Be Prepared

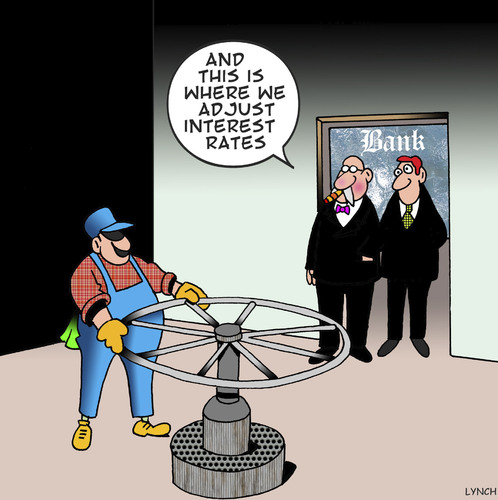

Bank interest rates are on the rise, and it’s got nothing to do with any action the Reserve Bank may take. The interest rate cycle has turned, and rates all around the world are going up. As a consequence, the cost of funds sourced by our banks from overseas are rising as well. The rate rises that have been announced in the last few days are not due to the banks acting badly – they are simply passing on their increased cost of money.

Unfortunately, our Reserve Bank went gone way too far with rate reductions, and now they are stuck between a rock and a hard place. On the one hand they can’t lower the official rate anymore because that would send our dollar into an even steeper decline and give the wrong message to the property market. On the other hand, they don’t want to put official rates up in in an environment where property prices are dropping in many places, and there are reports of mortgage stress.

The Reserve Bank didn’t move rates last Tuesday, and I reckon they won’t be changing rates any time soon.

It’s an interesting situation, and as the months go by, we may well find ourselves in a position where the official cash rate remains unchanged, at the same time as the banks gently move their rates up.

So, what should you do now if you have a home loan. The answer is obvious, get ahead of your repayments. This will have three major benefits , it will give you a safety buffer, you will get used to paying higher home loan repayments, and your loan will be paid off much faster if the forecast rate rises are not as harsh as many economists suggest.

A simple strategy is to ensure that your home loan repayments are at least $650 a month for every $100,000 borrowed. That’s $2600 a month if your loan is $400,000. This is based on an interest rate of 6% per annum on a 25 year term. If you are paid fortnightly, you can create an extra safety buffer by simply paying $325 a fortnight for each $100,000 borrowed.

Any spare funds should be placed in an offset account. This is highly tax effective, because your money will be receiving an effective after-tax rate equivalent to what is being charged on the mortgage. If you are a smart borrower your mortgage rate should be around 4% which means money parked in your offset account is giving you the equivalent of a capital guaranteed 4% after-tax.

Is this the time to switch to a fixed rate? This would give you some certainty for the period that you are able to fix the rate, but remember you always pay for insurance. Therefore, your fixed rate will probably be higher than your variable-rate, and there may be heavy fees if you need to quit the loan before the term is over because of a change in circumstances.

And remember, the actuarial people in the lending institutions set the pricing so the bank wins either way. It’s just possible the fixed rates may be set at a level which will give the bank a higher profit than if you took a variable rate.

So, unless you are extremely nervous, my preference would be to stay with a variable rate but use all your resources to pay it back faster, and accumulate as much as you can afford in the offset account. As always, preparation is your best friend.