Noel News 11 Nov

Knowledge is the ultimate currency which can never be destroyed.

It can be used over and over again without ever depleting its supply.

GEORGE GILDER

Good morning,

First let me thank you for the magnificent support you have given my new book Retirement Made Simple. Despite not even arriving in most bookstores yet, sales have already exceeded 7,000 copies.

First let me thank you for the magnificent support you have given my new book Retirement Made Simple. Despite not even arriving in most bookstores yet, sales have already exceeded 7,000 copies.

The official launch date is Monday, 16th November, which means a couple of very busy weeks coming up for me doing various media interviews. The feedback has been fantastic and it’s on track to be an even more popular book than Making Money Made Simple.

We did have some software glitches that caused a few orders to be lost. They have been fixed – but if you placed your order before October 31, and have not received your books yet please email me urgently at noel@noelwhittaker.com.au and we will chase it up.

Right now, the two most asked questions are:

- What’s my reaction to the election of Joe Biden as the US President?

- What is going to happen in a world where interest rates look like staying low for years to come?

There are no easy answers, but I have long believed that success requires you to follow some basic principles. A favourite of mine, as we face such uncertain times ahead, is that if you take care of the things you can control, you won’t need to worry too much about the things you can’t control. Let’s face it, there is nothing you or I can do to affect the outcome of the American election.

However, it’s an odds-on bet that there will be a couple of months of euphoria, before reality sets in as the new government faces the challenges of skyrocketing debt, and the difficulty of combating coronavirus once it gets out of control. The change in government in America won’t make much different to that – the gap between the haves and have-nots will continue to grow.

Interest Rates

Last week the Reserve Bank acted dropped interest rates even further. To make matters worse for retirees, there are hints that the next move is more likely to be down not up. Consequently I have been receiving a flood of emails from readers asking where they could find the best bank interest rates on their deposits.

There are two major issues here:

- First, finding the best rates; and

- Second, solving the problem of how to exist in a low interest rate environment.

To find the best rate I suggest you search online using websites such as Finder, Canstar and RateCity. At time of writing, the best I could find was 1.50% from Judo Bank for a three-year term, but keep in mind that rates change continually in the light of the banks cash position on the day. Furthermore, many so-called honeymoon rates may be good for six months, and then revert to the bank’s normal rate.

There may also be special conditions. Right now, my wife has an at call account with St George Bank which pays a face rate of 0.20% but which moves up to 0.70% provided she deposits at least $50 each month.

But the bigger picture here is the role of cash in your portfolio. If you are extremely nervous, and have total financial assets of say $200,000, a difference of 0.5% is only worth $1,000 a year to you. That’s not much in the scheme of things. And changing banks continually to grab an extra 0.5% is a mugs game – you will pay more than you save by incurring extra fees and possibly a loss of interest while funds are being cleared.

If the sum is bigger, it is not prudent to keep your whole portfolio in cash. Let’s face it – cash is the most expensive asset class you can own as it’s selling at 100 times earnings.

The obvious solution is to seek financial advice about a balanced portfolio, or simply do it yourself via an index fund such as Vanguard Australian Shares Index which currently has a yield of around 4.5%. The cream on the cake is that the yield is mostly franked so if you are retired with a tax-free income, you will get all the franking credits back. This would take an effective yield to close to over 6%. Full details are given in Retirement Made Simple.

I appreciate that shares are volatile, but by definition an index cannot go broke, and the index fund should keep on paying the dividends irrespective of the normal ups and downs of the share price.

And the great thing about shares is that you don’t need to outlay a massive sum. Let’s say you were rather risk averse, and your financial assets were $300,000 all in cash. You could simply leave $250,000 in cash, and put your toe in the water by investing $50,000 in an index fund. That huge cash buffer would give you heaps of time to ride out any falls in stock market, and the investment in the index fund would give you great experience with shares.

Of course, if you’re on the pension and are asset tested, every $10,000 you spend returns the equivalent of 7.8% per annum via a reduction in assessable assets. So instead of chasing an extra 0.05% on your $200,000 cash portfolio, you could simply spend $15,000 on a trip, or home renovations, and get an immediate increase in your pension of $1,170 a year. That’s much more fun than chasing a few more basis points on your term deposit.

