Noel News 11 July 2022 – Happy New Year?

I am convinced that life is a game where no one need be a loser… but I am equally as certain that one cannot participate in this mysterious act of living with any hope of satisfaction unless one understands a few simple rules.

OG MANDINO

The Greatest Success in the World

Happy New Year?

Good morning, I’m writing this on Friday 8 July – the beginning of a new financial year. I’ll start off by talking about markets because it’s been a pretty tough year for superannuation, and there are many scary headlines warning us how bad things may get in the following 12 months. It’s been a particularly bad year for my own superannuation fund which is down by 33% mainly due to exposure in international managed funds who had a big exposure to companies like Flutter and Zillow in their portfolios. In just one year Zillow had a high of $US123 and a low of $US28. Its $US35 today. I’ve had the excitement of the rapid rises and the despair of the plunges.

It’s been made worse for me because the house renovations we contracted to do 18 months ago are only just happening right now and costs have skyrocketed. We’re now in the invidious position of watching our superannuation assets fall at a time when our costs have gone up.

In this morning’s Australian is a review of a new book The Anxious Investor by Scott Nations – subtitled Mastering the Mental Game of Investing.

In this morning’s Australian is a review of a new book The Anxious Investor by Scott Nations – subtitled Mastering the Mental Game of Investing.

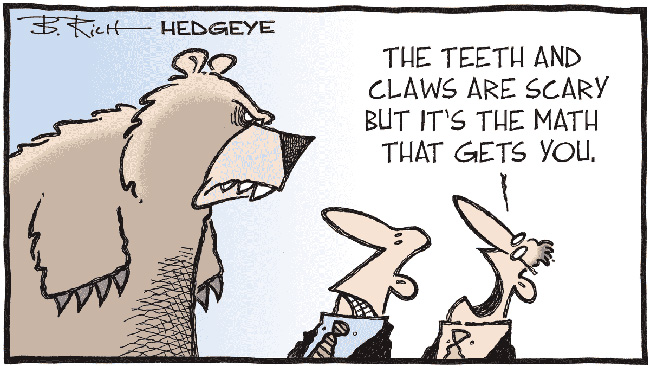

The article points out “bear markets present an illogical challenge for investors, losing money is about twice as painful as making money is pleasant. This is a phenomenon known as loss aversion. Investors typically sell when stocks go down, seeking to limit further losses.

The result is a tendency to buy into bubbles and sell into crashes. The decision to sell stocks during major downturns is one of the worst habits of the investment community. Herding is particularly dangerous on the downside of a bear market or stock market crash when the ability to think independently is simultaneously elusive and crucial.

Second half rebound??

According to Dow Jones Market Data, global markets closed out their most bruising first half of a year in decades, leaving investors bracing for the prospect of further losses. Accelerating inflation and rising interest rates fuelled a month’s long rout that left few markets unscathed. The S&P 500 suffered its worst first half of a year since 1970, investment-grade bonds, as measured by the iShares Core U.S. Aggregate Bond exchange-traded fund, lost 11%—posting their worst start to a year in history. The blue-chip Dow Jones Industrial Average lost 15%.

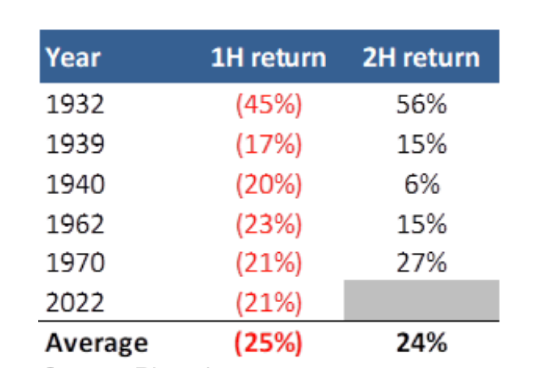

The good news for investors is that markets haven’t always done poorly after suffering big losses in the first half of the year. In fact, history shows they have often done the opposite.

When the S&P 500 has fallen at least 15% the first six months of the year, as it did in 1932, 1939, 1940, 1962 and 1970, it has risen an average of 24% in the second half, according to Dow Jones Market Data.

Source: Bloomberg

Age pension changes

Christmas has come early for many retirees, with both the age pension cut off points and the deeming rate thresholds increasing from 1 July.

