Noel News 10 Sep 2020

The error of youth is to believe that intelligence is a substitute for experience,

while the error of age is to believe experience is a substitute for intelligence.

LYMAN BRYSON

Welcome to our September newsletter – it’s amazing how quickly time passes. It was in my February newsletter that Covid-19 got its first mention, and then in the March newsletter I wrote:

“What we are facing now is far worse than the GFC and I believe it will change many people’s behaviour for the rest of their lives. During the GFC, business kept on going – now it’s been stopped dead. A few months ago, we were talking about a balanced budget – now we face the perfect storm of businesses everywhere going broke, hundreds of thousands of people out of work, and the government pumping everything it can to try to save the economy. The decline in tax receipts will be massive – as will be the increase in expenditure. It could take our debt to over $1 trillion!”

That was certainly prophetic, though I can’t take much credit for stating the obvious. Last week it was officially announced that we are in recession, and now all the commentary is what we should do about it. One group is pushing the government to cut taxes on the grounds that extra spending will stimulate the economy – another group is saying that we are better off to keep Jobseeker at its present levels. I must confess I am more inclined to agree with the second view. After all, a tax cut is no good to people with no income, and many people in jobs who do receive a tax cut are probably going to save it for a rainy day in case things get much worse.

On the other hand, keeping Jobseeker at its present level makes it a virtual certainty that any stimulus money will go straight into the economy, since most of the people who receive it will have no option but to spend it.

Despite recent volatility, the strength of the share market has been extraordinary. The S&P/ASX 200 completed a fifth consecutive month of gains with a total return of 3% for August. The ASX 200 has gained 19% since March, the best five-month period since 2009, but another 18% gain is required to recover February’s all-time-highs.

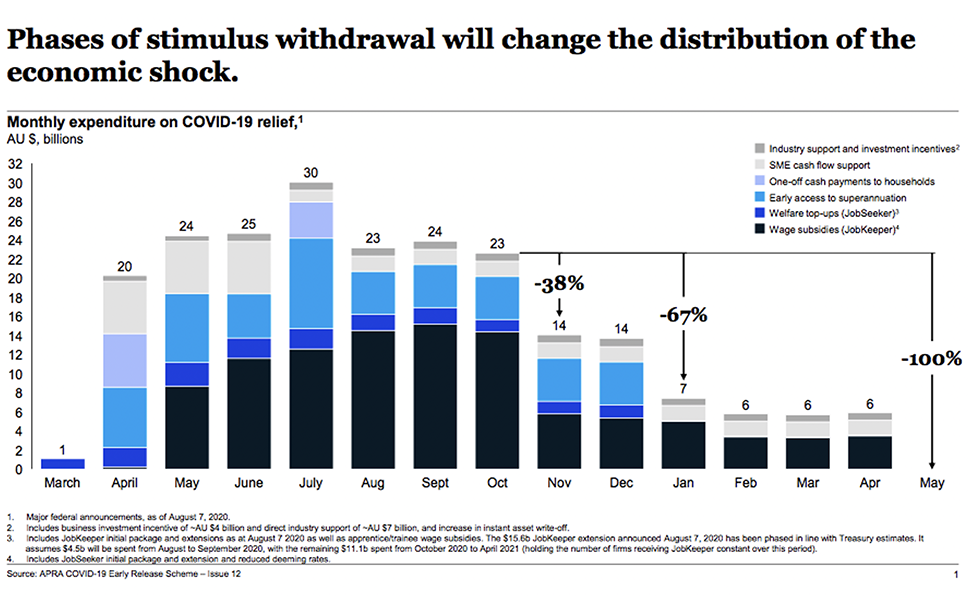

The big question is how long the stock market rally can continue. Last week Rachel Lane, Adam Creighton (of The Australian), and myself did a webinar for the Starts at 60 group, sponsored by Ingenia. Adam produced the graph below which highlights how much of the recovery has been solely due to government spending. This begs the question as to what will happen as stimulus spending tapers off in line with what’s on the graph.

Of course, this means uncertain times ahead, especially when we factor in the US presidential election. If Joe Biden gets over the line, stock markets may plunge. Realistically, all we can do is to go back to basics – this means we accept the fact that it’s impossible to pick the ups and downs of markets, which means we stay our course as long as our portfolio is diversified and fits our risk profile.