Noel at the Morningstar Conference

I’ve often thought about starting a podcast for all of you, but there always seems too much to fill the day without taking anything extra on. However, I did do a 40 minute session with Graham Hand at the Morningstar conference, and Morningstar have generously give me permission to include it in this newsletter. I do hope you enjoy it.

Retirement Made Simple Ebook now Available

Printed book sales of Retirement Made Simple have shown me just how much pent up demand there is for this clear and implementable guidance. Now the print book has been digitised, it’s available on our Ebook store for those of you who like all your knowledge in the palm of your hand.

Click here for the Ebook version of Retirement Made Simple

With the Beginner’s Guide to Wealth I wanted to help young people get started on their financial journey. With Making Money Made Simple, I’m here to help you build, grow and protect your wealth during your most productive years. So Retirement Made Simple is about this final and most significant chapter. The printed book is a weighty tome at 424 pages, so the eBook is a great way to have all your advice in a light, easy to read format that you can also search.

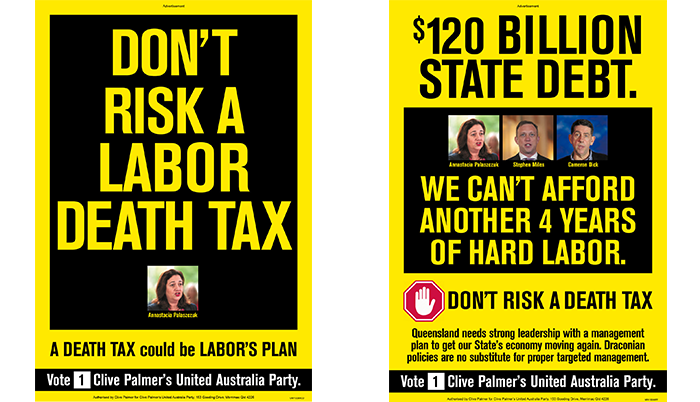

The Death Tax

One of the most memorable things about the Queensland state election campaign has been Clive Palmer’s full-sized advertisements warning “a death tax could be Labor’s plan.”

Apparently the advertisements did frighten a lot of people, so let’s look at whether a death tax is likely in the near future.

Let’s get real. Going to an election with a policy of bringing in death duties would be highly risky for any party. But there are situations already occurring in which a tax on death can occur.

If you cast your mind back to the 2019 Federal election, Labor went to the voters with a proposal to abolish the refund of franking credits for everybody except age pensioners. At the time I wrote that this had the potential to be a tax on widows, because of the difference between the pension assets test cut-off points for a couple and a single. If a couple had assets of $700,000 and were receiving a pension of $13,700 a year between them, the survivor would lose their pension on their partner’s death, because the cut-off point for a single pensioner is just $583,000.

Yes, under that proposal, the survivor would have lost the entire age pension, and their franking credits, as well their life partner. But the proposal sank like a stone at the polls.

There are two other areas where death can create a tax situation. The first is superannuation – remember that the taxable portion of your superannuation currently suffers a death tax of 17% if left to a non-dependent. This may not be relevant to a couple, because a partner is automatically classed as a dependent under superannuation rules, but it has huge implications for a single person. In the normal course of events, by the time people pass away their children have long ceased to be dependents, so any superannuation they inherit is subject to this tax.

Of course, it is easy to avoid, as long as you have at least one trustworthy person you are close to. The person with the superannuation just needs to execute an Enduring Power of Attorney with instructions for the attorney to withdraw their superannuation tax-free and deposit it in the member’s bank account if death becomes imminent.

The other existing tax often associated with death is capital gains tax. In most cases death does not trigger CGT, it transfers the liability to the beneficiaries of the estate, who will be liable for CGT when they dispose of the asset.

