Noel News 11 Oct

“You are in the right place at the perfect time. Keep enjoying the pursuit of your potential.”

DAVID MELTZER

Welcome to our October newsletter

We are now entering the last quarter of this year and I predict it is going to be a challenging one. We are in a unique situation right now with four states virtually Covid free, New South Wales attempting to move back to normality whatever that means, and Victoria coping with an ever-increasing number of cases. New South Wales and Victoria have accepted that it’s impossible to have a zero Covid environment and they are now focused on how to handle that. The other four states are reluctant to open their borders for fear of being overwhelmed by cases brought in from overseas travellers. Remember, it just took one limo driver to infect over 1000 people in New South Wales.

Everybody agrees that we cannot stay in lockdown forever but coming out of lockdown and opening up the economy requires us to accept that there will be deaths from Covid just as there used to be deaths from flu every year. I reckon the big test will come in the next few weeks as we watch how New South Wales handles the responsibility of being the first state to attempt to find a way out of this. Watch this space.

Housing markets are under extreme pressure as the top of the boom seems to be over, and the government is putting pressure on lenders to reduce the amount that can be lent. Blind Freddy can see the main problem with the housing market is the amount of government stimulus that has been provided in the last few years.

Not only did they slash interest rates to the lowest in history, they also took another range of initiatives to make it easier to buy that first home. All that stimulation increased the number of buyers, and the obvious result was that house prices started rising quickly. Once property prices start rising, the media start talking about a property boom and everybody jumps on the bandwagon for fear of missing out.

It’s not that long ago that the government introduced a scheme which would allow a limited number of first home buyers to buy a home without mortgage insurance – they were also also encouraging lenders to accept a lower deposit. On top is that is the scheme which has recently been expanded allowing people to make temporary contributions to super so they can save a deposit quicker.

And of course the politicians jumped on the bandwagon. In a recent newsletter I wrote that the prize for the most ill-conceived idea of the year must go to Liberal MP Tim Wilson for very publicly campaigning for first home buyers to be allowed to access part of their superannuation for a house deposit.

As my good friend Ashley Owen pointed out in last week’s Firstlinks:

“The 30-year boom in house prices rising well ahead of income growth is nearing an end. House prices can continue to keep on rising at rates above incomes only if interest rates continue to decline further. Interest rates have not only ended their 30-year decline, they are now more likely to rise than fall from here. The only question is when – and it will be soon.”

Remember we all have short memories. This is an extract from the Australian less than three years ago!

