller SUV with a range of 550 kms.

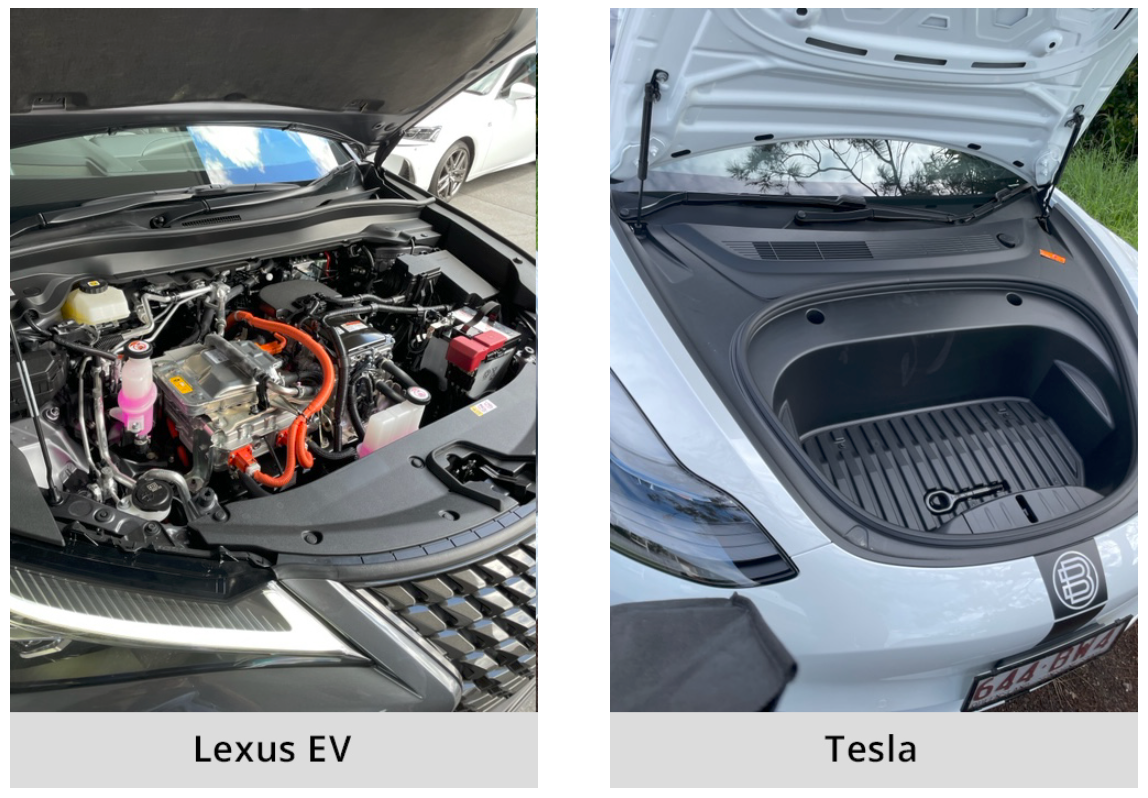

If you are considering changing to an EV hasten slowly. Right now, they are far too expensive, and prices must fall as years pass. And from my limited research of other electric vehicles Tesla appears to be way in the lead. My X is simply a flat base with four wheels and a large boot front and back. The motors are somewhere near the wheels.

In the last week, I have inspected the new Lexus EV, Mazda EV and Hyundai EV. I was gobsmacked to discover that each one has an engine under the bonnet. Apparently, they have just taken a normal ICE vehicle and replaced the petrol or diesel engine with an electric engine. Nothing else has been changed. So you still have a transmission hump and all the other bits that go with an ordinary vehicle.

They are light years behind the Tesla technology. The new Tesla Y is coming off plants in Texas, Shanghai, and Berlin right now and is forecast to be the biggest selling car of 2022. Kia intend to launch the EV6 pop sometime next year and they claim the battery will allow it to be charged at 350 kW an hour which means it can go from 10% to 80% in just 18 minutes. That’s fantastic – the only problem is finding a charger that can deliver power at that speed. It will also have a range of 510 km if you pay the money for the large battery.

Two things we know for sure. Prices will drop, range will increase and possibly the other manufacturers will catch up the Tesla as far as the technology goes. My advice is don’t rush in.

This month’s edition of Wheels has a huge section on electric vehicles. The more research you can do the better outcome you will have.

Podcast

A fortnight ago I did a podcast for Your Life Choices with John Deeks which covered reflections on the year to date and predictions for next year. It was released on the weekend and I thought it would be great to include in this newsletter. It’s only 16 minutes but I think you’ll enjoy it. It covers much of the stuff which is in this newsletter.

Listen to the podcast here:

Or here:

Christmas Books

As we think about stocking up for Christmas keep in mind that a book is one of the best gifts you can give. It’s an inexpensive present, and if chosen wisely can give benefit to the recipient for many years to come. Here are two of my favourites:

Money: The True Story of a Made-Up Thing by Jacob Goldstein is a fascinating read. The author guides us through the history of money from the time of Aristotle, through the barter system, to the invention of various sorts of paper money.