Let’s suppose your parents owned a bundle of CSL shares bought 10 years ago for just $10 each, and which are now worth over $300 each. If they died tomorrow and left those shares to you, you would be able to receive them free of CGT. But the moment you disposed of them, your CGT would be calculated from the original cost that the deceased paid for them, and you would be liable for CGT on any increase in value over that $10.

So there are definitely situations where death can trigger a taxable event. Notice though, that all the examples above relate to Commonwealth legislation, which has nothing to do with what any state government may decide to do.

But bringing in a death tax would not be easy. In the late 1970s Queensland Premier Sir Joh Bjelke-Petersen abolished death duties in Queensland, and this action was quickly followed by all the other states, as it would be impractical to have death duties in some states and not in others.

And there is one more issue – you can’t have death duties without imposing gift duty as well. Otherwise, people close to death would simply give their assets away to avoid a tax on the estate. Our tax system is continually under review, but I reckon that death duties will stay in the too hard basket for many years to come.

Health Matters

I have devoted the last 50 pages of Retirement Made Simple to ways we can live healthier, happier and longer. After all, good mental and physical health are our greatest assets, and research shows by nurturing these two aspects of our life we can improve it dramatically. In the book I mentioned Blue Zones which are areas in the world were people commonly live to 100 in good health. I recommended you subscribe to their free newsletter here.

Their latest newsletter talks about Marta Zaraska who has just released a book called Growing Young. I have already ordered a copy from Booktopia. She has been studying health for years and has produced some remarkable figures about the way optimism and happy relationships can be good for your health. According to Zaraska, building a strong network of family and friends can lower mortality risk by around 45%. This is much more than exercise which can lower that risk by about 30%, and eating six servings of fruit and vegetables a day which can cut the risk of early death by 26%.

She points out that many people think that living to 100 means spending the last 20 years of your life in a frail state. But that’s a common misunderstanding. Most super-centenarians escape disease until the very last three months of their life.

She also writes about a town in Pennsylvania called Roseto that attracted attention in the 1960 because the population had much lower rates of cardiovascular disease than the rest of America. It turned out that what made them different was their very tight community of people. It was relationships that made the difference.

She concludes by telling us that major drivers of longevity are kindness and volunteering. Volunteers have a 29% lower risk of high blood glucose, a 17% lower risk of high inflammation levels, and spend 38% fewer nights at hospital than people who shy away from involvements in philanthropic work.

And Finally

Why was the fraction apprehensive about marrying the decimal?

Because he would have to convert.

Why did the student get upset when his teacher called him average?

It was a mean thing to say!

Why was the math book depressed?

It had a lot of problems.

Why can you never trust a math teacher holding graphing paper?

They must be plotting something.

Why was the equal sign so humble?

Because she knew she wasn’t greater than or less than anyone else.

What do you call the number 7 and the number 3 when they go out on a date?

The odd couple though 7 is in her prime.

What do you call a number that can’t stay in one place?

A Roamin’ numeral.

Did you hear the one about the statistician?

Probably.

You’ll do algebra, you’ll do trigonometry, you’ll even do statistics. Will you do graph?

No, graphing is where I draw the line!

Why should you never talk to Pi?

Because she’ll go on and on and on forever.

Why are parallel lines so tragic if they have so much in common?

It’s a shame they’ll never meet.

Are monsters good at math?

Not unless you Count Dracula.

What’s the best way to flirt with a math teacher?

Use acute angles.

Did you hear about the mathematicians who are afraid of negative numbers?

They’d stop at nothing to avoid them.

How do you stay warm in any room?

Just huddle in the corner, where it’s always 90 degrees.

Why is six afraid of seven?

Because seven eight – “ate” nine!

Why DID seven eat nine?

Because you’re supposed to eat 3 squared meals a day!

Why does nobody talk to circles?

Because there is no starting point.

I hope you have enjoyed the latest edition of Noel News.

I hope you have enjoyed the latest edition of Noel News.

Thanks for all your kind comments. Please continue to send feedback through; it’s always appreciated and helps us to improve the newsletter.

And don’t forget you’ll get much more regular communications from me if you follow me on twitter – @NoelWhittaker.

Noel Whittaker