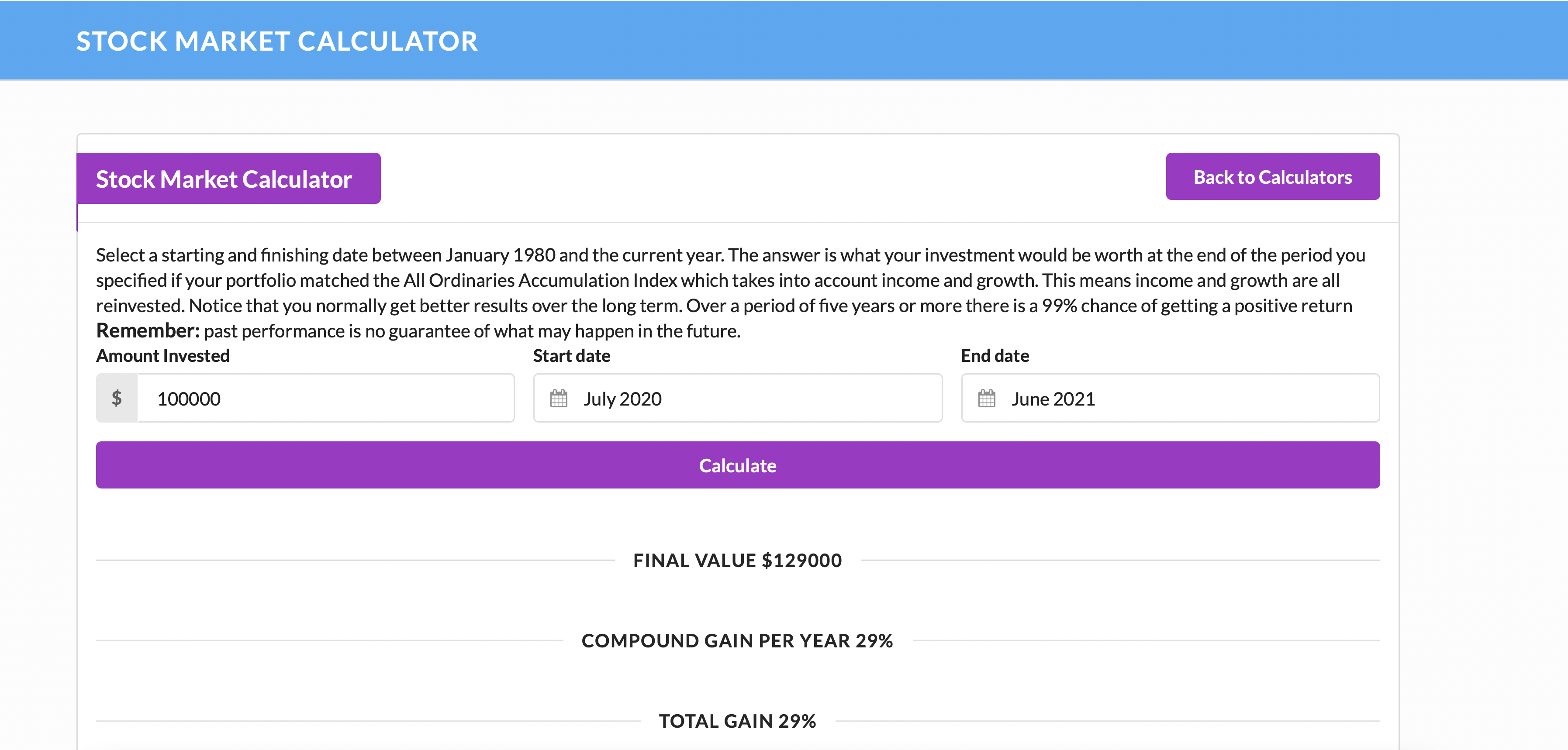

The share market has had a wobbly quarter. A great resource is my Stock Market Calculator which enables you to pick any starting and finishing date, choose a notional sum, and work out what you would have if your portfolio tracked the All Ordinaries Accumulation Index which includes both income and growth.

Let’s suppose you invested $100,000 on 1 July 2020. The calculator tells us that your portfolio would have grown to $129,000, an increase of 29% for those 12 months. Unfortunately, the last three months have not been as kind to us but remember share ownership is a long-term game and the price you pay for liquidity is volatility. Hang in there.

The power of deferring retirement

According to a recent report by Terry Rawnsley of KPMG, many older workers are deferring retirement. As result, over the last 20 years, the expected retirement age in Australia has risen to 65.2 for men and 64.3 for women. KPMG’s report attributes this to a range of factors, including strong labour market conditions, which help to retain older workers in jobs, changing social attitudes towards older workers, and an increasing trend towards part-time work among older workers.

COVID-19 has played a part too. With overseas travel virtually impossible for over 18 months, many older workers think they are better served by working longer than sitting at home with nowhere to go. Some need to top up cash reserves, because their income has been reduced by COVID-19. Others – a large percentage of the office workforce – are now happily working from home; while it has its challenges, many people find it beats both the office environment and the grind of commuting every day to and from an office.

But there’s more to it than any of these reasons. Pensionable age – that’s the age that you can access the pension – is increasing to 67 for people born after 1 January 1957, so anybody who wants to retire before their pensionable age needs to ensure they have enough capital to live on until they are eligible for a pension.

And there’s an even bigger factor. Because of the way the mathematics works, the largest increase in any long-term compounding investment, including your superannuation fund, comes at the end of the period. Remember, every time your portfolio doubles in size, there is more growth in the final double than the sum of all the other doubles combined.

The numbers are mind-blowing. Think about a person aged 60, earning $100,000 a year, with $500,000 in super. If their fund earns 8% per annum, the balance would be $800,000 in another five years. That’s an increase of 60% in your superannuation just by working another five years.