Money: The True Story of a Made-Up Thing by Jacob Goldstein is a fascinating read. The author guides us through the history of money from the time of Aristotle, through the barter system, to the invention of various sorts of paper money.

Did you know there was a time in America when many banks printed their own currency? Many put out Christmas bank notes adorned with pictures of Santa Claus! Naturally, money’s history is interspersed with tales of financial crises, and how they were handled.

The book also covers the creation and abolition of the gold standard, and finishes with a detailed description of the start of cryptocurrencies and where they may be heading. It’s the perfect present for anybody interested in the financial system.

Morgan Housel’s Psychology of Money is described as “timeless lessons on wealth, greed, and happiness.” Its 19 chapters each contain a major lesson.

I particularly like the way Housel stresses the importance of compounding on your long-term financial plan. He writes: “compounding works best when you can give a plan years or decades to grow. This is true for not only savings but careers and relationships. Endurance is key. And when you consider our tendency to change who we are over time, balance at every point in your life becomes a strategy to avoid future regret and encourage endurance.”

I really loved this book, and enjoyed the fact that I got a double benefit: it reinforced many of the things I’ve learnt over my own life, and opened my eyes to other issues I have not considered. Highly recommended for just about anyone.

As I said in my last newsletter I have now got the facilities to do special orders. Just…

- …go to my website and choose exactly what you want.

- Do not process or pay for the order.

- Email me at noel@noelwhittaker.com.au telling me exactly what book or books you want, where you would like the books sent to, and how you would like them to be autographed.

- I will then send you an invoice, you can bank the money in our bank account.

- I will prepare and post the books from my home.

Just keep in mind that shipping costs are high, and we do offer free postage on orders over $35 within Australia. However, I can’t give you free postage if you want books sent to multiple addresses.

The main books I would see as Christmas gifts are:

…which is the perfect book for people who need to learn about money.

…which really is about success principles and how to live a successful life.

…which is designed for anyone contemplating retirement.

For bundles;

Making Money Made Simple and Beginners Guide To Wealth are the perfect fit.

I must say it gives me a real feeling of satisfaction action to autograph a book to somebody – I know the fantastic long-term benefits it may bring.

And finally…

As we count down to Christmas, it’s time to have some fun and recognise those who have made unique contributions to the world of money in 2021.

Let’s start with Bitcoin. I gave it the Golden Tulip Award in 2017 for the fastest growing “asset class” when it rose 1671% in just one year. Then in 2018 it scored the Shrinking Tulip Award when it plunged from US$19,650 to just US$3225. Today I’m giving it the Phoenix Award because it rose 163% for the year to US$48,807. This does include a fall of 25% in the last month. As I’ve often said: you pay your money and you take your chances.

The Ebenezer Scrooge Award for the most heartless assault on the vulnerable in our society goes to Beforepay – an organisation which lets you “Get access to your wages instantly. It’s quick and easy to use and there’s no hidden fees.” I first heard about them on the ABC television program Gruen. It showed one of their advertisements, showing how a person with little food in the fridge could replenish their supplies very quickly by putting it on Beforepay. Another ad showed a couple dining out in an expensive restaurant with the guy opting for something cheap because he was broke; Beforepay showed him how to order lobster immediately to impress his date. Their website says, “There’s no interest or hidden fees. Just a 5% fixed transaction fee and flexible repayments with instalments across up to four pay cycles.” I reckon that’s an interest rate of around 36%. Old Scrooge would be jealous.

The Shih Tzu Trophy for the most hackneyed excuse of the year goes to con woman Melissa Caddick, who bought herself a diamond ring with the $1.15 million her parents had given her to buy them a house. One investor handed Caddick a cheque for $450,000 made out to ComSec but, to cover up the fact she had lied about having a ComSec account, Caddick said that somehow her dog had got hold of the cheque and eaten it. Caddick, along with a big chunk of the investors’ money, disappeared in November 2020 after a raid on her home. Ruff justice!

And finally, for the sixth year running, the Red Kelpie Award (for long-term, loyal and meritorious conduct) goes to … the Australian Stock Market. The kelpie normally gives us an exciting year but despite all the gloomy headlines it was steady as she goes and upwards all the way. The index stood at 6851 on 1 January and at 7300 on the date of writing. That’s a total return for the year of 15%, made up of 11% capital growth and 4% income. Okay, it hasn’t given us the excitement of Bitcoin, but I’d rather have my long-term future in the index. Most people don’t know that it has been the best performing index in the world over the last 120 years. That’s one hell of a track record.

I hope you have enjoyed the latest edition of Noel News and wish you and your family a Merry Christmas and prosperous New Year.

I hope you have enjoyed the latest edition of Noel News and wish you and your family a Merry Christmas and prosperous New Year.

Thanks for all your kind comments. Please continue to send feedback through; it’s always appreciated and helps us to improve the newsletter.

And don’t forget you’ll get much more regular communications from me if you follow me on twitter – @NoelWhittaker.

Noel Whittaker