Furthermore, the new Labor government has confirmed that the changes to the cut off points for the Commonwealth Seniors Health card (CSHC) that were promised by both parties prior to the election will be going ahead.

The new thresholds, together with the fall in many retirees’ assets because of the current market turbulence could mean that many pensioners will enjoy an increased pension – others who were ineligible may now qualify for a part age pension and all the goodies that go with it.

Photo by Alan Billyeald on Unsplash

Eligibility is tested under both an income and an assets test, and the one that produces the least pension is the one used. There is an age pension calculator and a deeming calculator on my website.

Thanks to the changes the cut-off point for the assets test for a homeowner couple has gone up to $915,500, for a single $609,250.

Your own home is not assessable – your superannuation and other financial assets are asset tested and also subject to deeming for the income test. Your furniture fittings and vehicles are assets tested. Many pensioners fall into the trap of valuing them at replacement value. This could cost them heavily because every $10,000 of excess assets reduces the pension by $780 a year. Make sure these assets are valued at garage sale value, not replacement value. This puts a value of $5000 on most people’s furniture.

Withdrawals from your superannuation are not treated as income – the value of your superannuation is deemed for the income test. Just keep in mind deeming is only relevant for income tested pensioners. If you are asset tested, income is irrelevant.

Most wealthier pensioners are asset tested, yet I keep receiving emails from them asking if it’s okay to earn some more money. Of course it is – the income test is not relevant if you are asset tested. A couple with assets of $800,000, receiving a pension of $172.90 a fortnight each, could have assessable income of $65,000 a year including their deemed income, and employment income, without affecting their pension because they would still be asset tested.

There is no penalty for spending money on holidays, living expenses and renovating the family home. But don’t do this just to increase your pension. Think about it, if you spend $100,000 renovating your home your pension may increase by just $7800 a year – but it would take almost 13 years of the increased pension to get the $100,000 back. Of course, the benefit of money spent should be taken into account too – money on improving your house, or travelling could have huge benefits for you. The main thing is not to spend money with the sole purpose of getting a bigger age pension.

You can reduce your assets by giving money away, but seek advice. The Centrelink rules only allow gifts of $10,000 in a financial year with a maximum of $30,000 over five years. Using these rules you could gift away $10,000 before June 30th and $10,000 just after it, and so reduce assessable assets by $20,000.

If you are a little over the asset cut-off point, you could reduce your assessable assets by purchasing one of the lifetime income streams I have discussed previously. The benefit is that only 60% of the purchase price is assessed for the assets test. For example, $300,000 invested in one of them would reduce excess assets by $120,000 and give eligibility to a part pension, as well as the income itself from the product. Your financial adviser will be able to give you more details.

The bottom line is, you’ll probably find your pension is increasing next payday. Just go to my calculators and do the calculations for yourself.

What now?

This is the perfect time to take stock of where you are and think about strategies for the coming 12 months. It’s certainly been a horrendous year for stock markets everywhere, and there is no sign that the situation will improve soon. However, I take solace in the knowledge that historically the Australian stock market has four bad years in every 10, and has never failed to recover strongly after a major downturn.

I feel a bit like the farmer going through a drought – I know the rain will come – I just don’t know when.

Photo by Logan Driskell on Unsplash

There is no doubt we are living in unusual times, but I have long believed that if you take charge of the things you can control, you should be well-placed to handle the things you can’t.

Inflation and rising interest-rates are the dominant factors, and the Reserve Bank has made it abundantly clear that rates are on the rise – probably in regular increments of 50 basis points.

Obviously, it is far better to prepare for a rate rise in advance than to find yourself in a financial bind when it happens. Therefore, make an effort to maintain home loan repayments of at least $8 a thousand a month – that’s $3,200 a month on a $400,000 loan. Repayments at this rate will have your loan out of the way in 15 years if interest rates are 5%. If they don’t go this high your loan will be paid off much faster and you will have given yourself a valuable safety buffer.

If you are over 55 pouring as much money as you can into superannuation. Yes, you need to keep cash on hand for emergencies, but there is no point in leaving money in bank accounts where the interest is fully taxable, when you can move it to superannuation where the income will be taxed at just 15%. I’ve been receiving scores of emails asking whether it’s wise to keep making contributions when the market is down. It’s the perfect time – it lets you get the assets at sale prices.