Remember to keep at least 3-4 years expenditure in cash to give us time to ride out whatever volatility is certain to occur in the next few months. If you’ve got a large holding of Australian shares, you may even consider having a hedge by way of an investment in BBOZ which I discussed in my previous newsletter. It’s a reverse index tracker, meaning that if the index rises 5%, BBOZ will drop 10%. Conversely, if the index drops 15%, BBOZ will rise 30%.

Scams

Since the pandemic began, reports of scam victims have increased by 55%, and scammers have extracted more than $500 million from Australians in just the last four months.

Don’t think you are too smart to be caught. My friend Roger, who is a retired businessman, went to Harvey Norman recently to get himself a new photocopier. His requirements were that it could connect wirelessly and not cost an arm and a leg in supplies. After consultation, he settled on a Canon.

He was having a frustrating time connecting it to his Wi-Fi when a notice popped up on his computer screen purporting to be from Canon. It noted he was having technical issues, and suggested he ring a certain number so Canon technicians could sort out the issue as part of the after-sales service.

It seemed genuine, so he rang the number. It was answered by a non-Australian person who said he was part of the Canon technical team and would need access to the computer to connect the photocopier. Roger tells me that after an hour of searching in his computer the alleged technician said that there would be a $980 service fee. Roger was horrified and said he would have to think about it – the response was that it must be paid immediately.

Roger hung up and called Harvey Norman to complain about the audacity of Canon to charge an installation fee that was more than the cost of the photocopier. They were shocked – and gave him the genuine Canon phone number to ring to complain. You guessed it: Canon were horrified as well, but did mention that this was becoming a common occurrence.

And it didn’t end there. Roger’s computer had been hacked, which meant he spent the next two weeks cancelling credit cards, changing passwords, and advising everybody he dealt with about what was, effectively, a break-in.

I think by now most of us are smart enough not to click on links in emails we don’t trust, but this takes scamming to a new level. It seems you now need to be wary about any phone numbers that pop up on your computer, and above all be extremely wary about who gets remote access to your computer.

Another scam that has been doing the rounds for months is the robocall from “Nicole from the NBN” telling tell you that your NBN is to be terminated tomorrow and you need to press 1 to reactivate it. Having had a few of these calls, I have always wondered what the scammer can gain by asking you to press 1.

The ACCC tell me that pressing that button identifies you as a person who would be likely to accept other calls from scammers in the future.

So stay on your guard. And if you are paying money by bank transfer, be especially careful, because some scammers are now hacking into emails and changing the bank details of people you owe money to. When you receive a bill, you now need to confirm that the bank details on the invoice are the same as the details held by your bank for previous payments. If in doubt, ring the supplier before payment.

And of course if it’s a new payee, make sure you ring their office, using a phone number you know to be genuine (not necessarily the one on the invoice) and confirm the account numbers are genuine.

Announcement: Brand new book ‘Mental Dynamite’

As many of you know, Think and Grow Rich by Napoleon Hill was the book that completely changed my life. You could imagine my surprise when, in 2018, my son James – who at the time had been living in the US for six years – was asked to write a modern companion called Think and Grow Rich: The Legacy! His book quickly became an international bestseller and has since been translated into six languages.

Today, his brand new book Andrew Carnegie’s Mental Dynamite has just been released. Fortunately, I was able to get my hands on an advance copy and it is a riveting read, especially given the times we’re in. It has major international distribution and is released in partnership with the Napoleon Hill Foundation.

Andrew Carnegie’s Mental Dynamite serves as a blueprint for harnessing success in business and life. It’s motivational, inspirational, and highly actionable. If you want a step-by-step guide to happiness and prosperity during one of the toughest times we will ever face, this book is a must read.

Order your copy today:

Bill Gates on Warren Buffet

I have long been a big fan of both Bill Gates and Warren Buffett, but many people don’t know they are best friends, and even play bridge online every day. I also subscribe to Bill Gates’s newsletter, and in the recent edition he penned this as a tribute to Warren Buffett on his 90th birthday. I think it’s just wonderful:

“I couldn’t possibly list all the interests Warren and I share. But one thing we discovered the first time we met is that we both love math and numbers. So in honour of Warren’s birthday, I thought I would share a few numbers related to turning 90—and to our friendship.

- 30: Number of years Warren has spent sleeping in his lifetime (assuming he gets his 8 hours a night).

- 10,649: Days since we met for the first time, on July 5, 1991.

- 2: Phone numbers I have on speed dial at my office—Melinda’s and Warren’s.