The financial side is important, and obviously the longer you can defer your retirement the more your superannuation should grow, and the longer it will last. It is highly recommended to do some sort of work after you retire. Ideally, it could be some kind of part-time work that will add meaning to your life, as well as boosting your superannuation, or it could be voluntary work, or even working on a hobby. It’s not all about the money.

But the pension rules are geared to encourage us to work a little: the first $150 a week you earn from a business or personal employment is exempt from Centrelink’s income test. Let’s look at a couple of pensionable age, who have assessable assets of $405,000 made up of $380,000 in super, and the balance in car and personal effects. If they draw down the standard minimum of 5% a year from their superannuation, that gives them income of $19,000 a year. If they also each earn $7,800pa from paid work, they would be eligible to receive the full pension of $37,923 a year. That means a total tax-free income of $72,523 a year.

But the big picture is that one of the biggest decisions you will make in your life is when you retire. There is a wealth of research telling us that those who prepare and plan for retirement tend to have a much happier, healthier retirement than those who suddenly find themselves out of work with no plans. Ideally, retirement should not be something which is thrust upon you, but something you move into gradually. And remember, the longer you can delay starting to draw on your superannuation, the more it will grow.

Crypto

Crypto is becoming a big deal at the moment. Finder.com’s latest research shows that 17% of Australians now own crypto, up from 5% just three years ago. Interestingly, the main investors are young people of all sexes, and women.

Of course Bitcoin is the most well-known crypto, and some people claim it will become a new world currency. Even august institutions such as Forbes are now forecasting that one Bitcoin will reach a value of US $100,000 by the end of 2021. It’s anybody’s guess, but one thing is certain: there is a major impediment to Bitcoin becoming a new global currency, and that is volatility. At date of writing, one Bitcoin was worth US $56,650 – that’s an increase of 393% over the last year, but a fall of almost 6% over the last six months.

An essential element of any currency is stability. If I receive $4,000 in my pay packet today, I would expect that over the next six months what that would buy would be fairly stable. I would not expect a 6% fall in my purchasing power in just six months.

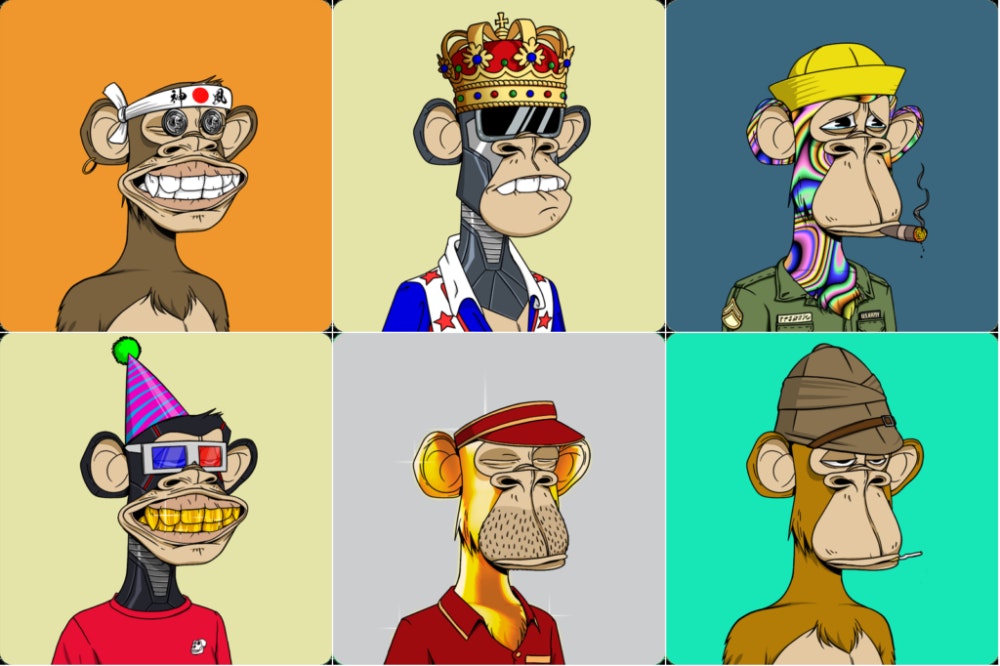

But Bitcoin is just the tip of the iceberg. My son James, who is based in in Los Angeles, tells me the hottest crypto play right now is non-fungible tokens, or NFT’s. He said, “Can you believe, I went out with a friend the other night and he paid $50 for a digital monkey? And he sold it two weeks later for $20,000!”