Remember too, a major benefit of placing money in super is that Centrelink does not count it until you reach pensionable age. For example, if the male partner was 67 and the female partner was 59, moving a large amount of superannuation from his name into her name could maximise his age pension benefits.

Major changes to superannuation came into force on 1 July. One of the most significant is the ability to contribute non—concessional contributions to superannuation to age 75 without passing the work test. This enables older retirees to take money out of the bank and put it into superannuation where the returns should be much better. Of course, you still need to keep at least 3 to 4 years expenditure in cash to give the market time to recover.

You can now make tax-deductible contributions between 67 and 75 provided you can pass the work test. I have written extensively about the benefits of using catch-up contributions to reduce or eliminate capital gains tax. Make sure you are right across them so you can use them to your benefit if appropriate.

Most of my articles have been built around one common theme: helping yourself so that you can have a more secure financial future. It is the actions you take today that will make the difference in the long term.

Interview with my son James

Thank you to all those who provided feedback on the recent interview with my second-born for his Win the Day with James Whittaker podcast. We’ve been overwhelmed by all the positive comments.

In case you missed it, we covered a lot in the conversation and I’m sure you’ll enjoy it. You can access it now wherever you listen to podcasts, or click the links below:

YouTube (video)

Apple Podcasts (audio)

Spotify (audio)

Be sure to leave a comment to let us know your thoughts on the episode.

My new superannuation book

This is a perennial best seller and has been completely updated to take into account all the changes which happened on 1 July.

It’s just come off the printing presses and is in stock right now.

We’ve got a few copies of Retirement Made Simple left – it’s also due for a new edition. This will be its fourth printing and even though I did my best to make it timeless the new edition will require a complete rewrite of the Superannuation section.

I thought we could create a win-win here. We only have about 200 copies of the retirement book left but I’ve put a special bundle together enabling anyone who buys a copy of the current retirement book to get the new superannuation book at a heavily discounted price.

The bundle of the two books has been slashed from $47.99 to just $36.99. This offer can only last until stocks of the retirement book are all gone.

Podcast interview with Margaret Lomas

Recently, I sat down with my good friend Margaret Lomas for a chat about current market conditions, property, and shares.

The episode is available now – just scroll down to find Margaret & Noel Whittaker in the list:

I hope you enjoy it.

Airline traps

We know that travelling by plane is full of challenges but in the last month there have been four instances where friends of ours have received the experience I’m about to talk about. They all had flights booked with Virgin or Qantas and received an email or text the day before the flight advising them of a change of time. For example noon to 10:30 am. In very small print there was also a change of date and not one of our friends noticed that.

You can imagine the chaos when they arrived at the airport a day early after checking out of their accommodation. One couple had a Virgin flight booked back from Cairns to Brisbane to link up with a flight to their home in Luxembourg two days later. They were on their way to the airport when they discovered the date change – luckily for them they managed to get a flight on Jetstar to Coolangatta.

To make matters worse Virgin refused to refund them the return leg of the flight which they hadn’t used. Be on your guard.

And Finally

Photo by Patrick Schneider on Unsplash

What do you call a dinosaur with a extensive vocabulary? A thesaurus.

England has no kidney bank, but it does have a Liverpool.

I used to be a banker, but then I lost interest.

I dropped out of communism class because of lousy Marx.

All the toilets in New York’s police stations have been stolen. Police have nothing to go on.

I got a job at a bakery because I kneaded dough .

Haunted French pancakes give me the crepes.

Velcro – what a rip off!

Cartoonist found dead in home. Details are sketchy.

Venison for dinner? Oh deer!

Earthquake in Washington obviously government’s fault.

I used to think I was indecisive, but now I’m not so sure

Be kind to your dentist. He has fillings, too.

If you do not have the time to do it right, when will you find the time to do it over?

“I stopped believing in Santa when I was 6. My mother took me to see him in a department store and he asked me for my autograph”

– Shirley Temple

I hope you have enjoyed the latest edition of Noel News.

I hope you have enjoyed the latest edition of Noel News.

Thanks for all your kind comments. Please continue to send feedback through; it’s always appreciated and helps us to improve the newsletter.

And don’t forget you’ll get much more regular communications from me if you follow me on twitter – @NoelWhittaker.

Noel Whittaker