- Incalculable: The impact Warren has had on the world by committing to give virtually all of his wealth back to society.

One of Warren’s most admirable qualities is his unshakable sense of right and wrong. It’s a trait he may have gotten from his dad, Howard, a stockbroker and three-term U.S. Representative from Omaha. During Howard’s first term, Congress got a pay increase. Howard refused to take the extra money: After all, he had been elected at the lower salary. Warren has that same high ethical bar.

Warren has a phenomenal eye for talent. He buys great businesses run by brilliant people, and then gives them the autonomy to make their own decisions. Most of the managers at Berkshire businesses stay for decades, often past the retirement age. Even if they make a few mistakes, they know Warren will stick with them.

For years, he admired the business acumen of Rose Blumkin, who had opened Nebraska Furniture Mart in 1937 and built it into the biggest furniture retailer in the country. In 1983, he bought the company from “Mrs. B.,” as she was known. She soon opened a rival across the street—and eventually sold that one to Warren too.

For as long as I’ve known Warren, his approach to life and work has stayed constant. It’s amazing, in fact, how little he has changed even as Berkshire Hathaway has become wildly successful. He has been taking questions at shareholder meetings for decades and still does today—even though the venues have had to expand a little bit. On the left is a shareholder meeting from 1989 (with his business partner, Charlie Munger), and on the right is the meeting in 2010.

Although Warren works incredibly hard, he always leaves time for extracurricular activities. Here he is throwing out the first pitch at an Omaha Royals minor-league baseball game, and guest-starring on an episode of All My Children opposite Susan Lucci and Jill Larson.

Of all the things I’ve learned from Warren, the most important thing might be what friendship is all about. As Warren himself put it a few years ago when we spoke with some college students, “You will move in the direction of the people that you associate with. So it’s important to associate with people that are better than yourself. The friends you have will form you as you go through life. Make some good friends, keep them for the rest of your life, but have them be people that you admire as well as like.”

A person that I admire as well as like—that’s the perfect description of how I feel about Warren. Happy birthday, my friend.

Paper Shredders

With all the scams and identity thefts going on, it makes sense to get yourself a paper shredder. I must confess I have been looking at one for ages, but found all the options online too confusing Then two months ago I happened to be in the post office and noticed a JVL shredder for sale for $70. I said to Geraldine “we can’t go wrong at that price” and bought one. It’s been an absolute delight.

It’s about the size of a rubbish bin, which means it sits next to my other rubbish bin, and automatically takes up to 10 sheets of paper including staples. Basically it’s a plastic rubbish bin, with a little motor that sits on top. I did a Google on it when I was writing this newsletter and they seem to be now $112, but hopefully if you shop around you may do better. Here’s an article with some other paper shredders that might be worth looking into.

And Finally

Once again “The Washington Post” has published the winning submissions to its yearly neologism contest in which readers are asked to supply alternative meanings for common words.

The winners are:

1. Coffee (n.), the person upon whom one coughs.

2. Flabbergasted (adj.), appalled over how much weight you have gained.

3. Abdicate (v.), to give up all hope of ever having a flat stomach.

4. Esplanade (v.), to attempt an explanation while drunk.

5. Willy-nilly (adj.), impotent.

6. Negligent (adj.), describes a condition in which you absentmindedly answer the door in your nightgown.

7. Lymph (v.), to walk with a lisp.

8. Gargoyle, olive-flavoured mouthwash.

9. Flatulence (n.), emergency vehicle that picks you up after you are run over by a steamroller.

10. Balderdash (n.), a rapidly receding hairline.

11. Testicle (n.), a humorous question in an exam.

12. Rectitude (n.), the formal, dignified bearing adopted by proctologists.

13. Pokemon, a Rastafarian proctologist.

14. Oyster (n.), a person who sprinkles his conversation with Yiddishisms.

15. Frisbeetarianism (n.), (back by popular demand): The belief that, when you die, your soul flies up onto the roof and gets stuck there.

16. Circumvent (n.), an opening in the front of boxer shorts worn by Jewish men.

I hope you have enjoyed the latest edition of Noel News.

I hope you have enjoyed the latest edition of Noel News.

Thanks for all your kind comments. Please continue to send feedback through; it’s always appreciated and helps us to improve the newsletter.

And don’t forget you’ll get much more regular communications from me if you follow me on twitter – @NoelWhittaker.

Noel Whittaker