NFT’s are goods or assets that aren’t interchangeable: it’s creating or having something that you can’t replace with something else. Fungibles are things, like Bitcoin, that you can interchange – one for another. Non-fungible tokens are units of data stored on a blockchain and certified as a unique digital asset and, accordingly, non-interchangeable. You can look at them as a digital equivalent of private collectables, where each piece has a different value.

Obviously, they’re hot property in these days of celebrity worship. What could be better than getting a guaranteed limited edition of Kim Kardashian’s latest fashion release? Or a signed, numbered, limited-edition photo of a celebrity in their home?

And they have taken off in a range of areas. You can now buy digital artworks, limited editions of clothing and fashion brands, unique sporting memorabilia … even the National Basketball Association has launched its own collection of NFT cards. Expect other codes to follow suit; the possibilities are endless.

James tells me the big favourite is NFT horse racing. The National Association for Stock Car Auto Racing (NASCAR) has partnered with Virtually Human Studio (VHS) to create virtual racehorses that compete against each other on a virtual racecourse. Races take place 24 hours a day and anyone can join in by buying a digital horse to breed or race, or by simply having a bet. You can start with a little as two dollars, or pay $125,000 or more for an NFT racehorse, if you are so inclined. The promoters claim that each racehorse is unique because it lives in an algorithm — no two horses are the same.

I just can’t get my head around it. Are people really prepared to pay big money for digitally created horses that have been designed by artificial intelligence? Won’t it just become a case of, “my AI is bigger than yours”? Maybe I’m old-fashioned, but it just sounds like gambling to me.

If you google NFT horseracing, you’ll find enough information to keep you occupied all weekend. But at the end of the day, anybody in the crypto space is only buying Bitcoin or an NFT in the hope that somebody else will buy it for a higher price. It reminds me of the wonderful old story about a box of strawberries that kept changing hands at ever-increasing prices. Finally, a buyer opened the box and exclaimed, “These strawberries are rotten!” The seller responded, “But these strawberries were never meant to be eaten – they were meant to be sold.”

Health Matters

Science shows us that being physically active helps us feel better, and prevents or slows many diseases, including heart disease, cancer, and dementia. It even helps us live longer. For these reasons, the US physical activity guidelines and the American Heart Association recommend at least 150 minutes of moderate physical activity weekly. Now, a study in the British Journal of Sports Medicine suggests that routine activity may help protect people who get COVID-19 from becoming seriously ill.

What the researchers learned in this initial study was pretty remarkable, though further research to support the findings is necessary. Even after correcting for all of those characteristics, people who were consistently inactive had a significantly higher risk of hospitalization, ICU admission, and death after getting COVID-19 than those who were active for at least 150 minutes per week. Additionally, those who were active for over 10 minutes per week had some protection against severe illness or death from COVID-19 — though not as much as those who got the full 150 minutes. It’s worth noting that people who were white were somewhat more likely to meet physical activity guidelines — a discrepancy that should be acknowledged and addressed.

This study is one more reason to encourage and promote physical activity for everyone. Companies could provide gyms or fitness memberships, standing desks, and movement breaks. Government funding for bike lanes, walking paths, and pedestrian access would make it easier and safer to exercise. But set your own priorities, too: we can all commit to moving more! And next time you see your healthcare team, spend a few minutes talking about what might get you moving more. Would an exercise prescription help? Is there coaching available to help you set activity goals and achieve them? Does exercise hurt, or are you not sure how to get started?

Consistent physical activity helps protect you if you do get COVID-19. Of course, getting vaccinated offers much greater protection. Possibly doing both may be super-protective, although this needs to be studied. Meanwhile, we know that moving our bodies every day, even if it’s just walking, provides many benefits from head to toe. We as a society need to make it easy and safe for everyone to be as active as they can be.

