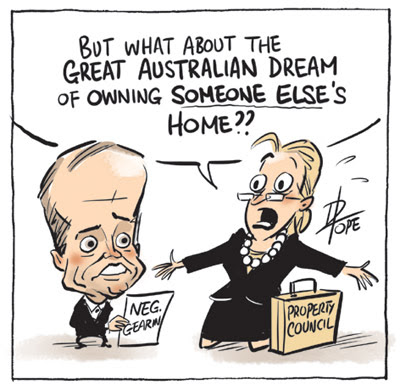

NEGATIVE GEARING

I am still amazed by Labor’s policy of restricting negative gearing to new homes – it simply won’t work. It will push unsophisticated investors into new property where the profit has already been made by the developer, leaving the established market wide open for savvy investors who understand that the way to make money in real estate is to buy a rundown property on a good block and add value to it. The irony is that they will be able to use the money they can no longer contribute to superannuation as a deposit. This will make the property positively geared from the outset.

And what has not generally been publicised is that Labor is only restricting negative gearing against “salary and wage income”. This means a person with income from other investments, a family trust, or other rental properties is able to negative gear an established property while a salary and wage earner cannot.

Read this case study from Philip, who sent it to me in the interests of a rational debate about negative gearing.

“I purchased an apartment in October 1987, borrowing 100% of the purchase price using my residence as security. The taxable loss was $7000 a year so my tax refund was in the order of $3,000 p.a. Three years later I paid it off when rates hit 17%. Total tax saved over those three years was around $10,000. After paying off the loan it was positively geared and I was paying $2000 in tax on the net rents.

The property has been positively geared for the last 25 years. Current net rent is $6,000 p.a. and at my marginal tax rate of 32.5% my tax is around $2,000 p.a. So having gained a net tax benefit of approximately $10,000 in the late 80’s, I have paid $50,000 in tax since.

The value of the property has risen substantially from my purchase price of $58,500 to a current value of $320,000. But when I sell I will be liable for capital gains tax of $30,000.

Since 1987 I have enjoyed net tax refunds of approximately $10,000 but have subsequently paid $50,000 in income tax and will shortly pay another $30,000 in CGT. The government has made a significant net $70,000 benefit from my investment risk and the subsequent good capital growth will almost certainly eliminate my ability to claim a pension in retirement. This sounds like a great deal for the Government to me.”