The Power of a Book

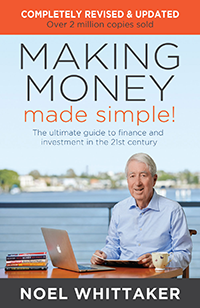

I think it’s important to keep in mind the huge effect you can have on people’s lives by introducing them to good books. The following email I received recently is a good example:

37 years ago I worked in Ballarat and one of my co-workers said they had heard you speaking the previous night. I don’t know if it was on the radio or if you were actually in Ballarat but my co-worker was hugely impressed with what you had said about your new book ‘Making Money Made Simple’. I was really interested and bought the book either that night or in the next few days. It changed my life, I understood for the first time how money worked and how easy it was to invest and budget.

37 years ago I worked in Ballarat and one of my co-workers said they had heard you speaking the previous night. I don’t know if it was on the radio or if you were actually in Ballarat but my co-worker was hugely impressed with what you had said about your new book ‘Making Money Made Simple’. I was really interested and bought the book either that night or in the next few days. It changed my life, I understood for the first time how money worked and how easy it was to invest and budget.

I’m long retired now but the reason I am ‘comfortably’ retired is because of your book. I’ve always kept it and still have it now so this is a 37 year belated ‘thank you’.

And finally…

While walking down the street one day a “Member of Parliament” is tragically hit by a truck and dies.

His soul arrives in heaven and is met by St. Peter at the entrance.

‘Welcome to heaven,’ says St. Peter.

‘Before you settle in, it seems there is a problem. We seldom see a high official around these parts, you see, so we’re not sure what to do with you.’

‘No problem, just let me in,’ says the man.

‘Well, I’d like to, but I have orders from higher up. What we’ll do is have you spend one day in hell and one in heaven. Then you can choose where to spend eternity.’

‘Really, I’ve made up my mind. I want to be in heaven,’ says the MP.

‘I’m sorry, but we have our rules.’

And with that, St. Peter escorts him to the elevator and he goes down, down, down to hell. The doors open and he finds himself in the middle of a green golf course. In the distance is a clubhouse and standing in front of it are all his friends and other politicians who had worked with him.

Everyone is very happy and in evening dress.. They run to greet him, shake his hand, and reminisce about the good times they had while getting rich at the expense of the people.

They play a friendly game of golf and then dine on lobster, caviar and champagne.

Also present is the devil, who really is a very friendly & nice guy who has a good time dancing and telling jokes. They are having such a good time that before he realizes it, it is time to go.

Everyone gives him a hearty farewell and waves while the elevator rises….

The elevator goes up, up, up and the door reopens on heaven where St. Peter is waiting for him.

‘Now it’s time to visit heaven.’

So, 24 hours pass with the MP joining a group of contented souls moving from cloud to cloud, playing the harp and singing. They have a good time and, before he realizes it, the 24 hours have gone by and St. Peter returns.

‘Well, then, you’ve spent a day in hell and another in heaven. Now choose your eternity.’

The MP reflects for a minute, then he answers: ‘Well, I would never have said it before, I mean heaven has been delightful, but I think I would be better off in hell.’

So St. Peter escorts him to the elevator and he goes down, down, down to hell.

Now the doors of the elevator open and he’s in the middle of a barren land covered with waste and garbage.

He sees all his friends, dressed in rags, picking up the trash and putting it in black bags as more trash falls from above.

The devil comes over to him and puts his arm around his shoulder. ‘ I don’t understand,’ stammers the MP.

‘Yesterday I was here and there was a golf course and clubhouse, and we ate lobster and caviar, drank champagne, and danced and had a great time. Now there’s just a wasteland full of garbage and my friends look miserable.

What happened? ‘

The devil looks at him, smiles and says, ‘ Yesterday we were campaigning…..

Today you voted.’

I hope you have enjoyed the latest edition of Noel News.

I hope you have enjoyed the latest edition of Noel News.

Thanks for all your kind comments. Please continue to send feedback through; it’s always appreciated and helps us to improve the newsletter.

And don’t forget you’ll get much more regular communications from me if you follow me on twitter – @NoelWhittaker.

Noel Whittaker